Over the past few years, technology has transformed the way companies approach ESG reporting. Automation, AI, and advanced analytics are now capable of handling tasks that once required weeks of manual work, from extracting data across complex systems to mapping disclosures against multiple frameworks. This rapid evolution has unlocked new opportunities: companies can now shift their focus from chasing data to driving insights, turning reporting into a foundation for smarter strategy and stronger accountability. As automation and AI mature, businesses can move beyond time-consuming manual processes to build smarter, faster, and more reliable ESG reporting systems. Rather than treating compliance as a burden, technology allows organizations to reduce risk, streamline workflows, and unlock the capacity to focus on what matters most: strategy, performance and long-term impact. In this blog, we explore why automation is becoming indispensable across all areas of ESG management, how it helps organizations navigate regulatory complexity, and the practical ways Rimm’s automation tools are setting a new benchmark for disclosure excellence.

Why Automation Matters in ESG Compliance Today

The sustainability reporting landscape has always been complex, but in 2025, technology is transforming how companies navigate it. Frameworks like IFRS S1 and S2, the EU’s evolving disclosure mandates, Japan’s new SSBJ standards, and regional regulations across Africa, Asia, and the Middle East continue to add layers of reporting requirements.

At the same time, the real opportunity lies in the rise of automation. Businesses are no longer turning to technology solely to meet compliance needs; they’re leveraging it to improve efficiency, cut costs, and unlock capacity for strategic decision-making and impact.

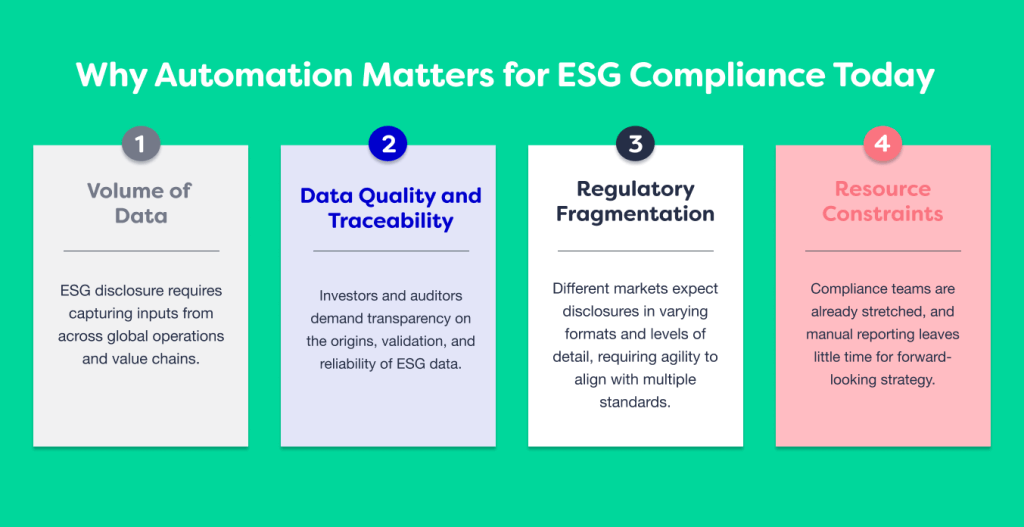

Traditional reporting approaches, relying on manual spreadsheets, fragmented teams, and duplicated effort, can no longer keep up. The challenges are clear:

- Volume of Data: ESG disclosure requires capturing inputs from across global operations and value chains.

- Data Quality and Traceability: Investors and auditors demand transparency on the origins, validation, and reliability of ESG data.

- Regulatory Fragmentation: Different markets expect disclosures in varying formats and levels of detail, requiring agility to align with multiple standards.

- Resource Constraints: Compliance teams are already stretched, and manual reporting leaves little time for forward-looking strategy.

This is where automation reshapes the equation. By reducing manual effort, automating validation, and creating direct alignment with regulatory frameworks, automation transforms ESG reporting into an enabler of business performance.

From Manual Burden to Strategic Enabler

At its core, automation isn’t just about saving time; it’s about unlocking new possibilities. Automated ESG compliance brings four critical benefits:

- Accuracy: Automation reduces the risk of human error in data entry, cross-referencing, and disclosure preparation.

- Efficiency: With repetitive tasks automated, teams can allocate resources to material analysis and strategic planning.

- Consistency: Automated tools ensure that disclosures align with frameworks such as IFRS S1/S2, GRI, or SSBJ, removing ambiguity.

- Agility: Companies can adapt quickly to evolving requirements without having to reinvent their reporting processes from scratch.

The result? Compliance shifts from a reactive, box-ticking exercise to a proactive, insight-driven process that builds trust and enhances credibility with stakeholders.

Rimm’s Automation Tools: Answer Assistance, Compliance Checker, and Answer Guidance

At Rimm, we’ve built automation directly into the heart of our ESG platform, enabling clients not only to meet evolving compliance requirements with clarity and confidence but also to streamline reporting, improve data accuracy, and unlock insights that drive smarter decisions and measurable impact. Three of our latest features illustrate how automation is transforming the reporting experience:

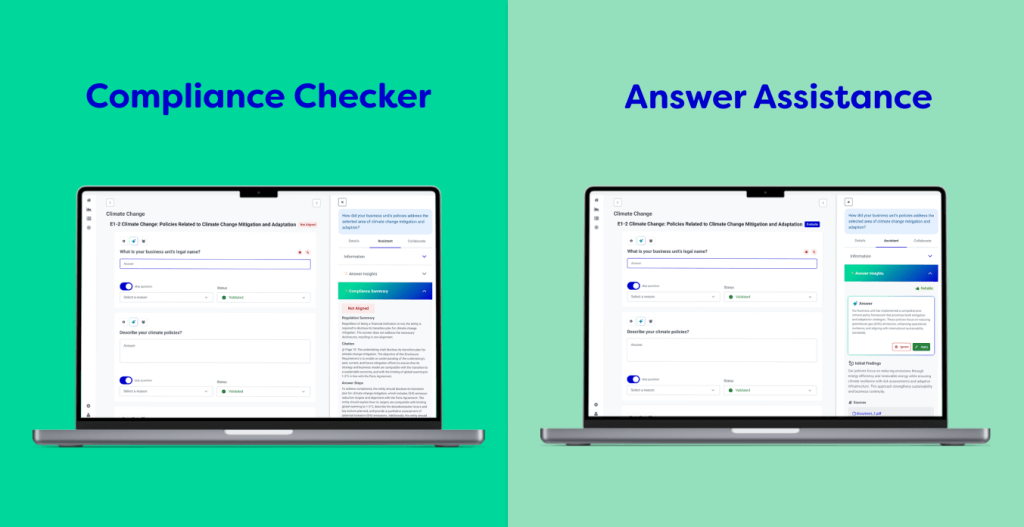

- Answer Assistance: This feature is designed to simplify and strengthen ESG reporting by providing intelligent, context-aware guidance as users complete their assessments. It not only suggests how to approach each question with clarity and relevance but also explains the intent behind the standard — what regulators, investors, or stakeholders are looking for, and why it matters. By turning compliance into a guided, educational experience, Answer Assistance empowers teams to produce accurate, confident, and meaningful disclosures that align strategy with sustainability goals.

- Compliance Checker: Acting as a real-time validator, this feature cross-checks data inputs and narrative disclosures against the specific framework relevant to each client, such as IFRS S1/S2, GRI, or SASB. For companies operating across jurisdictions, it ensures consistency and reduces duplication, highlighting gaps that may require further attention.

Practical Example: Supporting Clients on SSBJ Standards in Japan

The power of automation comes to life in real-world applications. A recent example is Rimm’s work with clients in Japan, where the Sustainability Standards Board of Japan (SSBJ) has introduced its own S1 and S2 standards, modeled on ISSB guidance but tailored to Japanese market expectations.

To support these clients, Rimm integrated bilingual functionality into our platform, ensuring that disclosures could be completed in both English and Japanese. With Answer Assistance and Compliance Checker, clients were able to navigate the SSBJ requirements seamlessly, mapping ESG data, validating climate-related disclosures, and aligning with governance and strategy expectations.

This automation-driven approach not only reduced compliance complexity but also gave clients the confidence that their reporting would stand up to scrutiny from both regulators and international investors. When discussing these client projects, Rimm Japan’s Product Lead, Zaki Zahirsyah, said:

“Our goal is to support Japanese companies including those that operate with very limited ESG resources ; small teams, tight schedules, and growing reporting demands. Many struggle with knowledge pain, unsure of SSBJ requirements; our SSBJ assessment screen solves this by automatically providing all required items with simple, tailored explanations. Others face productivity pain, lacking time for gap analysis; our AI functionality addresses this by reviewing their current reports and identifying missing information instantly.

Together, these tools reduce workload, remove uncertainty, and help companies produce accurate, confident disclosures with far fewer resource.”

Automation as a Bridge Between Regulation and Strategy

Automation doesn’t just make reporting easier; it makes it more meaningful. By ensuring compliance data is accurate, consistent, and aligned with global standards, companies gain a foundation they can build on strategically.

For example:

- Investors can trust that disclosures are comparable and reliable, supporting access to capital.

- Boards can use validated ESG data to guide decision-making on climate risk, resilience, and long-term strategy.

- Teams can shift their focus from reporting tasks to driving impact, whether that’s advancing a transition plan, engaging suppliers, or designing inclusive workforce strategies.

This is where the true potential of automation lies: enabling companies not only to meet today’s disclosure demands but also to anticipate tomorrow’s opportunities.

The Future of ESG Compliance: Automated, Integrated, Strategic

Looking ahead, automation will only grow in importance. As regulatory frameworks continue to evolve, companies that embed automation into their ESG processes will be best placed to:

- Adapt quickly to new requirements without duplicating effort.

- Deliver trusted disclosures that satisfy both regulators and stakeholders.

- Free up resources to focus on performance, innovation, and long-term value creation.

At Rimm, we believe automation is not the end of ESG reporting; it is the beginning of a new era where compliance becomes a strategic enabler, not a burden.

A Smarter Path Forward

In today’s fragmented regulatory environment, ESG compliance is no longer about simply “getting it done.” It’s about doing it well, consistently, credibly, and strategically. Automation is the key to making this possible.

With Rimm’s automation tools, Answer Assistance, Compliance Checker and Answer Guidance, we are helping clients transform compliance from a reactive task into a proactive advantage. From Japan to Africa to Europe, we see firsthand how automation empowers our clients to lead with clarity, purpose and confidence in their ESG journey.

If you’re ready to lead with transparency and purpose, let’s take the next step together. Discover how automation-powered ESG reporting can unlock new opportunities.

👉 Book a call with our team of experts here to get started!