Compliance

Streamline sustainability data management, reporting, and monitoring. Meet your ESG compliance obligations efficiently and integrate these essential workstreams into your everyday business operations. Avoid legislative risks and effectively enhance your ESG performance.

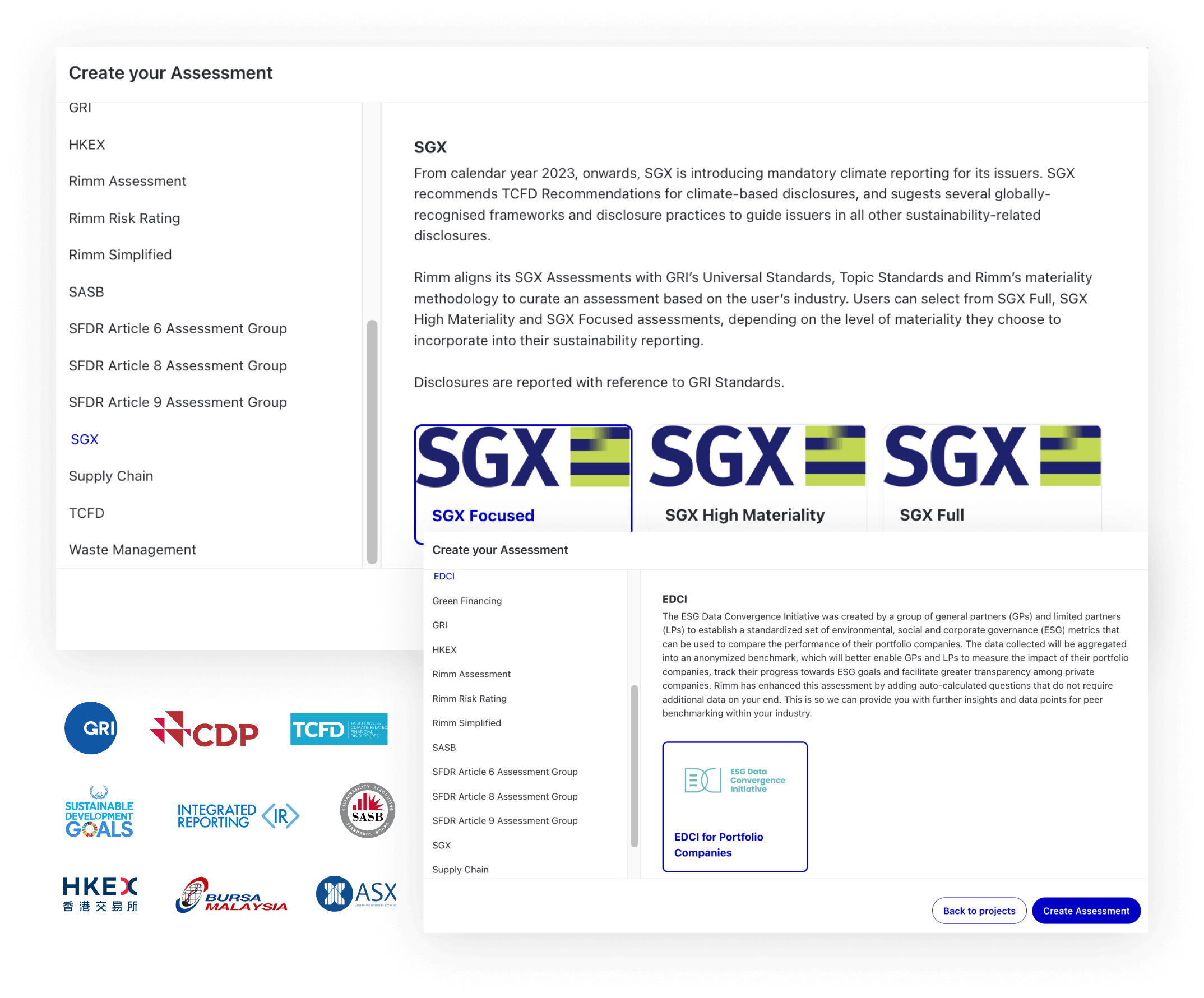

Assessments

Navigate through ESG disclosures

Our proprietary assessment tool aligns to all leading industry frameworks, and is dynamically generated based on the following:

Standards

Exchanges

Industry Materiality

Product Use Case: Framework Reporting

Access dynamically mapped ESG frameworks

Customize your sustainability report to major ESG standards and framework based on your geographical location. Rimm has a growing library of 4000+ questions that are generated based on multiple standards and exchanges.

ESG & Sustainability Standards

CSRD & Double Materiality

Complying with the requirements of CSRD can seem daunting. We’re here to work through the key requirements of the standard, providing the data collection and analysis tools to ensure all key aspects of CSRD can be met in an efficient and resource effective manner.

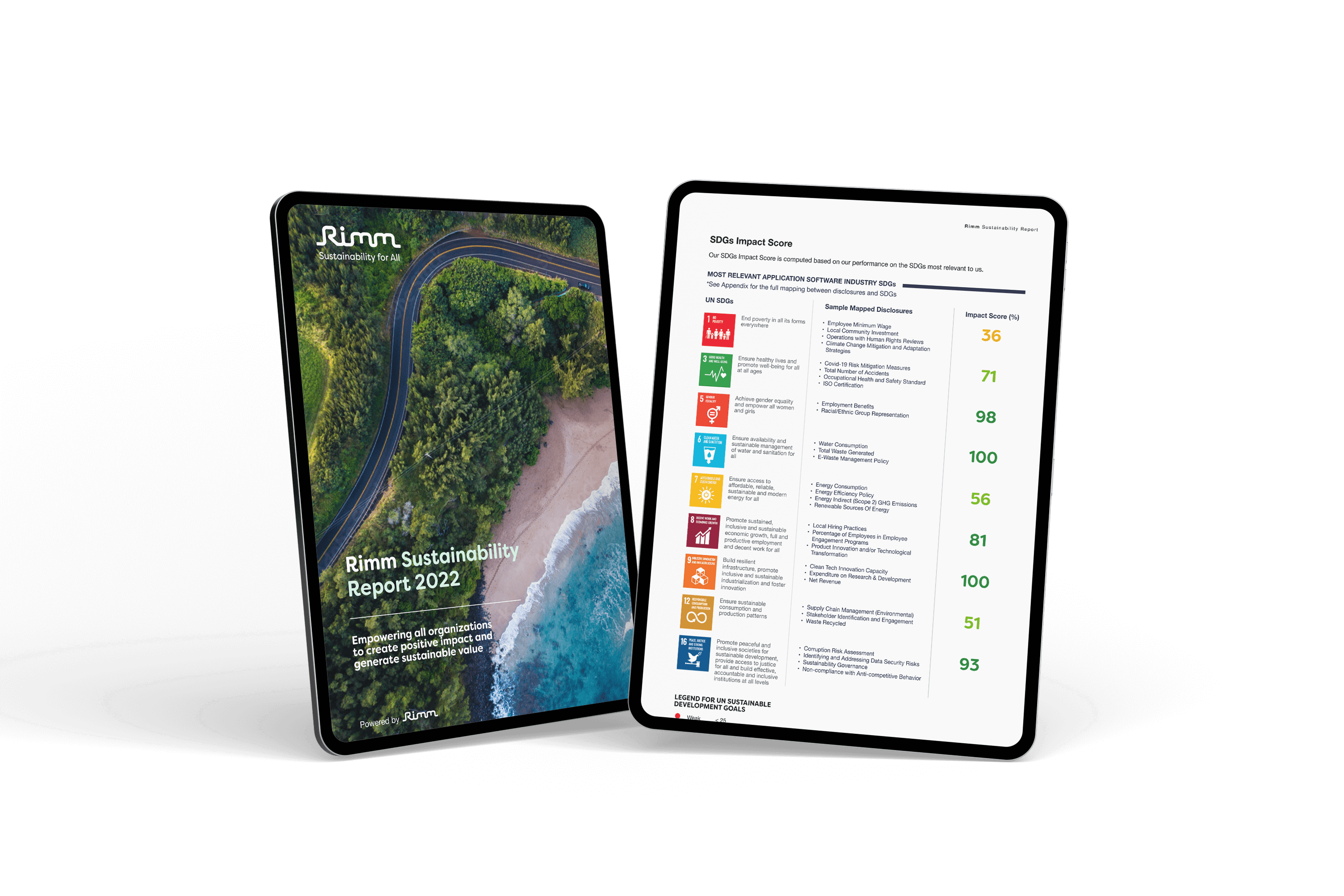

Customized Reports

Advanced analytics, packaged in many ways

Explore a variety of customization options that you can use to highlight certain sustainability aspects of your business to stakeholders that matter, including impact reports, compliance reports and more.

Benchmarking

Understand where you stand amongst your peers and gain a competitive advantage

With a data repository of over 20,000+ companies which are spread across several geographical locations (Americas, Europe, Africa Oceania and Asian-Pacific regions), benchmark your company’s ESG rating against fellow peers’. Get relevant data that you can utilize immediately to grow your business.

Our data repository consists of:

![]()

More than

100 data points per company

![]()

More than

26 million ESG data points

More than

1 million Social and Normal media reviews

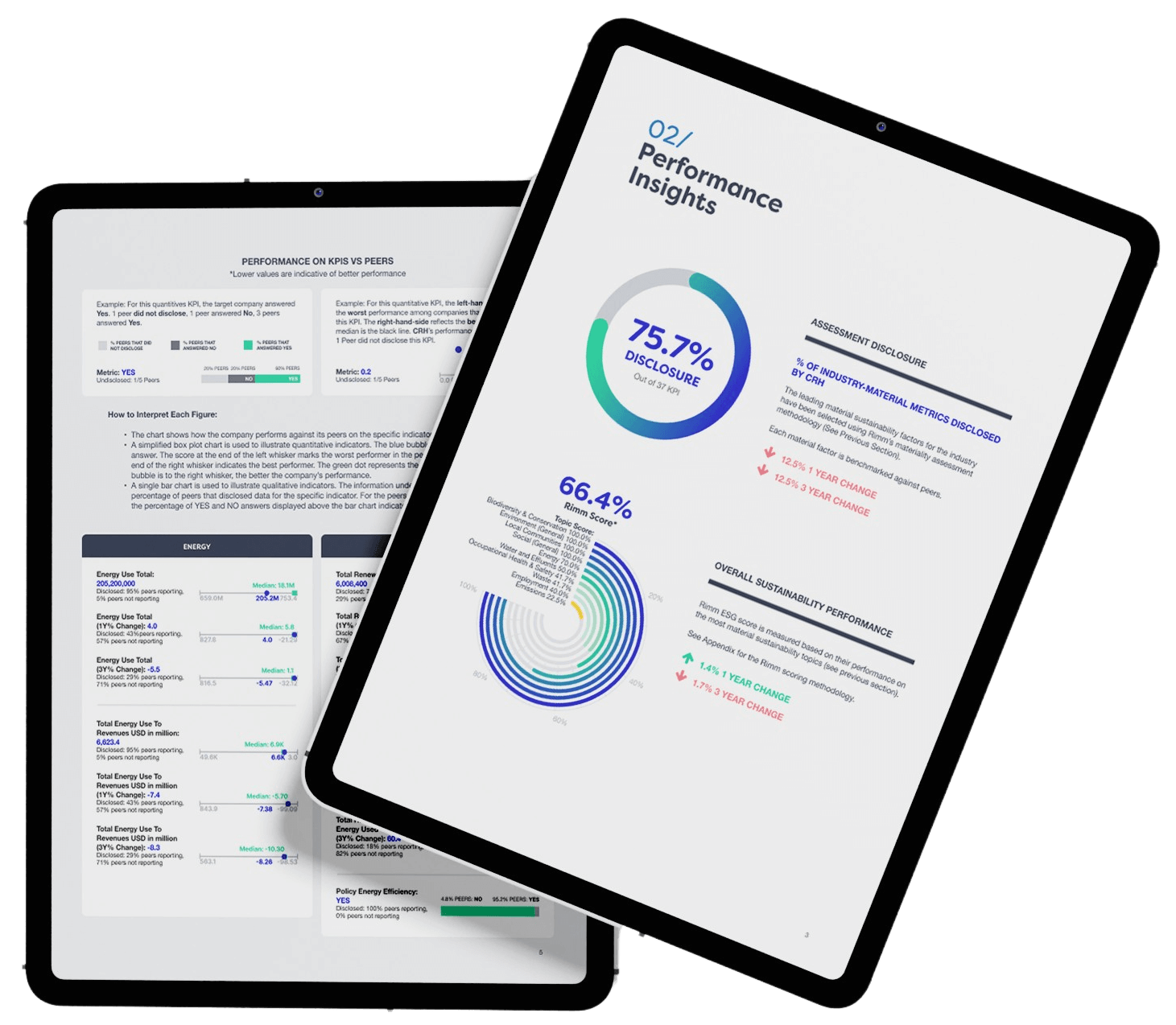

Product Use Case: Benchmarking

Analyze data in a customized and actionable manner

Compare your ESG performance against Rimm’s 20,000+ company database. To provide consistent ESG scores against standard KPIs, Rimm uses a uniform benchmarking and scoring system. Client preferences are focused on tailored scoring and benchmarking.

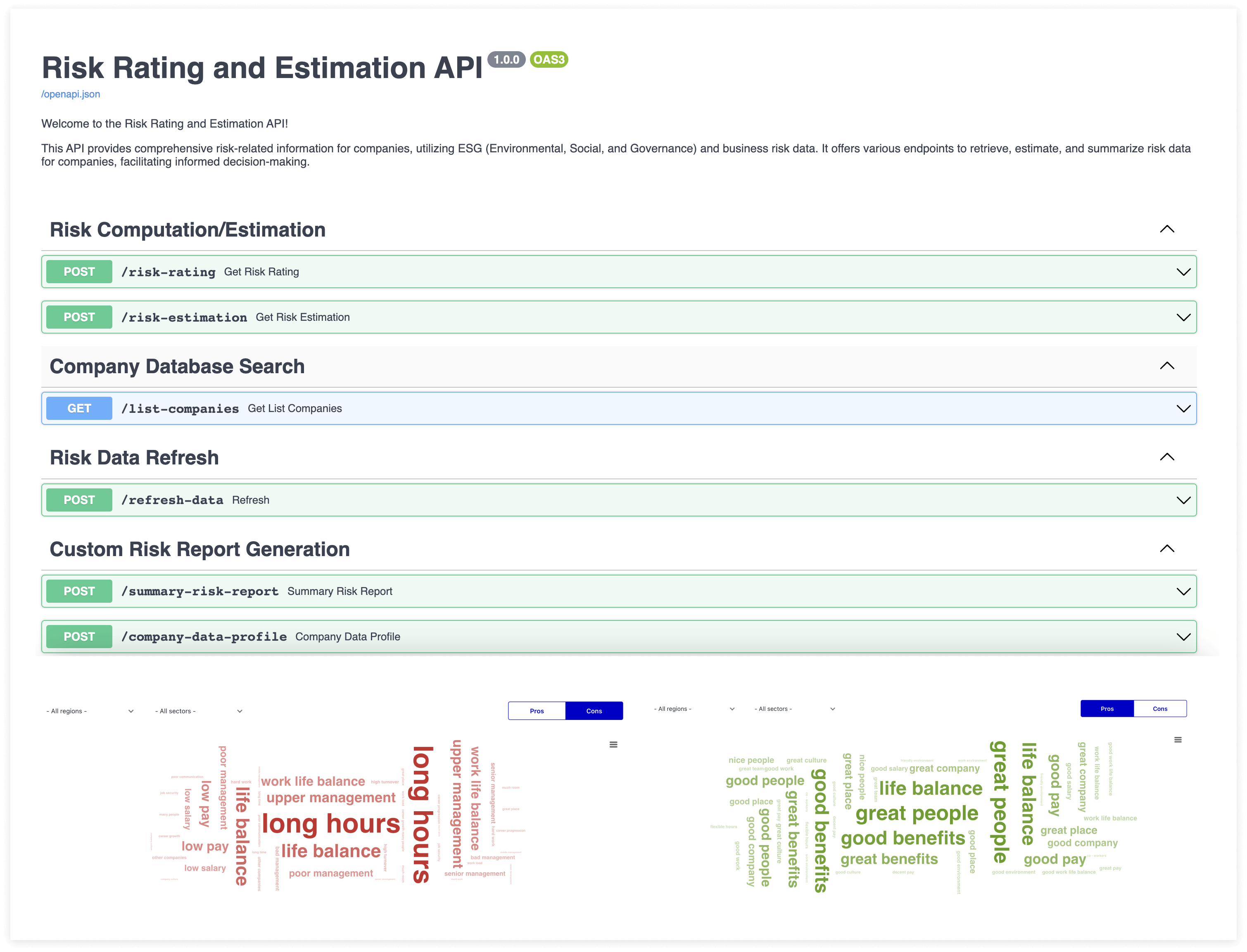

Risk Management

Analyze and Monitor Risk with our comprehensive Risk Management Solution

Deep dive into your risk profile with our Risk Management Solution, which translates critical ESG data used to quantify risk exposures, relevant and contextualized to your business for future-proofing, ensuring continual growth.

Risk Approximation

If the data is unavailable, we also offer risk estimations using a custom, state-of-the-art machine learning model, predicting risk intervals with a high degree of accuracy (>95%). This model has been trained from scratch using risk data, and can support clients in gaining a better understanding of their risk profile.

Risk Rating Solution

Deep dive into your risk profile with our Risk Rating Solution, which translates critical ESG data used to quantify risk exposures, relevant and contextualized to your business for future-proofing, ensuring continual growth.

UNDERSTAND

- Learn how ESG impacts your company’s strategy and operations

- Empower business decisions with accurate representations of you or your clients’ business risks

- Provide a holistic view of risk ratings using local context data

- Provide comprehensive KYC data

APPLY

- Set and track targets, and improve your sustainability risk profile, or help customers manage theirs

- Make informed decisions based on your data to manage ESG issues

STRATEGIZE

Strategize and prioritize risks to maximize resource allocation and ensure continual growth

Solution Features

12 ESG Risk categories to cover material ESG KPIs and 6 Business Risks to map out ESG impacts on the business

Explore our up-to-date database of over 20,000 companies, on disclosed KPIs and risk metrics, offering high level of accuracy.

Quantifiable rating outputs that can be seamlessly integrated via APIs into existing platforms, leaving workflows undisturbed.

Receive risk rating scores, analytics reports, and an ongoing monitoring service.

Product Use Case: Risk Rating and Monitoring

Identify and manage ESG and company risks: Make informed decisions based on your data to manage ESG issues, set and track targets, and improve your sustainability risk profile.

Expanding KYC Checks: Supports Know Your Customer (KYC) checks, providing data on ESG and Business risks that may impact engagement with potential customers.

Assessing Supply Chain: Analyze overall ESG risk throughout the supply chain, and select potential suppliers to work with based on their risk profile.

Green Financing: Using Risk rating can aid in accessing green finance, and support with making investment decisions for greater growth.

Supply Chain

Integrate sustainability across your value chains

Our unifed and comprehensive supply chain solution helps you streamline your supplier engagement to help you measure, analyze and significantly improve your scope 3 emissions. Our solution can help you effectively reduce your supplier emissions significantly, driving growth.

Analyze Supplier Emissions

![]()

For Manufacturers:

- Distribute customized supply chain assessments to all its suppliers.

- Aggregate data all in one place.

- Identify strengths and weaknesses in your supply chain, total emissions, other key ESG metrics, benchmarked to industry peers.

![]()

For SMEs and larger enterprises:

- ESG Assessment and Report both aligned to international standards and frameworks.

- Qualify easily for global supply chains, trade finance, etc.

- Access to ESG data from SMEs in key international supply chains.

- Audit layer can be added to facilitate trade finance decisions.