As 2026 begins, the ESG conversation feels markedly different from just a few years ago. The urgency is still there, but it’s more focused, more disciplined and far more strategic. Businesses are no longer asking whether ESG matters. Instead, they’re asking how to do it well in a world where regulations evolve unevenly, scrutiny is constant and expectations continue to rise. The closing months of 2025 made one thing clear: sustainability has entered a new phase. ESG is no longer driven solely by regulatory pressure or reputational risk. It is increasingly shaped by enterprise value, operational resilience and long-term competitiveness. In this blog, we explore the most important ESG trends defining 2026 and how organisations can stay ahead in a shifting sustainability landscape.

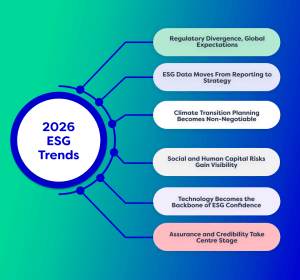

Trend 1: Regulatory Divergence, Global Expectations

By Q4 2025, it became evident that ESG regulation is no longer moving in a single direction. Some jurisdictions accelerated alignment with global standards such as IFRS Sustainability Disclosure Standards, while others slowed or re-prioritised mandatory requirements. This divergence has created complexity, but also clarity.

What hasn’t changed is stakeholder expectation. Investors, lenders, customers and partners continue to demand decision-useful, comparable sustainability information. Late-2025 investor sentiment surveys consistently showed that ESG data remains central to risk assessment and capital allocation, regardless of whether disclosure is legally required.

For businesses in 2026, the implication is clear: compliance alone is not the goal; credibility is. Companies that anchor their reporting to globally recognised frameworks, even in less regulated markets, are better positioned to build trust and attract long-term capital.

Trend 2: ESG Data Moves From Reporting to Strategy

One of the most notable shifts in late 2025 was how organisations began using ESG data internally. What was once treated as a year-end reporting exercise is increasingly embedded into strategic planning, procurement decisions and enterprise risk management.

Boards are asking sharper questions:

- Where are our most material sustainability risks?

- How exposed are we to climate, supply chain, or workforce disruptions?

- Which ESG investments deliver both impact and financial resilience?

This evolution signals a broader trend for 2026: ESG data is becoming management data. Organisations that invest in reliable, structured data systems are gaining clearer insights into performance, trade-offs and opportunities across operations and value chains.

Trend 3: Climate Transition Planning Becomes Non-Negotiable

Late 2025 reinforced that climate commitments without credible transition plans are no longer sufficient. Investors and stakeholders are increasingly focused on how companies plan to deliver emissions reductions, not just what they aim to achieve.

This includes clarity on governance, assumptions, timelines, dependencies and financial implications. As climate-related risks intensify globally, transition planning is emerging as a defining marker of ESG maturity in 2026.

Trend 4: Social and Human Capital Risks Gain Visibility

While climate remains central, Q4 2025 also saw renewed focus on social factors, particularly workforce resilience, skills development and supply chain labour practices. Economic uncertainty, talent shortages and geopolitical pressures have made social performance more visible and more material.

In 2026, businesses are expected to demonstrate how they:

- Support employee well-being and retention

- Manage human rights risks across supply chains

- Build inclusive, future-ready workforces

Social data is no longer viewed as “soft.” It is increasingly linked to productivity, continuity and brand strength, making it a strategic priority alongside environmental performance.

Trend 5: Technology Becomes the Backbone of ESG Confidence

Another defining lesson from late 2025 is that manual ESG processes no longer scale. As reporting requirements diversify and internal stakeholders increase, organisations are turning to technology to maintain consistency, accuracy and control.

Digital ESG platforms are enabling:

- Automated data collection across teams and regions

- Built-in validation and internal assurance workflows

- Alignment with multiple frameworks without duplication

- Visibility into performance trends

In 2026, technology is no longer a “nice to have” for ESG; it’s foundational. Businesses that digitise ESG reporting are better equipped to respond to change, reduce risk and unlock insight.

How Leading Organisations Are Preparing for 2026

As companies enter the new year, those best positioned for success are focusing on a few clear priorities:

- Standardisation with flexibility: Aligning disclosures with global frameworks while remaining adaptable to local requirements.

- Data quality over data volume: Prioritising accuracy, traceability and relevance over excessive metrics.

- Cross-functional collaboration: Engaging finance, sustainability, operations, HR and leadership teams through shared platforms and processes.

- Forward-looking insight: Using ESG data to inform scenario planning, investment decisions and long-term strategy.

Rimm’s Perspective: Turning ESG Complexity Into Clarity

At Rimm, our work with clients throughout late 2025 reinforced a powerful insight: organisations don’t struggle with ESG because they lack ambition; they struggle because the landscape is complex and constantly evolving.

Our platform is designed to simplify that complexity. By combining structured frameworks, guided assessments, automation, analytics and collaboration tools, we help organisations move beyond reactive reporting and toward confident, decision-driven ESG management.

As clients prepare for 2026, we’re seeing a clear shift: ESG is no longer treated as a parallel process. It is becoming embedded in how organisations plan, operate and communicate value.

Looking Ahead: Leading With Confidence in 2026

The year ahead will reward clarity over noise, substance over statements and systems over spreadsheets. ESG in 2026 is not about chasing every change; it’s about building resilient foundations that can adapt to whatever comes next.

Organisations that invest in quality data, credible disclosures and integrated strategy will not only stay ahead of shifting expectations, but they will help shape the future of sustainable business.

At Rimm, our team of experts are ready to support that journey 👉🏾 Reach out today HERE