With continuing pressure to report on ESG performance, organizations large and small face the challenge of collecting, managing, and accurately reporting vast amounts of data. The process of gathering large volumes of data is time consuming and complex to manage, raising several issues for the responsible individuals. In this blog, we dive into some of the issues surrounding data collection, and explore how our flagship platform ‘myCSO’ can help ease the burden.

Key Issues Related to ESG Data Collection

- Assessment Fatigue: we often hear our clients talk about ‘assessment fatigue’, a problem where individuals have to input data for multiple ESG assessments at the same time. Collecting large volumes of data in this way can be extremely time consuming and even error-prone, especially if organizations use traditional methods like spreadsheets to manage data, which many still do.

- Gathering Data from Multiple Sources: data collection for ESG involves sourcing information from multiple departments and external sources, each with their own formats and standards. As a result, organizations often face significant delays and inaccuracies when meeting reporting deadlines and maintaining data integrity.

- Centralized Data Administration: the challenge of centralizing all ESG data is another significant challenge. The lack of a unified repository can result in fragmented data that is difficult to analyze, report, and access. Inefficiency and inaccuracy can result from this fragmentation.

The Solution: Rimm’s Comprehensive Solution – myCSO

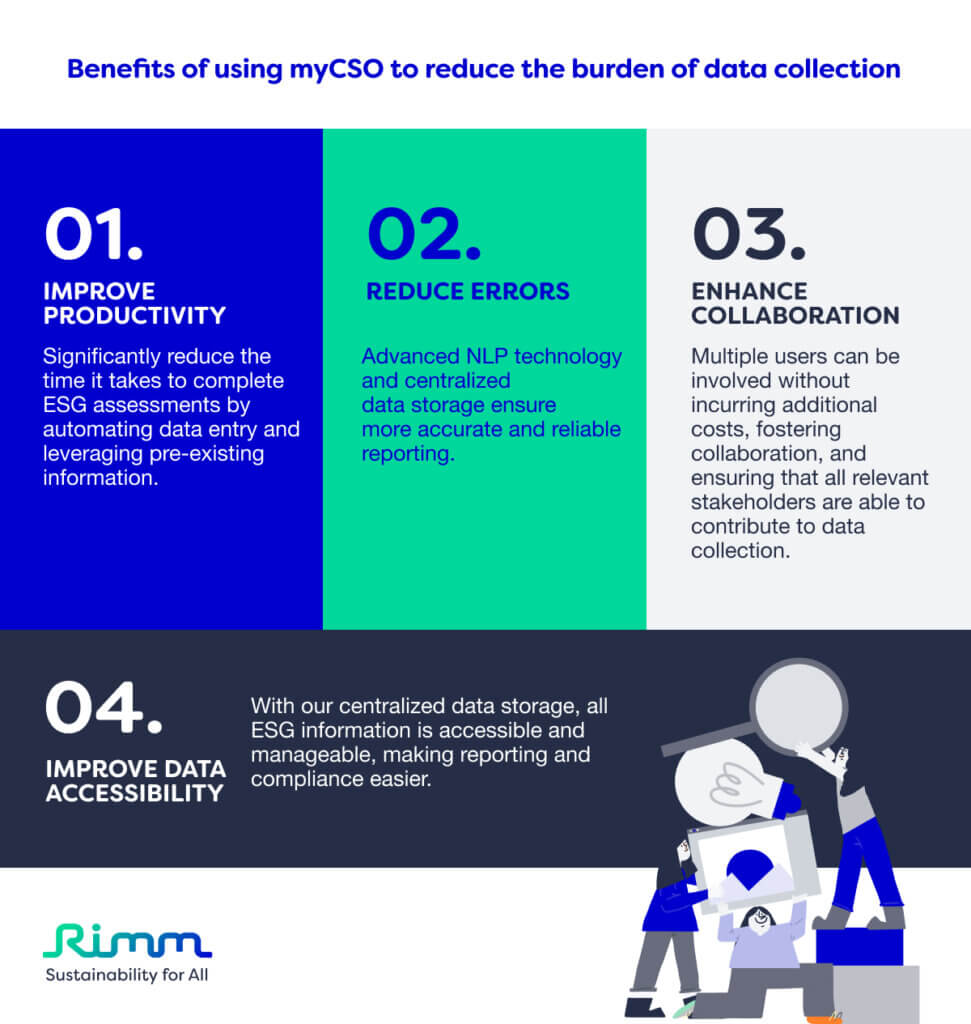

Rimm’s AI-powered flagship product myCSO solves these challenges head-on by streamlining the ESG data collection process, reducing assessment fatigue, and improving data accuracy.

Efficient Data Collection Methods

Rimm offers several methods for populating ESG questionnaires, reducing data collection time and effort significantly:

- Auto-populated Assessments: Rimm can automatically populate new questionnaires based on answers from previously completed assessments. As a result, redundant data entry is minimized, and assessments are accelerated.

- Document uploads and NLP integration: Users can upload Excel or PDF documents directly to Rimm. Through advanced Natural Language Processing (NLP) technology, Rimm captures and extracts relevant data from these documents, populating the assessments automatically. Using this capability saves time and ensures more accurate data entry.

Flexible Licensing Model

As opposed to many other platforms, Rimm charges per license instead of per user. Using this pricing model, firms can spread data collection workload among multiple users without incurring additional expenses. Using our platform, multiple team members can contribute to the effort, reducing individual burden.

Diverse Question Formats

Our platform supports a variety of question formats including quantitative, qualitative and multiple-choice questions. With this flexibility, organizations can gather comprehensive ESG data tailored to their specific reporting needs. The system ensures that all relevant information is captured accurately and efficiently.

Centralized Data Storage

Organizations can store all ESG data centrally for easy access and management. Streamlining the reporting process and improving data governance are two benefits of this centralization.

Excel Integration and System Compatibility

Nearly half of companies still collect ESG data using spreadsheets. For ease, we’ve built our platform so that users can upload excel files, and the required data is automatically extracted and provided as an answer to an assessment question – that’s the power of AI!

We have built a robust solution that addresses the pain points of ESG data collection, alleviating assessment fatigue and enhancing reporting capabilities. Leveraging advanced technologies and incorporating flexible, user-friendly features, we empower organizations to manage ESG data more efficiently and effectively.