ESG reporting is an essential sustainability practice for organizations. Understand the basics of reporting and the best practices you can use.

Environmental Social Governance (ESG) is a huge buzzword that continues to gain momentum. The term refers to three different aspects of corporate sustainability, Environment, Social and Governance, which have been used to categorize indicators that measure a company’s sustainability.

What is ESG Reporting?

ESG reporting is a business practice that allows companies to measure and communicate their commitment to and progress towards their ESG-related goals and initiatives, boosting transparency. Typically publicized across companies’ websites and social media, ESG reports can be used both internally within the company and externally for stakeholders – from employees and investors to local communities – to understand where a company stands with regard to its ESG performance.

“More than 90 percent of S&P 500 companies now publish ESG reports in some form, as do approximately 70 percent of Russell 1000 companies.” – McKinsey

A well-written ESG report should be a reflection of your company’s sustainability initiatives, performance and impact on stakeholders. Be sure to highlight the risks and opportunities that play a significant role in impacting your company’s long-term business performance, as well as your approaches to risk management, and account for diverse perspectives. Remember, your report should convey the company’s ability to create value over time!

Here are 5 best practices we recommend:

- Identify the most relevant metrics you should disclose.

Not all metrics are relevant to every organization and industry. You will first need to determine what sustainability factors are material to you. According to the Global Reporting Initiative (GRI), materiality refers to the relevance or importance of topics that best reflect an organization’s economic, environmental and social impacts, or influence the decisions of stakeholders. Knowing which topics are material to your organization will ensure that you always prioritize reporting on factors that matter the most to your stakeholders. - Choose the right sustainability standard or framework

There are many science-backed, credible international standards and frameworks to comply and align your reporting with, such as GRI and the Sustainability Accounting Standards Board (SASB). These frameworks not only help you avoid biases in reporting by providing a fixed set of topics and metrics that need to be disclosed but also help you stay ahead of increasingly stringent regulatory trends. Explain your choice of disclosures with reference to your selected standard(s) and use an appendix to map out your disclosure with the relevant topic in your chosen standard or framework. - Collect and communicate your data accurately

Compiling all the data needed to produce a report can seem like a daunting task. Fortunately, there are many automation services out there to help you transform your ESG data into a report format and make future data collection and analysis easier. First communicate with the right departments within your organization to ensure that all the information is accurately collected and appropriately formatted. - Verify your data to boost your credibility

Third-party verification and validation of reported information is an important step in reducing your company’s risks of greenwashing. Featuring a description of your company’s internal and external review processes enhances transparency with stakeholders on the reliability of your reported data. This can come in the form of an assurance statement in your report to let your stakeholders know that all the information provided has been checked before publishing. - Review your practices and progress every year

ESG Reporting is not just a one-off affair. Continuously reviewing your policies and practices and staying updated on your industry’s materiality factors annually will help build your track record on sustainability. Stay up-to-date with sustainability and ESG trends on an industry, national, regional and global level to improve your ESG-related strategies and initiatives for the future.

Read our previous blog post to learn more about the differences between sustainability, ESG and CSR reporting.

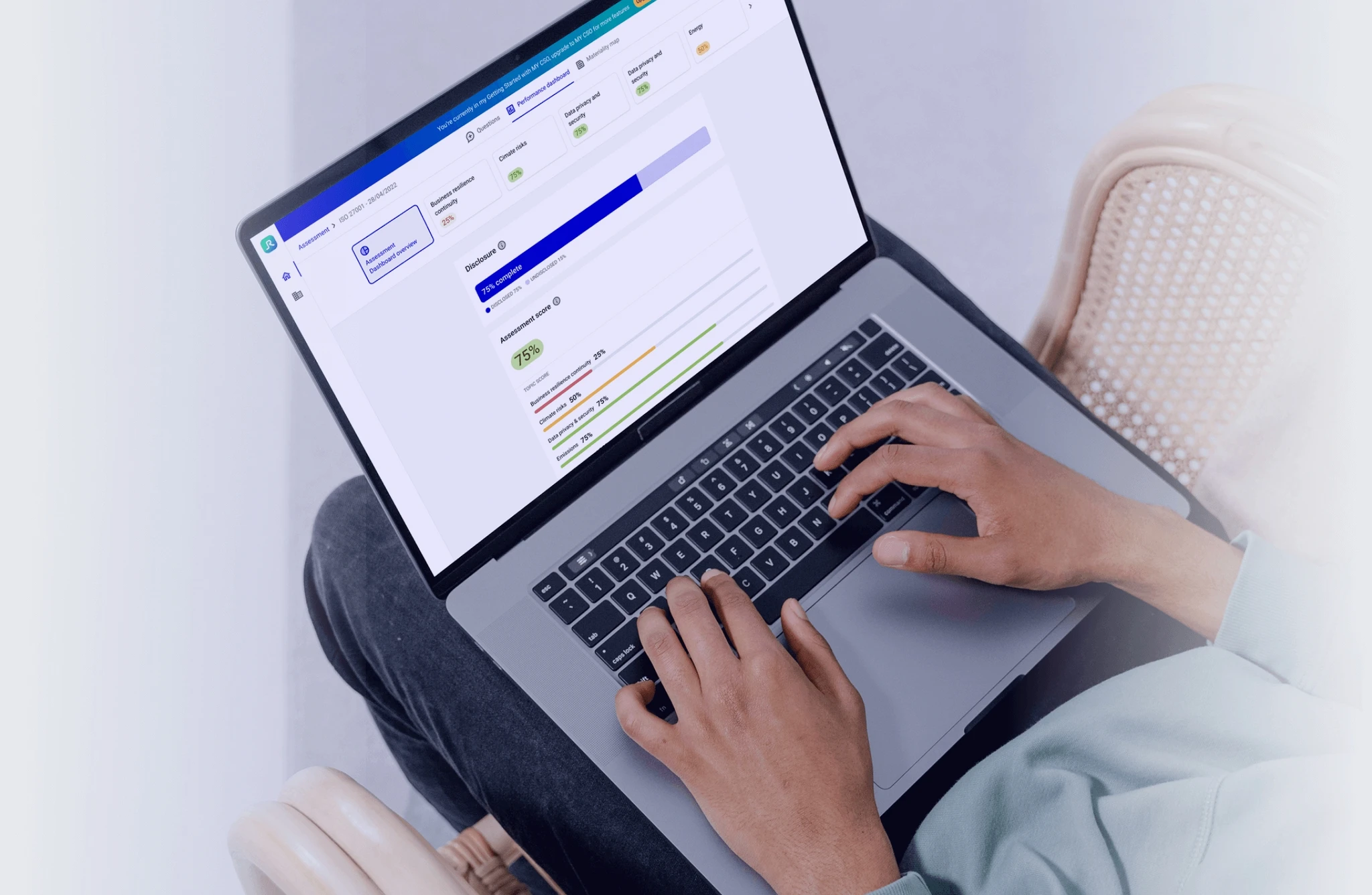

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.