With the ever evolving ESG reporting and regulatory scene, it can be difficult to keep up with key developments. Let’s look at 5 up and coming standards that will impact your business.

Sustainability reporting is becoming an integral part of business operations. For many companies, this trend goes beyond brand positioning and making a positive impact, affecting their regulatory compliance, financial statements, and funding from investors. With more complex and comprehensive sustainability disclosure requirements being introduced, navigating the sustainability reporting scene can be daunting, but remains key.

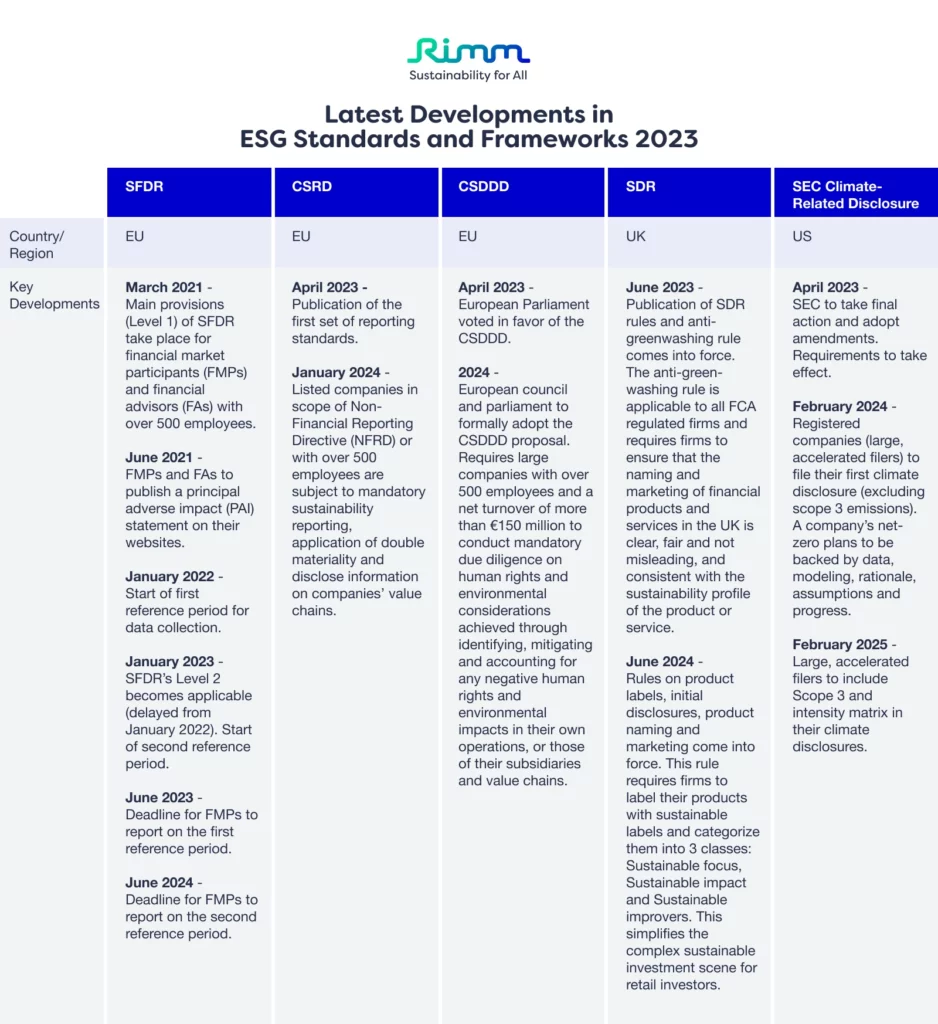

Here’s an overview of some of the important new standards and frameworks to keep on your radar in 2023.

1. Sustainable Finance Disclosure Regulation (SFDR)

The SFDR was proposed by the European Commission in 2019 and aims to promote sustainable finance and minimize greenwashing in the EU. The regulation requires financial market participants (FMPs) and financial advisers (FAs) to provide greater transparency around the sustainability of their investments and is divided into three levels of disclosure requirements: (Level 1) mandatory disclosure of sustainability policies by FMPs and FAs, (Level 2) detailed information on the environmental, social, and governance (ESG) characteristics of investments and how these are incorporated into the investment decision-making process, and (Level 3) mandatory disclosure of the impact of investments on sustainability.

2. Corporate Sustainability Reporting Directive (CSRD)

The European Commission has developed the CSRD framework to strengthen and standardize sustainability reporting for businesses operating in the EU. With its goal of offering stakeholders a thorough and consistent system of sustainability reporting to make decisions that will promote sustainable growth, the CSRD expands reporting requirements to all major corporations and companies listed on EU regulated markets, replacing the current Non-Financial Reporting Directive (NFRD). This initiative is estimated to affect over 50,000 European companies and over 10,000 foreign companies, which would bolster a new degree of confidence for sustainability reporting.

3. Corporate Sustainability Due Diligence Directive (CSDDD)

Proposed by the European Commission in February 2022, the CSDDD aims to hold businesses accountable for their impacts on the environment and society. With the overarching aim to make Europe climate neutral by 2050, the directive is currently in the feedback stage and is projected to impact approximately 13,000 EU and 4,000 non-EU companies once implemented in 2024. In order to comply with CSDDD, organizations must detect, prevent, mitigate, and account for any potential negative effects of their activities and supply chains on the environment, human rights and social issues. This has a ripple effect on SMEs that are involved in the supply chains of many of the affected larger companies as they may need to disclose information and minimize their own risks.

4. Sustainable Disclosure Regulation (SDR)

The UK Financial Conduct Authority (FCA) has also come up with their own measures targeting investment firms and distributors of in-scope investment products to combat greenwashing in the investment scene. The SDR incorporates the TCFD recommendations and double materiality. Some of the requirements of the SDR include three sustainable investment labels for retail investors to navigate the complex sustainable investment scene and more in-depth sustainability disclosures at the product (consumer, more general) and entity (stakeholders, more granular) level. While this measure is still in the early stages of implementation, it will have a significant impact; the FCA estimates that the SDR will affect about 450 funds managing £10.6 trillion in assets.

5. Climate-Related Disclosure Rule

In the US, the Securities and Exchange Commission (SEC) has proposed a new rule in 2022 requiring registered domestic and foreign companies to disclose information on climate-related metrics by February 2024. Under the new regulations, companies will be required to provide information on the physical and transition climate risks and impacts, governance practices around risks and risk management, mitigation plans, Scope 1 and 2 emissions, Scope 3 emission if material or a target has been set, and climate-related financial metrics in a note to audited financial statements. Building on the TCFD framework, these regulations aim to help businesses disclose climate risks and opportunities and standardize information for investors.

With the increasingly stringent and comprehensive regulations set to take place, organizations need to keep up with mandatory requirements under the new frameworks and standards for sustainability reporting and disclosure to be ready for compliance. Awareness, followed by appropriate planning, is key to mitigating the potential negative effects on your business and society.

Want to know what to include in your sustainability report?

Read our previous post on ‘What to Include in Your Sustainability Report’

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.