Accountability is a cornerstone of good environmental, social and governance performance. Organizations which hold themselves accountable are not just talking about sustainability, diversity, or good governance but are taking real, measurable actions to achieve their stated goals. In a world where investors, regulators and clients are increasingly scrutinizing companies’ ESG efforts, accountability fosters trust and long-term value. But how do organizations create and nurture accountability in their ESG efforts? In this blog we dive into this topic, in particular focusing on the value of setting and tracking goals.

Why is accountability important for organizations engaging in ESG efforts?

Without accountability, ESG initiatives may become little more than a marketing exercise, leading to “greenwashing” or other forms of misrepresentation. Holding individuals, teams and the organization accountable ensures genuine progress and creates the framework for transparency, which is crucial for external validation and internal growth.

How can companies be accountable with their ESG efforts?

1. Set clear ESG goals

To be accountable, companies must first clearly define their ESG goals. This involves setting measurable and realistic targets across material ESG topics. This process can be facilitated by completing a materiality assessment to identify which topics within ESG are most relevant to your organization, to help narrow your focus on where to set goals.

2. Track and measure progress regularly

The next step is to track progress consistently and transparently. Goal-setting provides direction, but tracking progress ensures momentum and helps identify barriers to success early on. Regular reviews, whether quarterly or annually, will ensure that targets remain aligned with business realities and allow adjustments as necessary. Tracking allows companies to adjust their strategies when goals are at risk of being missed and to celebrate achievements when milestones are reached.

In addition, by conducting audits and compiling reports at regular intervals, companies demonstrate transparency to external stakeholders, ensuring that they aren’t just setting goals but are committed to achieving them.

3. Assigning internal stakeholders with key responsibilities

Effective accountability involves assigning responsibilities to individuals or teams who can take ownership of specific goals. This might mean creating dedicated roles, such as a Chief Sustainability Officer, or ESG task forces that oversee various aspects of the company’s sustainability strategy.

Additionally, accountability requires embedding ESG objectives into job descriptions and performance reviews, ensuring that individuals across the organization understand their role in meeting these targets. Clear lines of responsibility mean that when goals are not met, there are processes for reflection, evaluation and course correction.

4. Building the right organizational culture

For accountability in ESG to truly thrive, there must be a culture of responsibility throughout the organization. This starts at the top, with leadership demonstrating a commitment to ESG principles not just in word but in action. Board members and C-suite executives should lead by example, setting and pursuing their own goals related to ESG.

Creating an ESG-focused culture also means empowering employees at all levels to contribute to sustainability, equity and governance efforts. It’s important for everyone in the organization to feel that they have a role to play, fostering a sense of collective responsibility.

Introducing Rimm’s latest platform features for goal setting and tracking!

We are continually working on new features and tools to add to our flagship platform myCSO, to support organizations on their ESG journey. We are delighted to share some new features which have recently been deployed to our platform, including:

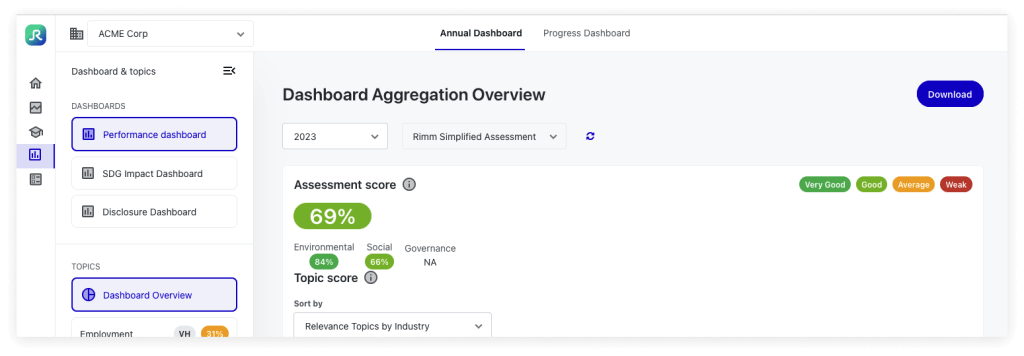

- Multiple reporting periods: Not all organizations want to report on an annual basis, so we’ve built in more flexibility for users to choose the reporting cadence to best suit their business needs – weekly, monthly, quarterly, biannually or annually.

- Annual dashboard: To ensure dashboards are still available regardless of the reporting cadence chosen, we’ve introduced annual dashboards, which aggregate values reported by business unit and company, at an annual level. Get annual performance metrics and reports or use the aggregated values to comply with international standards.

- Goal setting: It is important to set goals as an organization, but even more valuable to have them captured in the platform where your ESG data is being collected. With our new goal setting feature, users can view historical data to set more accurate and realistic goals, and track progress towards them with clear categorization (Goal Met, Not Met, or Not Set).

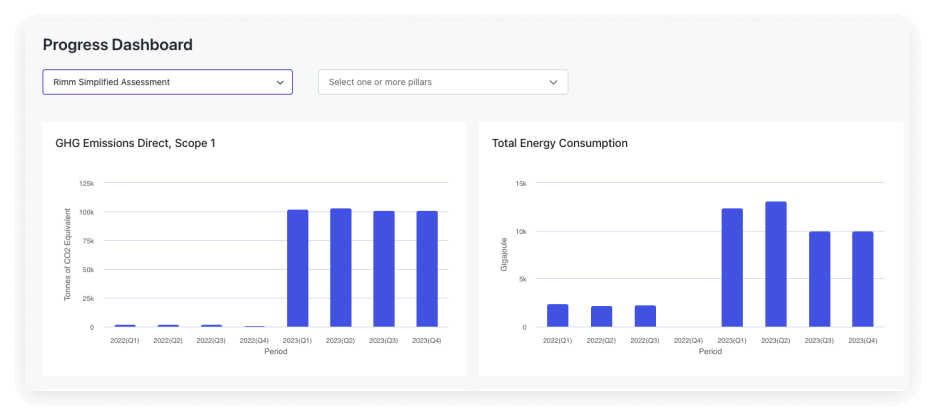

- Progress dashboard: Tracking goals is made easier with visualizations of progress, so we’ve created dashboards to help users quickly and easily view progress towards goals on key performance indicators. User’s can also view quarterly performance across multiple KPIs to compare progress and see overall company performance versus goals.

As organizations embark on their ESG journey, accountability is what keeps them on track. By setting clear, measurable goals and regularly tracking progress, businesses can ensure they are making meaningful contributions to environmental sustainability, social justice and governance standards. Whether online, offline or across the organization as a whole, accountability must be embedded at every level to create lasting impact and build trust with stakeholders.