In this blog post, we explore how ESG modularity has become a key element in aiding sustainable investment decisions at a time when investors are demanding transparency around ESG. Find out how your company can get started on easier compliance methods with minimal disruption to your existing workflows.

Understanding ESG Modularity

The concept of ESG modularity refers to the ability to break down the broad spectrum of ESG considerations into modular components or individual factors. As opposed to treating ESG as a monolithic framework, modularity allows investors to evaluate and prioritize specific elements. ESG issues can vary significantly across industries, regions, and companies, so a one-size-fits-all approach may not be appropriate.

The Importance of Flexibility

Flexibility is one of the key benefits of ESG modularity. When investors break down ESG criteria into modular components, they can tailor their approach to align with their unique preferences, risk tolerances, and investment objectives. Investors can take advantage of this flexibility to concentrate on the ESG factors that matter most to them, such as reducing carbon emissions, enhancing gender diversity, or strengthening community engagement.

Enhancing Decision-Making

By providing investors with a granular understanding of risk and opportunity associated with their investments, ESG modularity can also enhance decision-making. A more nuanced analysis of ESG factors can be conducted rather than relying on broad ESG scores or ratings. A deeper level of insight can lead to better risk management and more informed decisions.

Integration Across Asset Classes

ESG modularity also facilitates the integration of ESG considerations across asset classes. Investors can apply modular ESG frameworks to evaluate the sustainability performance of their entire portfolios, regardless of whether they invest in equities, fixed income, real estate, or alternative assets. Regardless of asset class, this holistic approach ensures that ESG considerations are seamlessly integrated into the investment process.

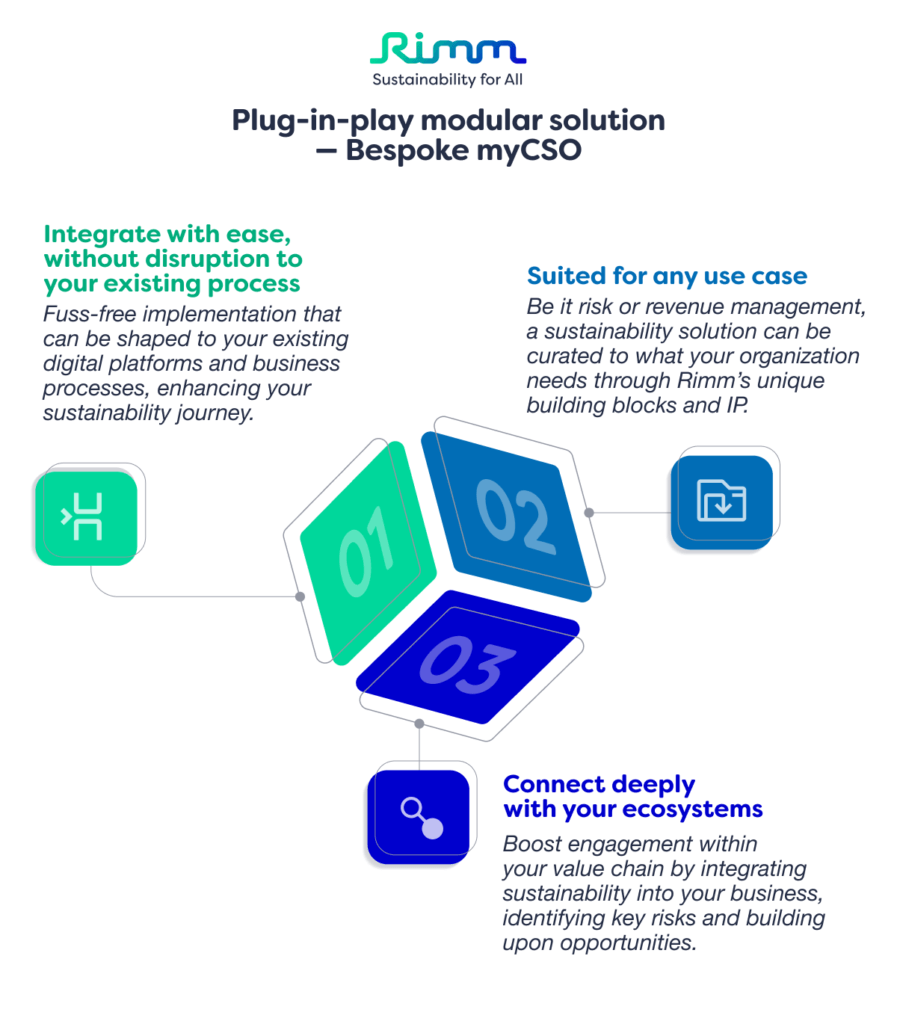

Bespoke myCSO from Rimm Sustainability

Rimm’s Bespoke myCSO is a modular ESG solution that allows clients to customize their sustainability solutions to match their specific needs. With Rimm’s varied building blocks like assessments, impact reports, carbon calculators, etc. The client can create their own plug-in-play modular solution.

Regulatory and compliance mandates imposed by governments can be met with this solution by large enterprises. Using Bespoke myCSO, clients can save time and meet all regulatory and compliance requirements easily.

Insights into the Future of Sustainable Investing

Sustainability investing continues to gain momentum, and ESG modularity is poised to play an important role in shaping its future. With bespoke myCSO, investors can benefit from greater flexibility, insight, and integration capabilities, while also achieving competitive financial returns. Investors, asset managers, and other stakeholders can use bespoke myCSO to drive long-term value and advance sustainability.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.