In a world where ESG regulation is both accelerating and retreating, depending on where you look, businesses are left navigating a complex and often contradictory landscape. While some jurisdictions are scaling back mandatory disclosures, others are doubling down, pushing for greater clarity and comparability in sustainability reporting. Amid this regulatory uncertainty, one framework is gaining widespread global traction for its structured, investor-focused approach: the International Financial Reporting Standards (IFRS). Developed by the International Sustainability Standards Board (ISSB) under the IFRS Foundation, IFRS S1 and S2 represent a unified baseline for sustainability-related disclosures. IFRS S1 sets out general sustainability reporting requirements across industries, while IFRS S2 focuses specifically on climate-related disclosures, building on the well-known TCFD framework. Together, these standards are designed to help companies report the sustainability risks and opportunities most likely to impact their financial position, business model and long-term strategy. In an environment where regulatory mandates may be evolving, stakeholder expectations around transparency, comparability and decision-useful data remain firm. In this blog, we explore why IFRS S1 and S2 matter in 2025, what they require from businesses and how Rimm is helping organizations translate these standards into credible, actionable and performance-driven ESG reporting.

The Shift Toward a Unified ESG Reporting Framework

Since their finalisation in June 2023, IFRS S1 (general sustainability) and S2 (climate-related) have created a globally consistent benchmark for ESG reporting, reducing fragmentation and enabling comparability across markets. In June 2025, the ISSB further released guidance on climate-related transition‑plan disclosures, clarifying what entities should include: governance, strategy, metrics and risk approach, all aligned to enterprise value. With over 36 jurisdictions adopting or planning adoption, the focus is clear, even where local regulations lag.

But the momentum goes beyond adoption statistics. Across boardrooms and sustainability teams, IFRS S1 and S2 are becoming a strategic lens, not just a reporting exercise. Businesses are realising that these frameworks offer more than regulatory alignment: they offer a structured language to articulate sustainability performance in a way that financial stakeholders understand.

This is especially important in 2025, where ESG narratives can be polarising and confidence in reporting hinges on clarity and comparability. Investors are demanding standardized, verifiable data to evaluate climate-related and non-climate-related and is risks, capital allocation and long-term resilience. The IFRS approach aligns ESG disclosure directly with enterprise value, giving organisations a practical framework for integrating sustainability into the core of business strategy, not the periphery.

And while compliance may not yet be legally binding in every region, the reputational and competitive costs of ignoring IFRS guidance are mounting. Companies that fail to disclose using credible frameworks increasingly face exclusion from sustainable finance portfolios, scrutiny from supply chain partners and mistrust from employees and customers. IFRS S1 and S2 are increasingly being adopted as widely recognized frameworks for sustainability disclosure.

Decoding S1 & S2 Requirements

IFRS S1 addresses general sustainability-related risks and opportunities that can impact enterprise value, while IFRS S2 specifically focuses on climate-related matters. Both standards are built around four key pillars:

- Governance: Oversight structures for climate and sustainability-related issues

- Strategy: Integration of sustainability into business strategy, including transition plans where applicable

- Risk Management: Identification, assessment, and management of relevant risks

- Metrics & Targets: Measurement and disclosure of Scope 1, 2, and 3 emissions, climate targets, transition plan assumptions, and dependencies

June 2025 guidance elaborates Sections 3.1–3.3 of S2: requiring disclosure on governance, strategy, metrics, targets and crucially, formal transition-plan details if a company has set one.

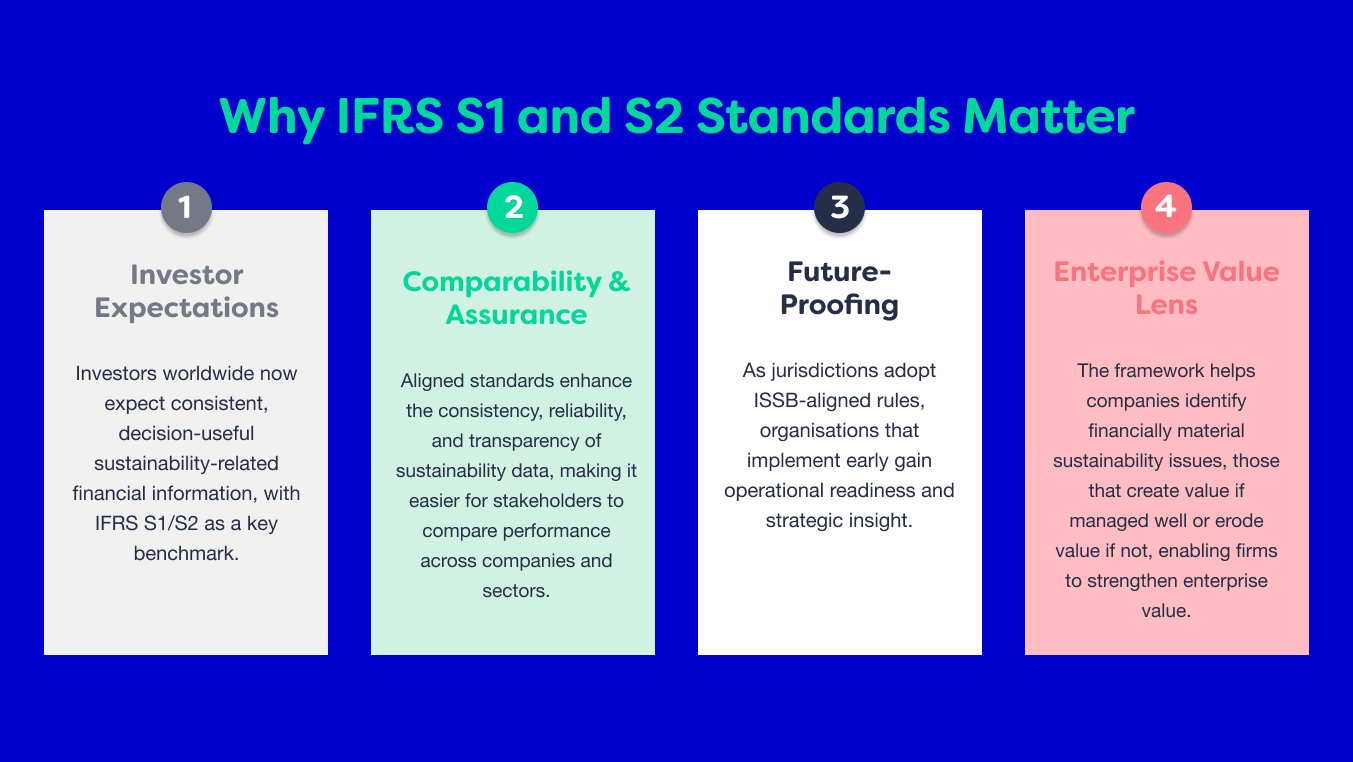

Why These Standards Matter Even Where Laws Don’t Yet Apply

- Investor Expectations: Investors worldwide now expect consistent, decision-useful sustainability-related financial information, with IFRS S1/S2 as a key benchmark.

- Comparability & Assurance: Aligned standards enhance the consistency, reliability, and transparency of sustainability data, making it easier for stakeholders to compare performance across companies and sectors.

- Future-Proofing: As jurisdictions adopt ISSB-aligned rules, organisations that implement early gain operational readiness and strategic insight.

- Enterprise Value Lens: The framework helps companies identify financially material sustainability issues, those that create value if managed well, or erode value if not, allowing firms to strengthen enterprise value even where disclosure isn’t legally required.

How Rimm Drives Compliance and Performance

At Rimm, we help organisations cut through the complexity of IFRS S1 and S2 reporting by combining our advanced AI-powered platform with deep subject-matter expertise. Our approach is designed not only to ensure compliance but to make ESG data collection, validation and disclosure practical, collaborative and strategically valuable. Here’s how we do it:

- Answer Assistance & Compliance Checks: The Answer Assistance feature guides users through each disclosure question by providing suggested answers along with explanations for why that answer was selected. It also links to source materials, giving full transparency on where the information comes from. The Compliance Checker evaluates your responses against standards such as IFRS, ISSB and CSRD. Results are categorized as Highly Aligned, Partially Aligned, or Not Aligned with AI Insight Available, with detailed insights on how to bring answers into compliance.

- Collaborative Capabilities: Assessments through the Rimm platform are industry-specific, customised to each client’s sector, so disclosures are always relevant and decision-useful. By allowing an unlimited number of users, it is easy to delegate specific disclosures to relevant departments and even tag nominated stakeholders. For instance, if a finance-related disclosure is required, the account administrator can invite the appropriate finance team member(s) to contribute directly to the platform. This streamlines collaboration, ensures accuracy, saves time and reduces bottlenecks.

- Data Collection & Quality: While IFRS S2 requires disclosure of Scope 1–3 emissions, our data management support goes much further. Rimm’s platform collects and validates a broad range of sustainability data, from energy use and waste management to workforce metrics and governance indicators.

- With a database of over 7,000 questions, we ensure the right ESG assessments are configured for your organisation and the relevant ESG metrics are collected.

- Our workflow tools make internal assurance and validation seamless by allowing teams to assign responsibility, flag inconsistencies and provide documentation within the same platform.

- By engaging multiple stakeholders, companies can ensure that every part of the organisation contributes to accurate and credible reporting.

- Reporting & Disclosure: Once data is collected and validated, our platform autogenerates dashboards, highlights key metrics, and an analytics report. Using these outputs, we build custom reports, ensuring a strong framework-aligned ESG narrative is created.

- Benchmark & Scenario Analysis: Rimm enables organisations to compare their performance against industry peers and future climate scenarios. This goes beyond compliance: companies can use these insights to demonstrate resilience, identify opportunities for improvement and align long-term strategies with climate pathways.

Start Your IFRS S1/S2 Journey Today

Even if local regulation has not yet mandated disclosure, leading organisations are adopting IFRS standards, not because they have to but because it builds credibility, unlocks capital and deepens stakeholder trust.

IFRS: A Strategic Route Map

Step |

Focus Area |

Result |

1. Get Familiar with the Requirements |

Understand IFRS S1 and S2 standards, disclosure categories, and guidance |

Builds foundational knowledge and sets clear expectations |

2. Perform Gap Analysis |

Compare current ESG practices and data against IFRS requirements |

Identifies strengths, weaknesses, and areas needing attention |

3. Fill the Gaps |

Develop processes, collect missing data, and align governance structures |

Closes compliance gaps and strengthens reporting readiness |

4. Internal Review |

Engage internal teams, leadership, and stakeholders in reviewing disclosures |

Ensures accuracy, ownership, and cross-functional alignment |

5. Third-Party Data Assurance |

Validate data through independent assurance providers |

Increases credibility, audit-readiness, and stakeholder trust |

6. Publish |

Incorporate disclosures into annual reports or standalone sustainability reports |

Provides transparency and meets stakeholder/regulatory expectations |

7. Iterate & Improve |

Use benchmarking, feedback and scenario analysis to refine disclosures |

Drives continuous improvement and long-term ESG performance |

From Compliance to Strategic Confidence

IFRS S1 and S2 have reset expectations, not just for compliance, but for strategic alignment. In 2025, ESG disclosure anchored in global standards demonstrates governance maturity, market readiness and climate resilience.

With Rimm’s ESG platform, organisations can move beyond compliance: embedding standardised ESG data into strategy, investment decisions and narrative impact.

If you’re ready to lead with transparency and purpose, let’s take the next step together. Discover how IFRS-aligned ESG reporting can unlock new opportunities.

Book a call with our team of experts here to get started!