The conversation around sustainability and corporate accountability has evolved. Today, businesses are not only evaluated based on their direct emissions but are increasingly held accountable for their full environmental footprint, including those embedded across their entire value chain. With shifting regulatory expectations and growing investor scrutiny, Scope 3 emissions have become a critical focus for organizations aiming to meet global climate goals. Despite accounting for more than 70% of a company’s total carbon footprint, Scope 3 remains the most difficult to track, manage and mitigate. Companies that fall behind on addressing these indirect emissions risk more than non-compliance, they risk diminishing competitive edge, losing investor trust and weakening long-term business resilience. In this blog, we explore why Scope 3 is rising to the top of the sustainability agenda and how businesses can move from complexity to clarity using smarter tools and strategies.

Many organizations have made progress on Scope 1 and Scope 2 emissions, reducing their direct operational footprint and purchased energy emissions. However, without tackling Scope 3, the largest and most impactful source of corporate emissions remains unaddressed.

Why is tackling Scope 3 critical?

- Investor & Consumer Expectations: ESG-driven investors and sustainability-conscious consumers are demanding full value chain accountability. Businesses that can prove sustainability beyond direct operations will gain credibility and investor trust.

- Business Risk & Resilience: Companies that ignore Scope 3 emissions expose themselves to supply chain disruptions, regulatory penalties as the case may be and reputational damage.

- Competitive Advantage: Organizations that excel in Scope 3 tracking and reduction strategies will secure sustainability-linked investments, build stronger partnerships and differentiate themselves in ESG-driven markets.

- Regulatory & Compliance Demands: With regions like the EU easing its regulatory pace, businesses may feel less urgency. However, global momentum is still pushing for greater accountability. Frameworks such as ISSB, SEC climate disclosure rules, and EU Taxonomy continue to require companies to account for their total carbon impact, including Scope 3.

Challenges in Measuring and Managing Scope 3 Emissions

Despite its growing importance, managing Scope 3 emissions is one of the most complex and resource-intensive challenges in ESG reporting.

Key obstacles businesses face:

- Fragmented & Incomplete Data: Many suppliers lack the infrastructure or incentives to provide accurate emissions data, creating significant gaps in reporting.

- Lack of Standardization: Different industries operate with varying emissions factors and different methodologies. The lack of a universal framework makes it difficult to compare, benchmark or measure Scope 3 consistently.

- Limited Supply Chain Visibility: Businesses struggle to obtain granular data on supplier and product lifecycle emissions, hindering meaningful reduction strategies.

- Time & Resource Constraints: Traditional ESG reporting relies on manual processes, making it expensive, time-consuming and highly prone to errors.

These challenges often result in underreporting, miscalculations or non-compliance, making it difficult for companies to set realistic reduction targets or make data-driven sustainability decisions.

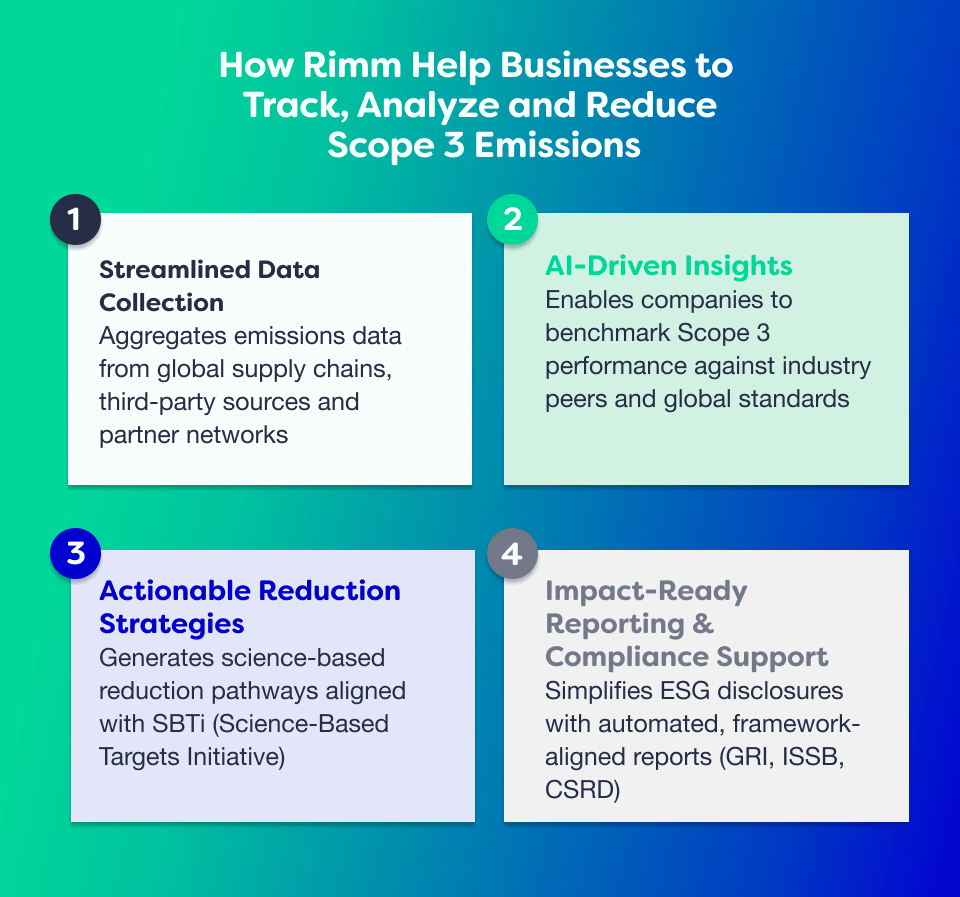

How is Rimm helping businesses to track, analyze and reduce Scope 3 emissions?

At Rimm, we believe managing Scope 3 emissions should be efficient, accurate and actionable. That’s why we’ve partnered with a certified emissions data provider to ensure our platform is powered by industry-leading emissions factors. This collaboration enables automated, science-based carbon calculations that are aligned with the latest reporting standards — giving our clients confidence in the accuracy and integrity of their data.

Our platform delivers a comprehensive, AI-powered approach that transforms Scope 3 compliance into a strategic advantage:

By integrating Rimm’s cutting-edge solutions, businesses can turn Scope 3 compliance from an operational headache into a competitive advantage.

What’s Next? The Future of Scope 3 Reporting

Looking ahead, Scope 3 reporting will continue to evolve, becoming more standardized and scrutinized. Companies that invest in automation, AI-driven insights and streamlined tracking tools will be best positioned to:

- Enhance ESG transparency and attract sustainable investment opportunities

- Strengthen supply chain resilience, ensuring a low-carbon and responsible value chain

- Meet customers’ expectations and build trust and loyalty

- Meet evolving regulatory requirements with minimal disruption

Take Control of Scope 3

The path to net zero isn’t just about what happens within your own walls, what we have learned so far is that it’s about addressing the broader value chain impact across your entire ecosystem. Scope 3 emissions don’t have to be a roadblock, they can be an opportunity for leadership, innovation and long-term value creation.

The future of corporate sustainability is here. Are you ready to lead? Book a call with our team of experts here to get started!