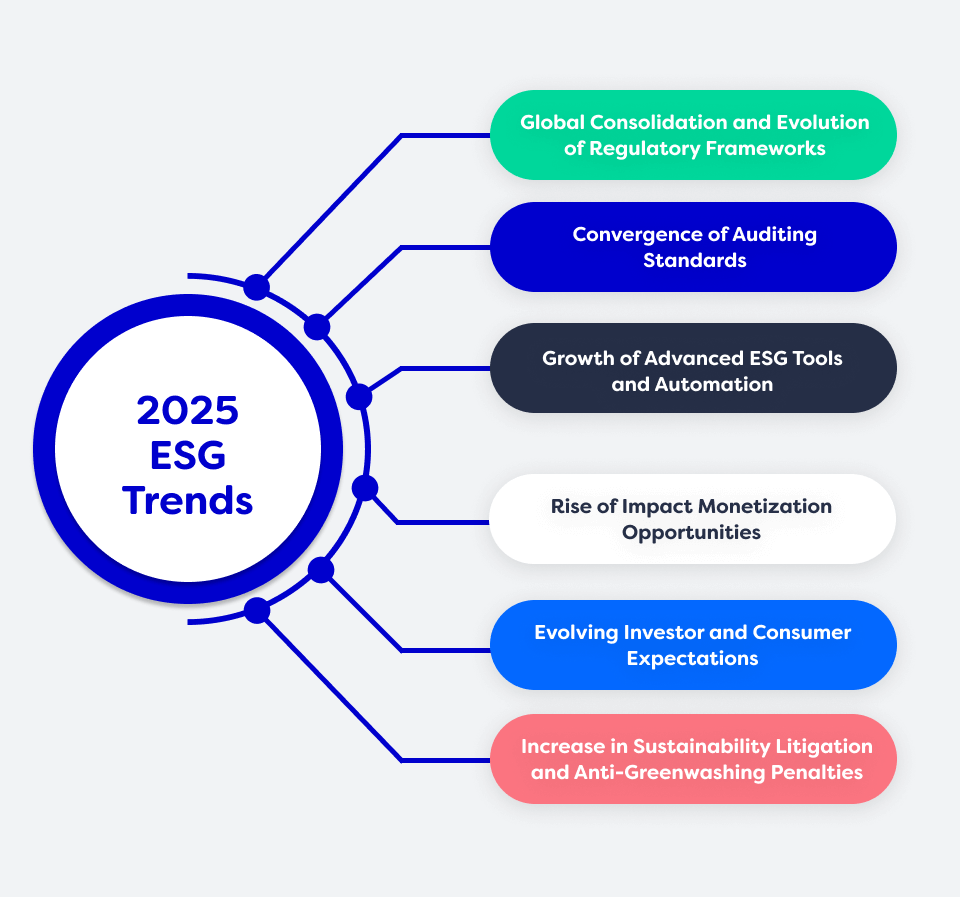

In 2025, the sustainability landscape is evolving faster than ever, presenting businesses with both challenges and opportunities. From evolving regulatory requirements to the transformative power of automated ESG tools, staying ahead of these trends isn’t just about compliance—it’s about unlocking strategic advantages. As organizations navigate this shifting terrain, those who embrace innovation, transparency, and proactive adaptation will not only meet rising stakeholder expectations but also position themselves as leaders in the race towards a sustainable future. In this blog, we’ll explore some of the key ESG trends shaping 2025, and discuss actionable steps that can be taken for organizations to stay ahead in a dynamic environment.

1. Global Consolidation and Evolution of Regulatory Frameworks

The landscape of ESG reporting continues to evolve as regulatory requirements advance globally. ESG standards are becoming increasingly stringent, with parallel efforts to consolidate frameworks, making compliance both more demanding and more streamlined for organisations.

The International Sustainability Standards Board (ISSB) is spearheading a transformative effort to bring global consistency to sustainability reporting. Adopted by over 25 jurisdictions, these standards aim to unify the fragmented landscape of ESG disclosures, enabling investors and stakeholders to make better-informed decisions. With the ISSB’s guidelines setting the tone, companies worldwide are finding it easier to align their reporting practices and demonstrate accountability in a credible, globally recognized format.

In the EU, the Corporate Sustainability Reporting Directive (CSRD) complements this global momentum by mandating detailed sustainability reporting for over 50,000 large companies and listed SMEs. This directive has significantly expanded the scope of ESG disclosures and highlights the importance of aligning with broader international standards like those developed by the ISSB.

In contrast, the U.S. has seen a rise in anti-ESG sentiment, with some states rolling back ESG policies. However, global momentum remains strong. As Seth Warren, our Head of Sustainability Practice at Rimm, states: “Despite rising anti-ESG sentiment in the U.S, the global momentum for enhanced sustainability reporting remains strong, driven by jurisdictions, firms, and investors recognizing ESG as critical for resilience and risk management.”

Organizations navigating multiple markets face increasing complexity. Leveraging digital platforms like ESG-specific compliance tools can streamline reporting processes, ensuring alignment with diverse frameworks while reducing operational burdens.

2. Convergence of Auditing Standards

Auditors have long faced challenges in aligning ESG reporting standards across jurisdictions. The International Auditing and Assurance Standards Board (IAASB) is working to harmonize these standards, providing greater consistency and credibility in sustainability disclosures.

The shift toward unified auditing practices is critical for investor confidence. A recent report highlighted that 76% of institutional investors consider reliable ESG data as essential for decision-making (PwC Global Investor Survey, 2024).

Strengthening internal audit capabilities and aligning reporting practices with emerging standards can help businesses maintain a competitive edge while building trust with stakeholders.

3. Growth of Advanced ESG Tools and Automation

Sustainability managers are increasingly adopting advanced tools to streamline ESG processes. AI-powered platforms now enable organizations to automate data collection, analyze vast datasets, and generate detailed reports with minimal manual intervention.

Generative AI (Gen AI) has emerged as a game-changer, facilitating predictive analytics and automating decision-making processes. According to a 2024 report by Gartner, 60% of large enterprises are expected to adopt AI-driven ESG tools by 2026, enhancing efficiency and accuracy in reporting.

By embracing these technologies, businesses can redirect resources toward strategic initiatives, ensuring long-term ESG success.

4. Rise of Impact Monetization Opportunities

Organizations are increasingly capitalizing on sustainability through impact monetization. According to McKinsey, the global market for carbon credits is projected to surpass $50 billion by 2030, driven by growing corporate commitments to net-zero goals.

Blockchain technology is playing a pivotal role in enhancing the transparency and traceability of carbon credit transactions. Companies can also benefit from trading renewable energy certificates (RECs), a market valued at over $12 billion in 2023 (IEA, 2024).

Implementing robust mechanisms to track and verify sustainability contributions ensures compliance while opening doors to innovative revenue streams.

5. Evolving Investor and Consumer Expectations

Investors increasingly demand tangible evidence of ESG performance, with sustainable fund assets reaching $2.5 trillion by the end of 2023, according to ISS Insights. Meanwhile, consumers prioritize ethical and transparent practices, influencing purchasing decisions and brand loyalty.

A 2024 Deloitte survey revealed that 65% of consumers are willing to pay more for sustainable products, underscoring the critical role of ESG in driving market differentiation.

To meet these expectations, organizations must engage stakeholders with transparent reporting and authentic communication about their ESG initiatives.

6. Increase in Sustainability Litigation and Anti-Greenwashing Penalties

Regulatory bodies are intensifying their crackdown on greenwashing, with litigation cases doubling between 2022 and 2024 (UNEP, 2024). Misleading sustainability claims can result in hefty fines and reputational damage.

This is even more prevalent for heavy industries, including energy companies, with climate litigation against fossil fuel giants like BP, Shell, and ExxonMobil almost tripling since 2015. These lawsuits often relate to misleading advertising, with companies overstating their environmental efforts, or due to failure to set and implement emissions reduction targets.

Considering another example, Keurig, a North American beverage company, faced a $1.5 million penalty from the U.S. Securities and Exchange Commission (SEC) for overstating its environmental achievements (TechTarget, 2024). This penalty followed years of scrutiny over its claims that K-cup coffee pods were recyclable, despite most recycling facilities in the U.S. and Canada being unable to process the pods due to their size and material composition.

Honest and accurate sustainability reporting is essential for companies to avoid costly litigation and reputational damage, as the examples above demonstrate. With regulatory crackdowns intensifying, misleading environmental claims, like those made by Keurig and fossil fuel giants, highlight the financial and legal risks of greenwashing.

Embracing the Future of ESG

As the ESG landscape evolves, businesses face both challenges and opportunities. Staying informed about regulatory developments, leveraging advanced technologies, and aligning with stakeholder expectations are essential steps to thriving in this shifting environment.

At Rimm, we believe in empowering businesses to lead the charge toward a sustainable future. Our suite of innovative tools and expert guidance ensures that companies not only meet compliance requirements but also create meaningful impact. As our Head of Sustainability Practice puts it, “Global momentum for enhanced sustainability reporting is unstoppable, driven by a shared recognition of ESG as a cornerstone of resilience and risk management.”

Let’s embrace 2025 with purpose and make it a year of transformative progress for sustainability. Our team of experts is here to help you achieve your sustainability goals. 👉🏾 Reach out today