For asset managers, tracking sustainability performance in portfolio companies is complex. manage+ simplifies the process.

Asset managers are increasingly under pressure from investors, regulators and other stakeholders to disclose information about the environmental, social and governance (ESG) performance in their portfolios. In response, many managers need to shape up their processes for tracking and organizing ESG performance in their portfolio companies.

But this requires aligning with a complex mesh of sustainability frameworks and standards. So many asset managers are desperately seeking something that helps them more easily track and manage sustainability reporting. But they can relax – a one-click ESG reporting solution is at hand, and it’s called manage+.

4 ways to improve ESG data management and reporting

manage+ helps asset and fund managers reduce the time, cost and resources they spend on ESG data management and reporting across their portfolios. manage+ provides a bird’s eye view of your portfolio sustainability performance, helping you track it seamlessly from one dashboard; boost communication with your portfolio companies; and generate your portfolio’s aggregated metrics in one click.

Here is more detail about the four key ways manage+ helps asset managers.

1. Comply with global sustainability standards and frameworks

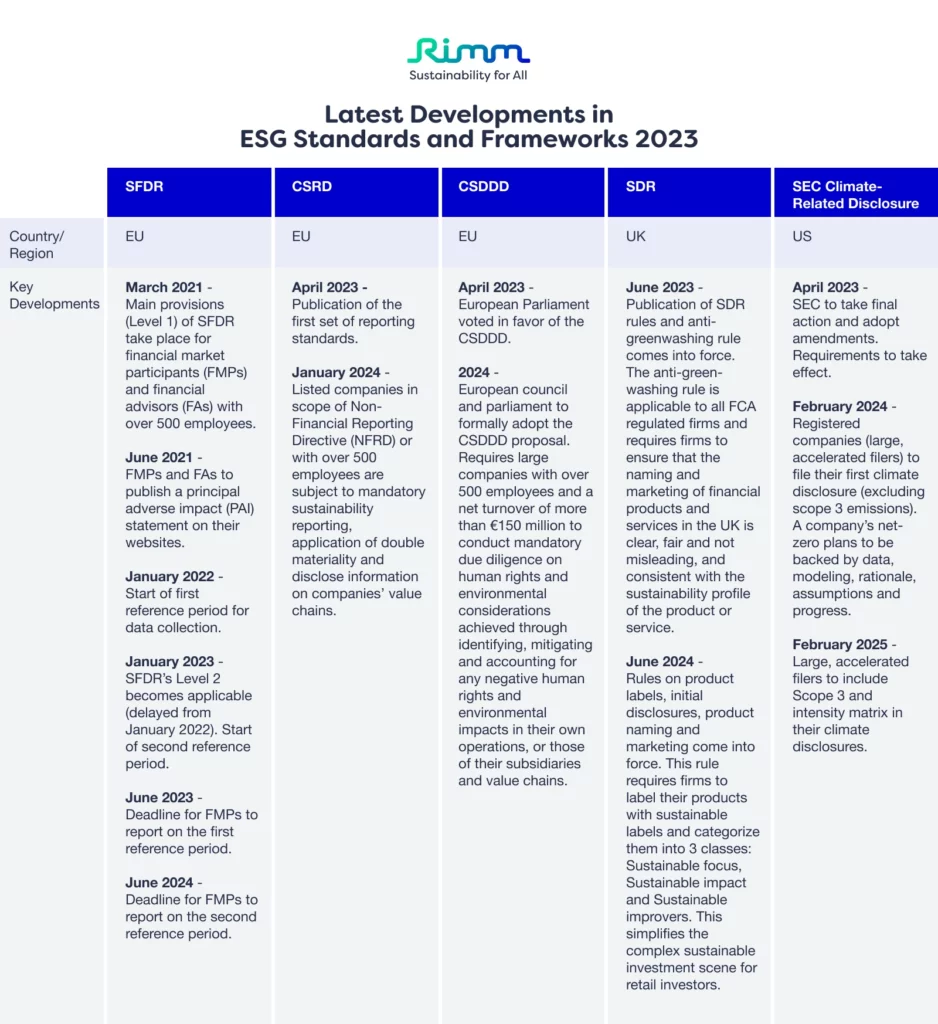

manage+ enables you align with frameworks relevant to your company, such as Task Force on Climate-related Financial Disclosures (TCFD); Sustainable Finance Disclosure Regulation (SFDR); Institutional Limited Partners Association (ILPA); Global Reporting Initiative (GRI); Sustainable Accounting Standards Board (SASB); and ESG Data Convergence Initiative (EDCI).

Asset managers invite their portfolio companies to input their details and create a myCSO account, including information about their industry and sub-industry. myCSO then automatically generates assessments tailored to material topics for each company.

This aligns companies with the relevant international standards and frameworks to make compliance and reporting hassle-free for them and the asset manager.

2. Auto-populate your ESG data to any LP or regulatory template

manage+ integrates a natural language processing (NLP)-driven tool that enables precise auto-population of the asset manager’s ESG data into any LP or regulatory template.

This eases reporting; significantly streamlines data collection and reporting processes; and saves time and effort for your fund managers and regulatory compliance teams.

3. Easily manage and analyze your portfolio’s ESG performance in one place

Get a holistic overview of your portfolio’s ESG and sustainability performance across industries on one portfolio dashboard. This includes an overall ESG score that also breaks down to show how well each company performed on various ESG topics and indicators.

Once companies have submitted their assessments, myCSO will auto-generate a performance dashboard and reports analyzing their ESG performance.

This analysis helps you identify and target areas of weakness to work on and improve sustainable impact and value across your portfolio.

4. Benchmark and compare ESG performance and track KPIs

The dashboard shows how well each company performed on common indicators against its peers of the same or similar industry, region and size.

This enables asset managers to analyze and benchmark performance, track key performance indicators and extract insightful data that benefit you and your portfolio.

Want to learn more about manage+?

Book a demo and start managing your portfolio companies’ ESG with ease today.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.