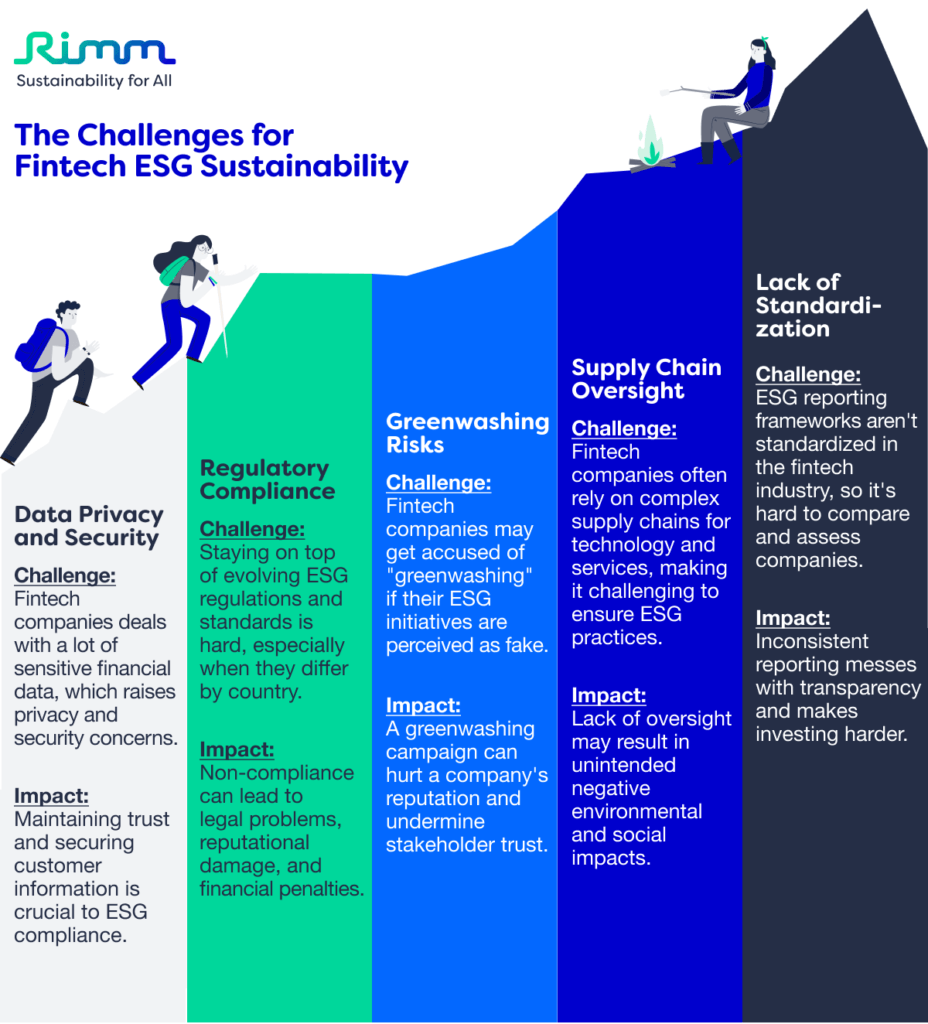

Organizations are now collecting and storing large amounts of non-financial data for ESG. In this blog post we discuss why data security is important in the context of non-financial ESG data, the methods available to do so, and the steps we take as an organization to protect client data.

Why is data security important?

Data breaches are an unfortunate byproduct of the highly connected and digital world we live in, placing a responsibility on organizations to ensure sufficient data protection measures are in place. With the rise of ESG, organizations now have to collect large amounts of non-financial data, in addition to the financial data already being collected and stored. Whether for sustainability reporting requirements or to inform strategic decision-making, protecting this data is vital before it’s publicly released.

As the volume of non-financial ESG data being collected by organizations continues to increase, ensuring that the data is being handled securely and ethically is an important governance consideration which, if done well, can contribute to greater resilience and long-term, sustainable business growth.

By investing in robust data security measures, organizations can avoid the financial costs of damages associated with data breaches, reduce the overall risk of financial and non-financial data being lost or stolen, and reduce the risk of reputational damage.

How can data be protected?

As technology has developed, the ability to contain data breaches has also improved, and there are now a myriad of ways that organizations can protect their data. To create and implement an effective data security policy, consideration must be given to the type and volume of data being stored, where vulnerabilities exist, and how best they can be mitigated.

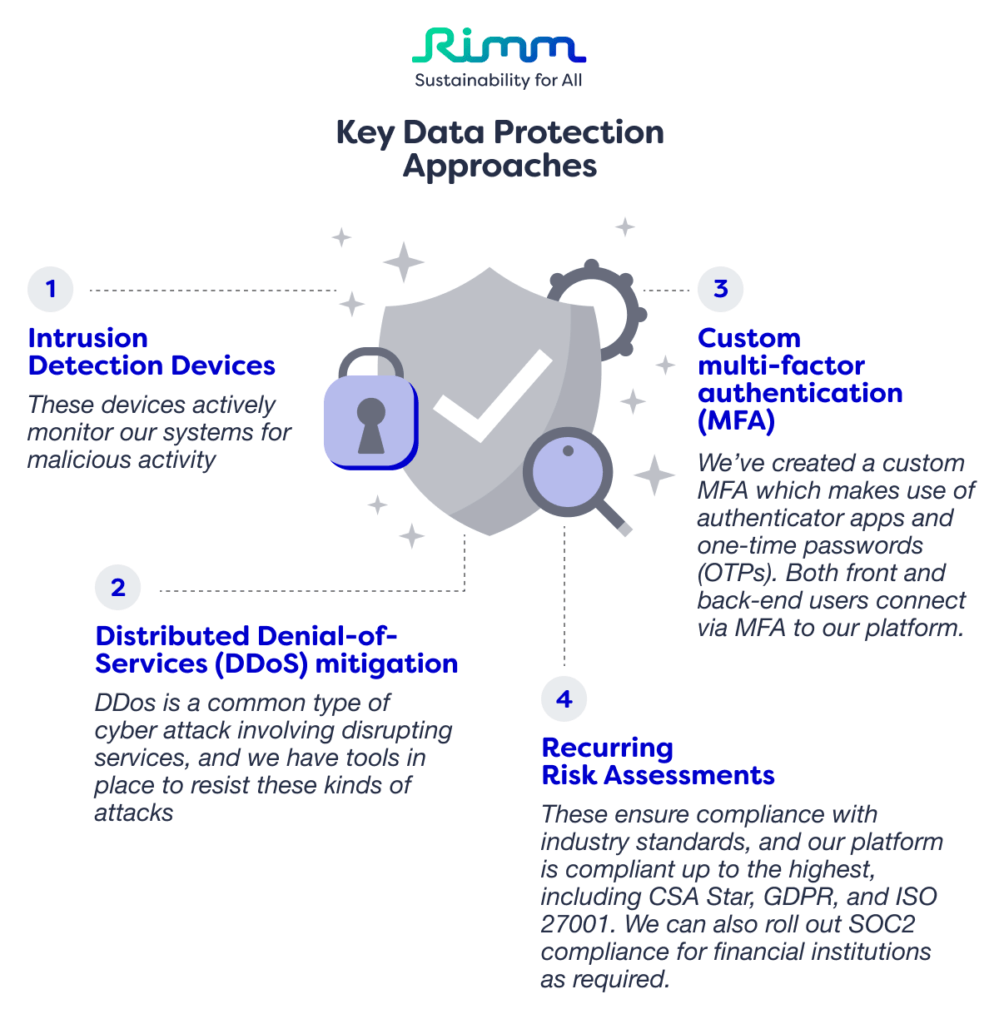

Approaches to data security include creating security layers to increase the chances of identifying and halting potential attacks, introducing role-based access to control what access rights certain individuals are entitled to, and asking users for multiple pieces of evidence to verify their identities, known as multi-factor authentication (MFA).

Keeping data security measures updated in line with industry standards is also a useful way to ensure the protections put in place are robust enough. There are several ISO and industry standards relating to data security and privacy, including GDPR, ISO 27001 and SOC2.

How we protect client data

At Rimm, we believe that data security is an important part of ESG, whether it is the ethical handling of data or compliance, the non-financial data that organizations gather should be secured and protected, just like financial data. We take data security seriously and know it is important to clients, which is why our platform is hosted on an enterprise-class high performance cloud infrastructure with multiple layers of security. Our platform is also hosted within Amazon Web Services data centers, which are secure and certified.

Our security system is governed by a comprehensive set of Policies & Procedures, including Access Control, Data Classification, Encryption, Information Security and Physical Security. Below are some of the key approaches used to ensure we protect our clients’ data:

Interested to learn more about our solutions? Book a session to talk with our team today.

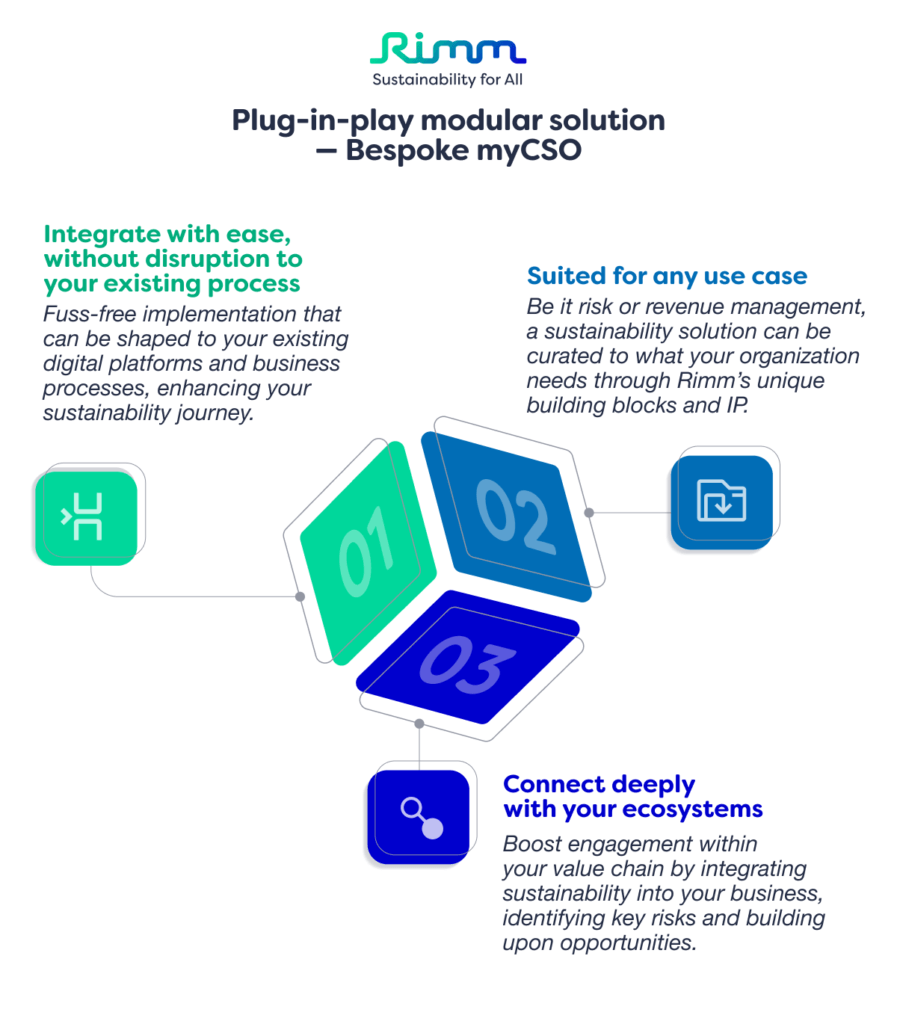

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.