The intersection of finance and sustainability has gained significant momentum in recent years, reshaping the financial landscape. Our blog explores the profound impact of ESG and sustainability on the fintech industry, how it’s driving innovation, fostering change, and reshaping the future.

Environmental, Social, and Governance (ESG) in Finance:

Investors, consumers, and businesses evaluate a company’s environmental, social, and governance practices by looking at ESG criteria. Adopting ESG principles in fintech means aligning financial services with ethical and sustainable practices. Here’s how each component works:

- Environmental (E): Fintech is starting to recognize its impact on the environment, from energy consumption to waste generated. Green fintech like paperless transactions, carbon-neutral operations, and renewable energy adoption can help make the world a better place.

- Social (S): Any industry needs social responsibility to succeed, and fintech is no exception. By leveraging technology, fintech companies are promoting financial inclusion, offering affordable services to underserved communities, and facilitating responsible lending. Socially responsible fintech solutions bridge the financial gap and empower individuals and businesses alike.

- Governance (G): Transparent corporate governance, ethical decision-making, and diversity and inclusion are top priorities for fintech companies. To build trust among stakeholders, fintech firms need to adhere to robust governance practices.

Innovation in ESG and Fintech:

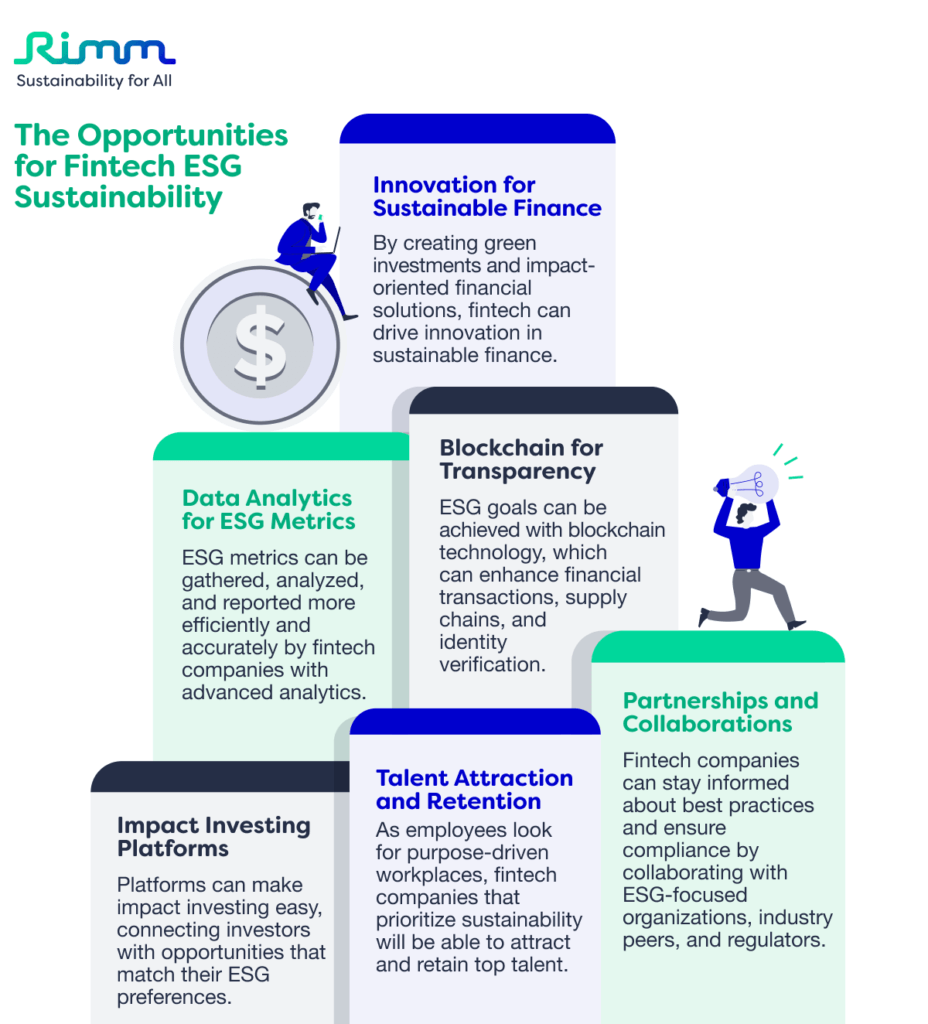

- Responsible Investing: Fintech platforms facilitate responsible investing by integrating ESG metrics into investment decision-making processes. As a result, investors can align their portfolios with their values, promoting sustainable and ethical investing.

- Blockchain for Transparency: Blockchain technology in fintech enhances transparency and accountability. In alignment with ESG governance principles, blockchain ensures data accuracy, reduces fraud, and fosters user trust by providing a transparent ledger.

- Green Financing: Fintech companies are at the forefront of green financing options. With innovative solutions like peer-to-peer lending for sustainable projects, fintech makes the economy more sustainable.

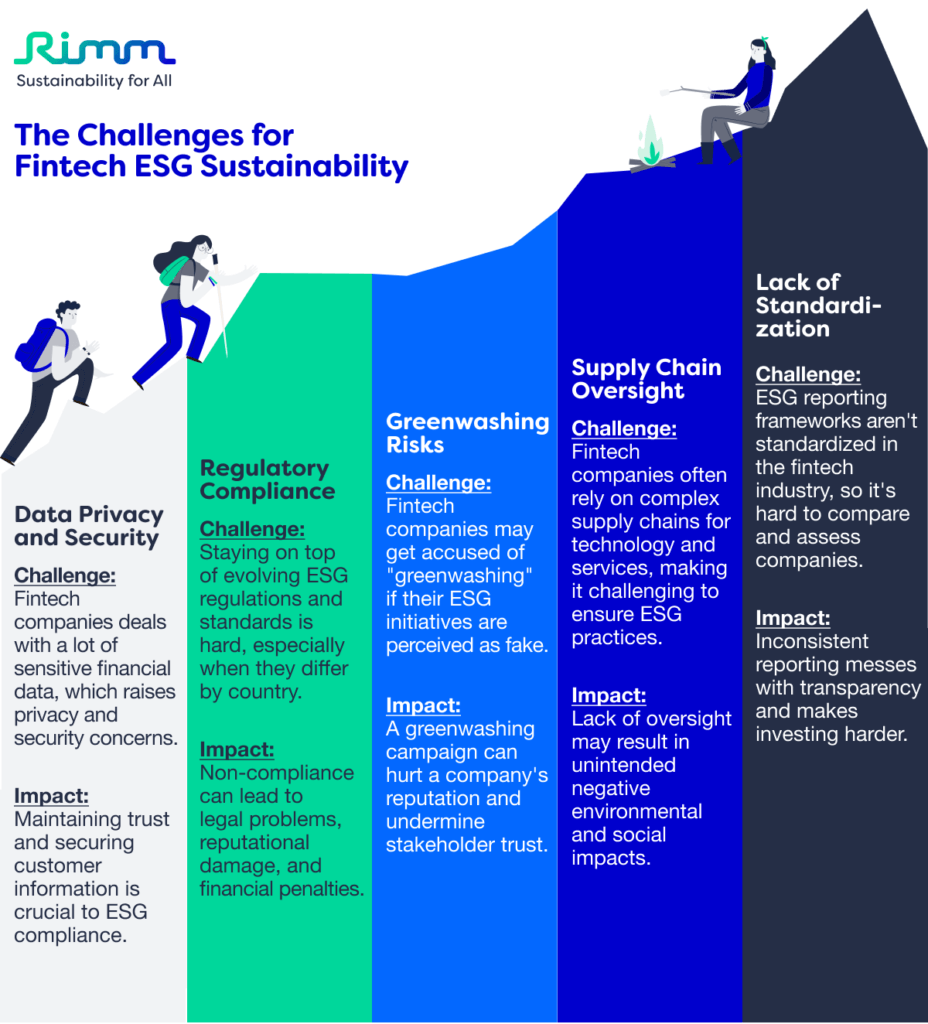

Challenges and Opportunities

Keeping ESG sustainable in fintech is challenging but also has many opportunities. Financial industry stakeholders are demanding more transparency and responsible business practices, so ESG considerations are becoming more important. These are some challenges and opportunities for fintech ESG sustainability:

What does Rimm do to solve this problem?

The exclusive offering by Rimm to financial institutions allows seamless traction, reducing the time, costs, and resources that asset and fund managers spend on managing and reporting ESG data. With Rimm’s solutions, you can have a bird’s eye view of your portfolio’s sustainability performance, boost communication with your portfolio companies, and generate aggregated metrics instantly. In addition, Rimm provides bespoke myCSO, which emphasizes modularity, and plug-in-play options that allow Fintech companies to customize their solutions using Rimm’s various AI-powered building blocks. It allows an organization to easily keep track of regulatory compliance and to stay ahead of changing ESG regulations.

The ESG sustainability revolution is changing how businesses operate. With its agility and technological prowess, fintech can lead this transformation. Embracing ESG principles can create value for stakeholders, the planet, and society. Sustainability and finance go together; they contribute to a more resilient, inclusive, and sustainable economy.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.