Ravi Chidambaram (Founder and CEO, Rimm) collaborates with WMI and NTU to deliver certified ‘ESG for Asset Managers’ course. Read on to learn more about the experience.

In today’s world, as investors and consumers are increasingly looking for companies that prioritize sustainability, ESG has become a key consideration for asset managers. Incorporating ESG in the investment processes can not only help asset managers assess the social and environmental impact of their investments, but also prepare against physical and transition climate risks and improve returns in the long term. By prioritizing ESG, asset managers can identify opportunities for positive impact and sustainable growth and help build a better world.

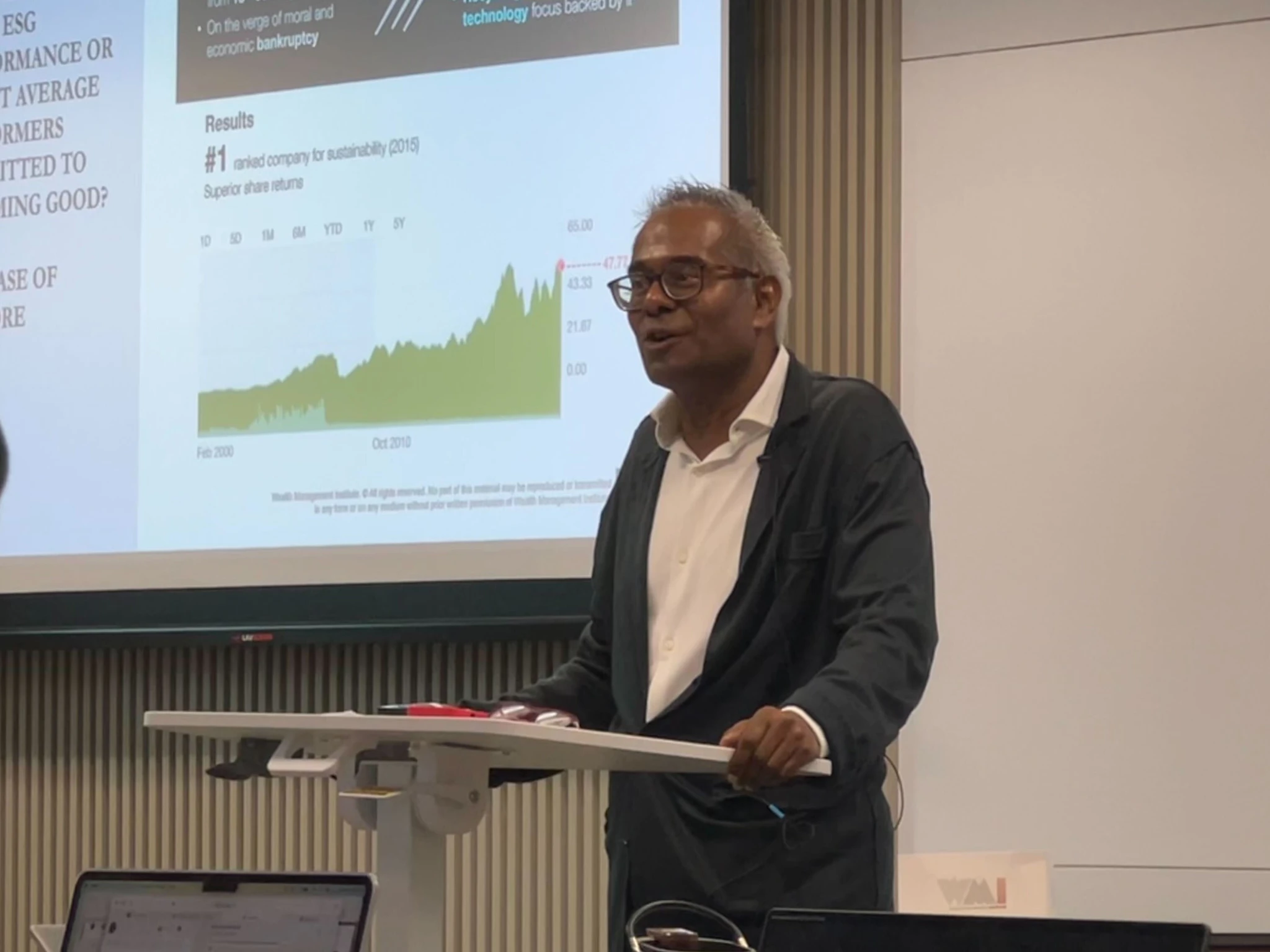

To support asset managers and wealth management practitioners in navigating the changing investment landscape, Rimm’s Founder and CEO, Ravi, held his first certified course on ‘ESG for Asset Managers’ in collaboration with Wealth Management Institute (WMI) of Singapore, a leading center for wealth and asset management education and research. The course was part of a broader ‘MSc Asset and Wealth Management’ program by Nanyang Technological University (NTU) and draws on Ravi’s ESG analytics and investment banking expertise, WMI’s extensive experience in running and certifying programs for asset management, and NTU’s establishment as a leading tertiary, academic institution.

Taught over a span of two days with a total intake of 44 students comprising wealth management professionals and finance practitioners, the course focuses on the application of ESG and sustainability frameworks, standards and approaches for investors. Our team at Rimm was also extensively involved in supporting Ravi in the preparation for various components of the course and was consulted on providing a range of learning opportunities, including interactive lectures with Rimm’s extensive network of esteemed thought leaders and academics in the ESG space, case studies, as well as highly collaborative and immersive group projects.

Ravi, who is also an adjunct professor at Yale-NUS College, covered a range of topics through a strategic investment and compliance lens, including public equity ESG investing, private equity ESG engagement strategies, and impact investing. Rimm’s Chief Research Officer (CRO) Dr. Geraldine Bouveret, was also invited to lead a comprehensive module on climate risks, with an in-depth exploration of physical and transition risks that companies need to be increasingly cognizant of in light of climate change.

As part of the modules, Rimm’s Education team also supported in guiding students through highly engaging in-class activities and collaborative data exercises inspired by the methodologies behind the Rimm platform. These include the ESG materiality and benchmarking exercise, as well as the SDG impact measurement exercise which were facilitated to encourage students to think critically about the methodologies used to measure ESG performance and share their perspectives on their findings.

In addition to our core team, the students also had the opportunity to hear from distinguished guest speakers in the sustainability field who were invited to cover different modules pertaining to ESG investing. Professor Kim Schumacher, renowned for his expertise in sustainable finance, addressed the topic of greenwashing, including competence greenwashing and its implications for companies. Sasja Beslik, Chief Investment Strategy Officer at SDG Impact Japan and is known for his extensive work in catalyzing the rise of ESG investing globally, particularly in Europe and the world, and is a recognized thought leader and practitioner in this space, was also invited to conclude the course on working towards better ESG investing.

The course was an excellent opportunity for the Rimm team to collaborate with various practitioners in the finance and investment space with a keen interest in ESG and to exchange meaningful perspectives on the topics discussed.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.