There is a wide range of ESG ratings systems available with inconsistent results on ESG scores for different companies. Hear Ravi Chidambaram (CEO, Rimm) on navigating this challenge.

ESG ratings provided by firms like MSCI and Refinitiv have come under increasing scrutiny by corporations, regulators and investors. These companies have been criticized for using opaque, inconsistent methodologies in developing ratings, making it difficult for practitioners to compare ratings between providers or predict ESG-risk outcomes.

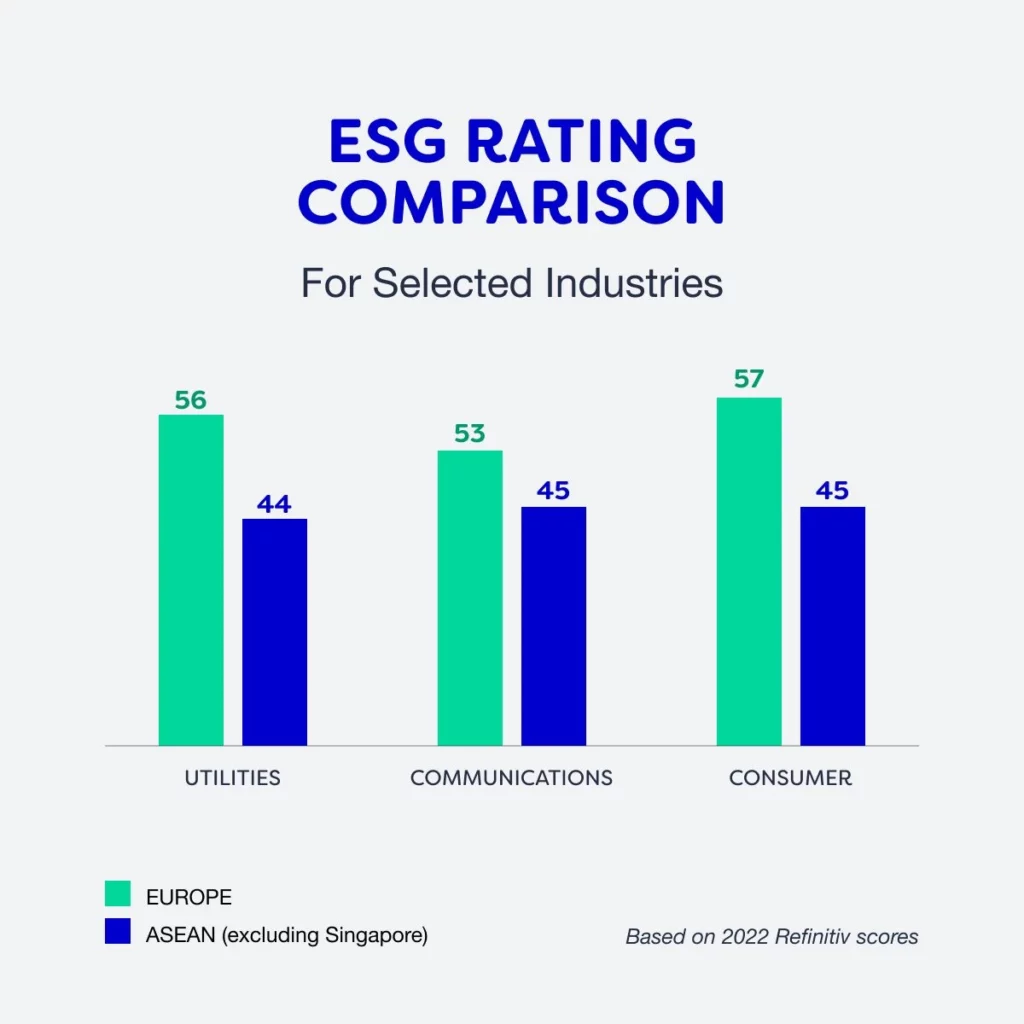

Another overlooked shortcoming amongst current major ratings providers is their “one size fits all” ratings system. In this model, virtually the same criteria are used to judge the ESG performance of a company from the United States or Europe with a similar company in the same industry in an emerging market. As the chart below shows, average ratings for emerging markets companies are often lower than companies from the West.

A recent academic paper by Professors Jeff Chen, Zenquan Li, Ting Mao and Aaron Yoon (“Global vs. Local ESG Ratings: Evidence From China”) demonstrates that local ESG ratings were much better than global ratings for predicting how ESG risks can materialize in Chinese companies. This was particularly the case in predicting social and governance risks in areas like corruption, legal violations and employment conditions. The authors conclude that the main reason for this is that local raters had a much better appreciation of the “contextual” nature of ESG risks in China.

ESG is a function of the local cultural, social, political and regulatory environment and varies greatly between countries and regions. For example, many Asian businesses are family-owned with multiple, related party transactions between different family entities. In Western corporate governance, this would normally be a red flag, but if managed responsibly, the risk posed by such related party deals may be benign. In a similar vein, a Nigerian or an Indonesian bank may be unfairly penalized for having greater lending exposure to fossil fuels than a Western bank though those countries derive the majority of their GDP from fossil fuels.

At Rimm, we see a clear demand from our clients in emerging markets for a more localized and contextualized ESG rating model. These companies want a more nuanced rating to better understand performance in the context of the local environment to set more realistic sustainability goals and targets. Local ESG ratings can also drive domestic, green capital markets growth as local investors are better able to price risk and opportunity within a local framework. We have already started developing a local ESG rating system for Indonesia and expect to trial it there soon.

Want to learn more about Rimm’s sustainability and ESG solutions?

Speak with our team to learn more about our ESG solutions.

Ravi Chidambaram

CEO – Founder

A strong believer in ethical, purpose-driven, and environmental-focused principles, Ravi Chidambaram has brought much value to the community through his knowledge and expertise. He shares his insight as a Professor of Sustainability at Yale-NUS and as a global commentator on sustainability issues. Now a serial entrepreneur, he is currently working on his 4th start up. It was there where he realized the need for sustainability that is both accessible and actionable, resulting in the creation of Rimm.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.