For years, ESG reporting has been treated as a fragmented exercise. Individual entities report in isolation, metrics are collected inconsistently, and sustainability narratives rarely connect across a group or portfolio. The result? Disclosures that technically meet requirements but fail to answer the questions stakeholders actually care about: How resilient is this organisation as a whole? Where are the risks concentrated? And how is sustainability performance improving over time? In recent times, that approach is rapidly losing relevance. As investors, boards and employees demand clearer insight into how organisations manage sustainability across complex structures, consolidated ESG reporting is emerging as a critical trust-building tool. It shifts the conversation from scattered compliance to coherent strategy. In this blog, we explore why portfolio and group-level ESG reporting matters more than ever, how it strengthens governance and accountability and what organisations can do to turn consolidated reporting into a strategic advantage.

From Fragmented Compliance to Consolidated Strategy

The early years of ESG reporting were largely reactive. Organisations responded to questionnaires, ratings agencies and regulatory requirements as they arose, often without a unifying framework. This was particularly true for investment firms, holding companies and diversified groups, where each subsidiary or portfolio company followed its own approach to sustainability.

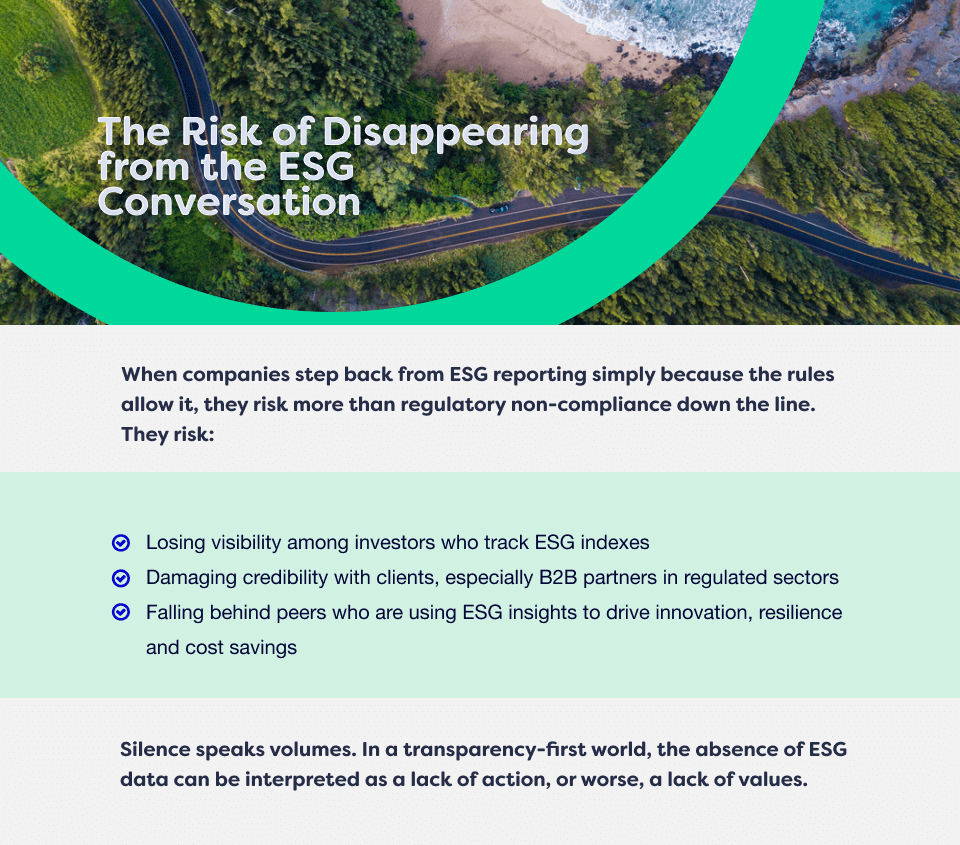

Today, that fragmentation creates real risk. Without consolidation, leadership teams struggle to see the full picture. Emissions may be reduced in one entity while rising in another. Workforce risks may be well-managed locally but poorly governed at the group level. And governance practices may vary widely, making oversight inconsistent and accountability unclear.

Consolidated ESG reporting addresses this challenge head-on. By bringing environmental, social, and governance data together at the portfolio or group level, organisations can assess performance holistically, identify systemic risks and set clear priorities. It also allows sustainability to be managed with the same discipline as financial performance, something investors increasingly expect.

Why Group-Level Reporting Builds Trust

Trust is built on clarity and consistency. Stakeholders want confidence that sustainability commitments are not limited to individual success stories, but are embedded across the organisation.

For investors, consolidated ESG reporting provides comparability. It allows them to understand how different entities within a portfolio perform against shared benchmarks, how risks are distributed and how capital allocation decisions align with sustainability objectives. For boards, it strengthens oversight by enabling consistent governance structures, policies and performance indicators across the group. For employees, it reinforces credibility, showing that sustainability values apply everywhere, not selectively.

In practice, consolidated reporting also reduces the noise created by multiple, disconnected disclosures. Instead of explaining sustainability performance entity by entity, organisations can tell a clearer, more strategic story about progress, challenges and long-term direction.

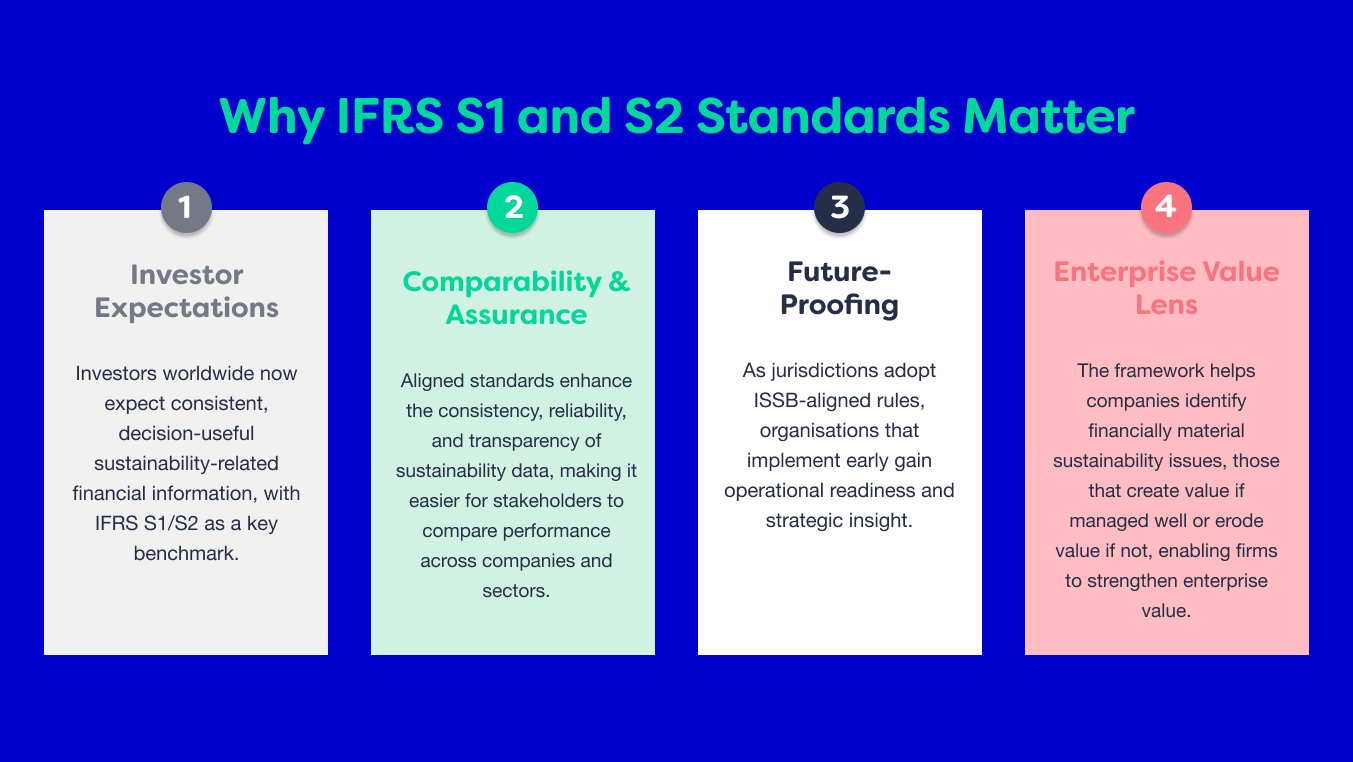

The Role of Global Frameworks in Credible Consolidation

Consolidation alone is not enough. To be meaningful, group-level ESG reporting must be anchored in recognised frameworks that ensure consistency and credibility.

Aligning disclosures with global frameworks such as the SDGs and regionally relevant initiatives like the ESG Disclosure and Classification Initiative (EDCI) helps organisations speak a common language. It improves comparability across portfolio companies, enhances alignment with investor expectations and reduces the risk of greenwashing by grounding narratives in established standards.

Framework alignment also provides structure. It guides organisations on what to measure, how to interpret results and how to connect sustainability performance to broader economic and societal outcomes. When applied at the group level, these frameworks become powerful tools for governance, enabling leadership teams to track progress against shared goals rather than disconnected metrics.

GLy Capital: Turning Consolidation Into Clarity

GLy Capital’s journey offers a compelling example of how consolidated ESG reporting can move beyond disclosure to real impact. Having reported with Rimm for the past three years, GLy has progressively strengthened its approach to sustainability reporting at the portfolio level.

In its 2024 consolidated sustainability report, GLy aligned emissions, workforce and governance data across its portfolio companies to global frameworks, including the SDGs and EDCI. This approach created a consistent baseline for performance measurement, allowing leadership to compare entities more effectively and identify both risks and opportunities across the portfolio.

The benefits were tangible. Board-level oversight improved as sustainability data became more structured and decision-useful. Portfolio companies gained clearer guidance on expectations and performance benchmarks. And trust with investors and employees deepened, supported by transparent, comparable and credible disclosures.

Rather than treating ESG as a reporting obligation, GLy used consolidation as a governance tool, strengthening accountability and reinforcing sustainability as a core part of its investment strategy.

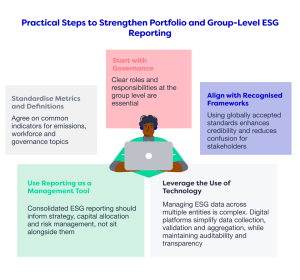

Practical Steps to Strengthen Portfolio and Group-Level ESG Reporting

For organisations looking to follow a similar path, a few practical principles can make a significant difference:

Start with Governance: Clear roles and responsibilities at the group level are essential. Define who owns the ESG strategy, who validates data and how performance is reviewed across entities.

Standardise Metrics and Definitions: Agree on common indicators for emissions, workforce and governance topics. This ensures data can be aggregated meaningfully without losing context.

Align with Recognised Frameworks: Using globally accepted standards enhances credibility and reduces confusion for stakeholders reviewing consolidated disclosures.

Use Reporting as a Management Tool: Consolidated ESG reporting should inform strategy, capital allocation and risk management, not sit alongside them.

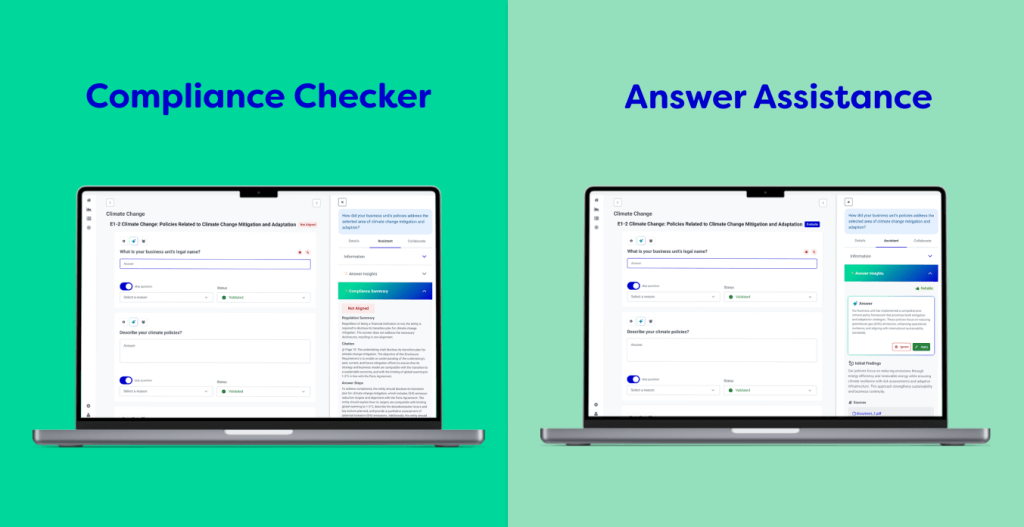

Leverage Technology: Managing ESG data across multiple entities is complex. Digital platforms simplify data collection, validation and aggregation, while maintaining auditability and transparency.

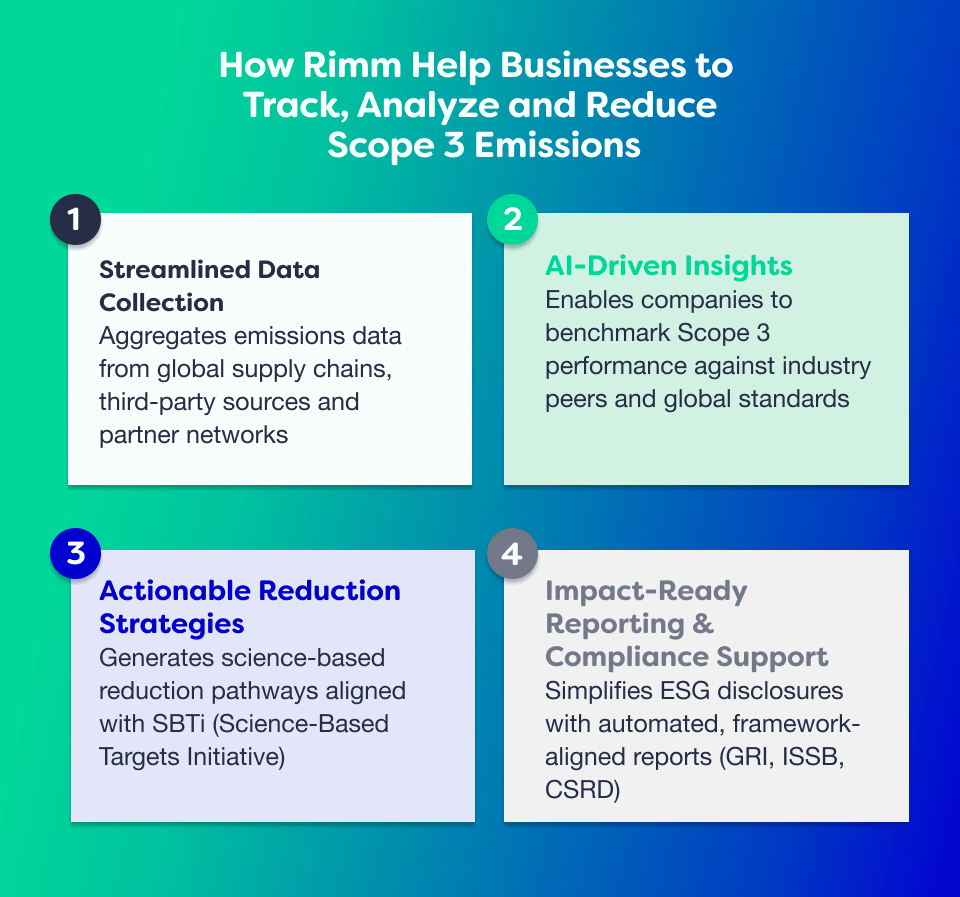

How Rimm Supports Group-Level ESG Reporting

How Rimm Supports Group-Level ESG Reporting

At Rimm, we work with investment firms, holding companies and complex organisations to transform ESG reporting from a fragmented process into a coherent, portfolio-wide capability. Our platform enables organisations to collect consistent data across entities, align disclosures with global frameworks and generate consolidated reports that support both transparency and strategic decision-making.

By combining structured data management with clear reporting outputs, we help clients move beyond disclosure toward governance, accountability and long-term value creation. GLy Capital’s three-year reporting journey with Rimm reflects what’s possible when consolidation is approached with clarity, consistency and purpose.

Looking Ahead: Reporting as a Trust-Building Asset

In a world of heightened scrutiny and complex organisational structures, consolidated ESG reporting is no longer optional. It is a signal of maturity, discipline and long-term thinking.

Organisations that invest in group-level ESG reporting are not just improving compliance; they are building trust, strengthening governance and creating a foundation for sustainable growth. The question is no longer whether to consolidate, but how effectively it is done.

At Rimm, we believe that when ESG reporting reflects the full picture, it becomes more than disclosure. It becomes a strategic asset.

If you’re ready to strengthen trust through portfolio and group-level ESG reporting, we’re here to help. Let’s take the next step together 👉🏾 Reach out HERE