Do you have a clear understanding of the overall risk profile of your organization, and that of your clients? Read on to find out why a comprehensive understanding of risk is essential for businesses.

The extent to which companies are exposed to certain risks impacts strategic and operational decision-making, so getting an accurate representation of your company or client’s risk profile is pivotal to ensure decisions are effective and informed. In addition to decision-making, there are several other reasons why organizations should prioritize understanding their risk profile:

Prioritization: having a clear understanding of the risks posed to an organization can guide resource allocation and help ensure continual growth. By seeing what risks are most material and pose the biggest threat, organizations can ensure sufficient resources are used to mitigate and manage them.

Improving Risk Profile: As the saying goes, you can’t manage what you can’t measure! Being able to see and monitor risk means organizations can set and track targets to improve their risk profile, or help customers manage theirs. In doing so, organizations not only improve their credibility in the short term, but also future-proof themselves in the long term.

Expanding KYC Checks: Risk rating can support Know Your Customer (KYC) checks, providing data on ESG and Business risks that may impact if or how customers are engaged. This is particularly useful for professional service firms supporting clients with KYC checks, and even for financial service providers who are mandated to complete KYC checks by regulators.

How can organizations better understand their risks?

Organizations that do not seek to understand their risk profile can become overly exposed to material risks that impact their revenue and profitability, and be ill-prepared to mitigate against these risks in the present and future. There is also a risk of falling behind competitors by failing to take the necessary steps to manage risks.

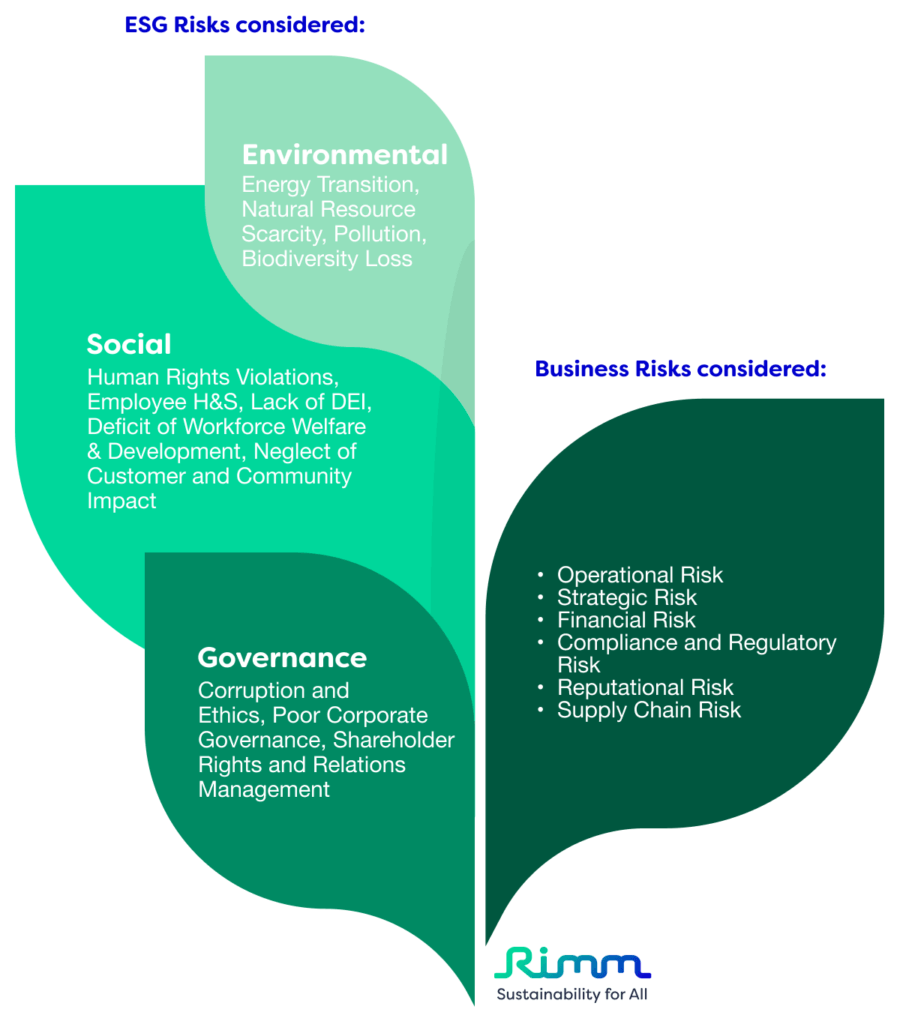

It’s good to know the importance of measuring risk and the dangers of not doing so, but how do you understand it? Considering local context is key: ESG is a function of the local cultural, social, political and regulatory environment and varies greatly between countries and regions. As such, it is important that ESG rating models are localized and contextualized. In addition, organizations can get a better understanding of their risk profile (or clients) by looking at both business and ESG risk together. By considering a comprehensive list of risk categories from natural resource scarcity to regulatory risk, a holistic understanding can be gleaned.

How our Risk Rating Solution Works

Our Risk Rating Solution considers 12 different ESG Risk categories that cover material ESG KPIs by industry, intertwined with 6 Business Risks to map out ESG impacts on the business. Using publicly available sources, estimations, or direct company assessments, the tool can provide risk rating scores (showing methodologies and inputs), comprehensive analytics reports and a monitoring service. These outputs can be integrated into existing business platforms through APIs.

To ensure an understanding in context, our analysis and insights consider industry-specific leading material factors and compare performance to peers.

Our comprehensive database has over 20,000+ companies and is constantly updated with the latest available information, looking at company-disclosed KPIs and comprehensive risk metrics.

Using a custom, state-of-the-art machine learning model we can also offer risk estimations, predicting risk intervals with 95% accuracy. This model has been trained from scratch using risk data, and can support clients to gain a better understanding of their risk profile.

Interested to learn more about our Risk Rating Solution? Book a session to talk with our team today.

Roata Stefan-Cristian

Junior Data Scientist

Having graduated from Yale-NUS with a Lee Kuan Yew Gold Medal, only offered to the best-performing students in the cohort, Stefan is a well-versed individual familiar with the workings of data science and analytics and has contributed greatly to the creation of our data solutions at Rimm.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.