Singapore, a global hub for finance and commerce, is taking proactive measures to address climate change. One of these measures involves requiring climate-related disclosures from companies listed on the Singapore Exchange (SGX) and some non-listed entities. Find out what it all entails in our blog below.

The Need for Climate-Related Disclosures:

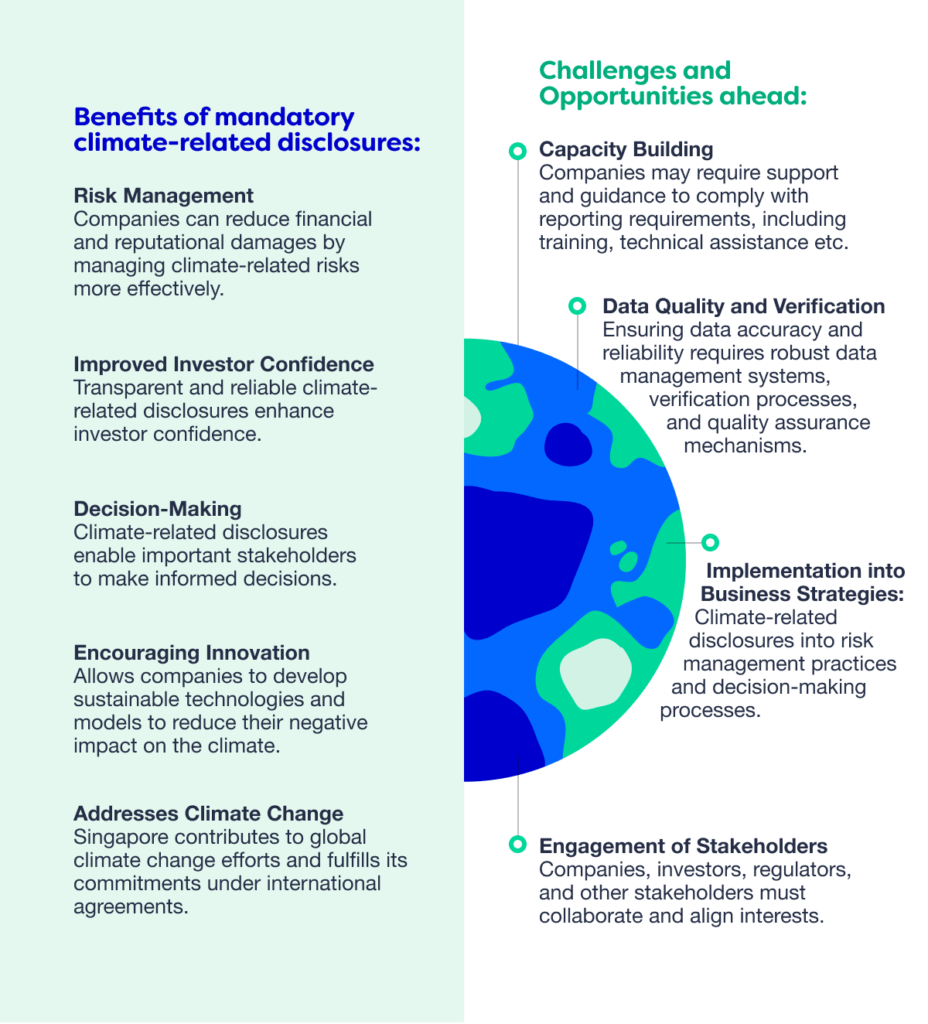

Global climate change poses significant risks to economies, businesses, and societies. The effects of climate change include physical damage to infrastructure, disruption of supply chains, regulatory changes, and reputational risks for companies.

Risks and opportunities associated with climate change are increasingly recognized by both companies and investors, influencing their business decisions. When companies provide transparent, reliable information on their sustainability performance, they are better equipped to meet demands from their lenders, customers and investors, which will elevate Singapore’s position as a green economy.

Key Components of Reporting Requirements:

As of 2025, Singapore will require SGX-listed companies and certain non-listed entities to begin disclosing climate-related information in accordance with IFRS International Sustainability Standards Board (ISSB) standards.

Reporting Timeline

2025: Scope 1 and 2 Emissions need to be reported

2026: Scope 3 emissions, or value-chain emissions to be reported

2027: To obtain external limited assurance on Scope 1 and 2 GHG emissions two years after reporting from an independent auditor.

2029: Large non-listed companies will report on Scope 3 Emissions by this year

The Important Details

- Scope and Coverage: The reporting requirements will apply to a broad range of companies, including publicly traded companies listed on the SGX and some non-listed entities that meet specified criteria. Taking into account companies across different industries, the reporting framework provides a comprehensive view of Singapore’s corporate landscape.

- Disclosure Standards: Companies will be required to adhere to internationally recognized disclosure standards, specifically the recommendations of the ISSB and other relevant frameworks. Companies can use these standards to disclose climate-related risks, governance, strategy, and metrics uniformly and comparably.

- Reporting Guidelines: Singapore’s regulatory authorities will issue guidelines and templates to help companies comply with reporting requirements. Reporting formats, deadlines, and information companies need to disclose will be outlined in these guidelines.

- Compliance and Enforcement: Companies will be expected to comply with reporting requirements and ensure the accuracy and completeness of their disclosures. Companies that do not comply with regulatory requirements may be penalized or sanctioned. Integrity and credibility are upheld by Singapore by enforcing compliance.

What are the Benefits, Challenges and Opportunities ahead?

How can Rimm help?

Rimm provides their clients with an award-winning ESG solution – myCSO which is fully powered by AI. Our solution can help Singaporean companies to stay ahead of the curve. Our automated reporting is aligned to all major ESG standards around the globe including ISSB. Our unique solution known as Transition Risk 360 (TR360) can assist companies in tracking their climate-related risks and track their carbon footprint more effectively and efficiently. The TR360 tool assesses your company’s transition risk as the market moves towards a low-carbon economy. Other Risk management tools include Risk rating and Risk approximation which can help a company mitigate risks which can predict risk intervals with a high degree of accuracy.

For a limited time, Singaporean corporations and enterprises will be able to benefit from up to 70% grant support* that is government-approved when you utilize Rimm’s solutions, making climate reporting more accessible than ever before.

Sign up for the grant here!

*Terms and Conditions Apply

Interested to learn more about our solutions? Book a session to talk with our team today.