With the core of insurance revolving around managing risks, principles that are inextricably linked to environmental, social and governance (ESG) criteria, the insurance sector has an understanding of ESG risks and their impact. However, with increasing expectations from stakeholders and customers alike, the industry needs to change. Read more below.

Insights into ESG in the insurance industry

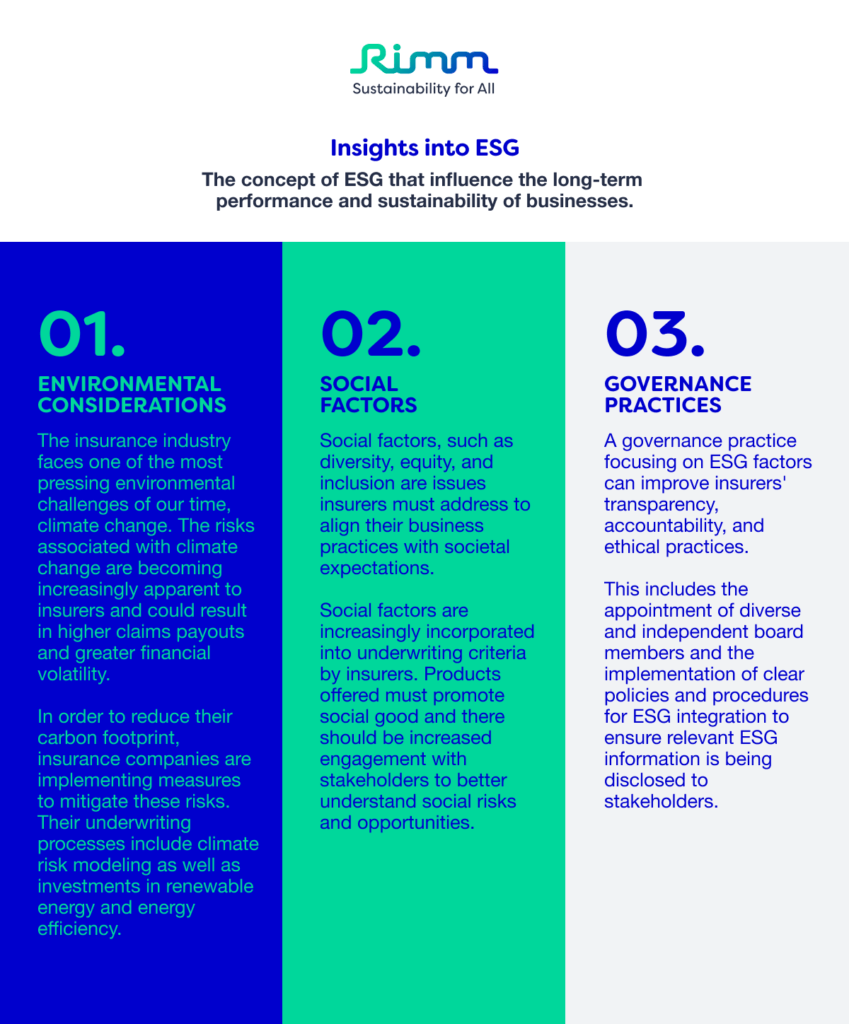

The concept of ESG refers to a wide range of factors that influence the long-term performance and sustainability of businesses. A number of these factors are becoming increasingly important for risk management, investment strategies, product development, and general business practices in the insurance industry.

Investing in ESG-compliant insurance

It is also important to consider ESG factors when investing in insurance. As insurers seek to align their portfolios with sustainable and responsible practices, they increasingly incorporate ESG criteria into their investment strategies.

There has been an increase in insurance companies investing in ESG-themed funds, engaging with companies to improve their ESG performance, and divesting from industries that have high ESG risks, such as fossil fuel industries.

How can Rimm help?

The insurance industry is experiencing a transformation due to ESG factors, driving a shift towards sustainability, responsible business practices, and stakeholder engagement. Through the adoption of ESG principles, insurers are not only mitigating risks and enhancing resilience but also promoting sustainability and inclusion.

Rimm Sustainability is a pioneer in ESG management and data solutions. Rimm’s flagship product myCSO which is an AI-powered ESG data management solution allows you to seamlessly integrate ESG data into a single platform and track all the relevant data metrics like carbon footprint (Scope 1, 2, 3), double materiality and more. Rimm’s specific AI-powered tools align with all 6 objectives (climate change mitigation, climate change adaptation, the circular economy, pollution, effect on water, and biodiversity) which are necessary to judge a green investment which allows you to get a better strategic perspective.

- Biodiversity Tracker: Tool that maps your company’s biodiversity footprint and resulting impacts.

- Greenwashing Sonar: Analyzes public ESG disclosures for accuracy in claims and data.

- SDG Impact Tracker: A more quantitative methodology that assesses alignment with SDGs and tracks progress over time.

Interested to learn more about our solutions? Book a session to talk with our team today.