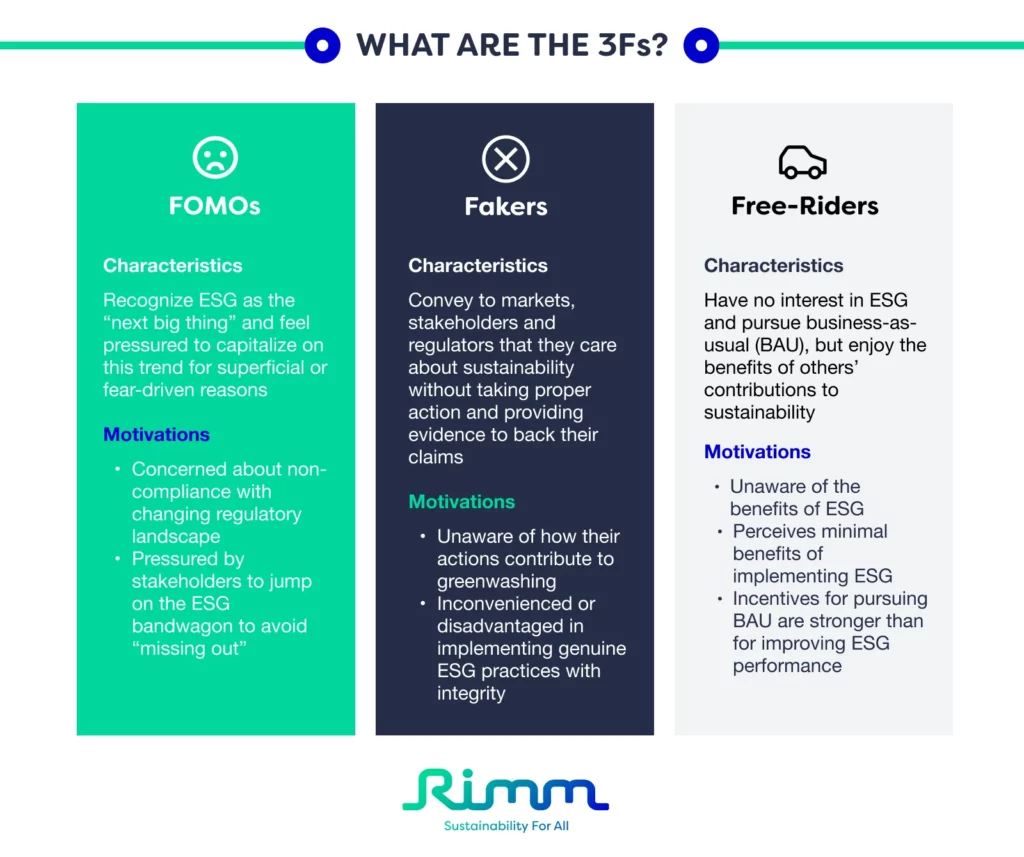

As the ESG movement continues to grow, organizations may knowingly or unknowingly fall under these three characteristics. Learn how you can avoid these mistakes!

Earlier this month, Rimm Sustainability held its first in-person event in our Singapore office, focusing on the topic of the 3Fs (Free-riders, FOMOs and Fakers). The event centered around a panel of experts engaging in an honest and insightful discussion about why most companies are not doing ESG right and how we can turn the tide. We had the pleasure of inviting Russ Neu (Social Collider, CEO), David Ward (Nurturing Co., CEO) and Ravi Chidambaram (Rimm, CEO) to share with us their wealth of experience and knowledge surrounding ESG and what genuine, positive impact means to them.

Moving the needle in ESG requires the 3Fs to understand the real implications of their actions and what genuine impact would entail. Inaction or token actions can have self-imposed, adverse impacts in the long run, especially with recent trends indicating that stakeholders increasingly value genuine, positive impact.

More widespread recognition that legislation is evolving and corporations need to take responsibility for creating a positive impact can improve companies’ approaches to ESG. Greater transparency, which can be achieved through third-party audited sustainability reports or certifications from established external organizations, can mitigate the risks of greenwashing. Moreover, while regulations, fines and penalties can play a role in eliminating the free-rider problem, free-riders will soon find themselves behind the curve in light of recent ESG trends

Here’s a brief summary of what our panelists had to share.

Key takeaways:

- Fake forms of sustainability can be distinguished from genuine sustainability practices through tangible, quantitative means for identifying greenwashing (e.g. third-party audited sustainability reports).

- One of the key challenges in ESG is ensuring accurate measurements of relevant ESG performance metrics. It is important for companies to understand and map out the relevant indicators to use when collecting data as a first step – you can’t manage what you can’t measure.

- There are many scenarios and time horizons to make meaningful contributions in sustainability. It’s never too late to get started, but it will take time for meaningful contributions to make an impact.

- Companies or investors can strengthen the call-to-action within this space by educating themselves on the benefits of embedding strong ESG practices. This will provide SMEs with the tools to improve measurement and tracking, creating impact and increasing transparency.

- While these benefits and tools vary tremendously across companies, regions and industries, it is encouraging that engagement levels have increased noticeably in recent years.

“Any company that begins the process of ESG is a good company. That’s great, you are starting somewhere. But you need to build capabilities where you can track the data more accurately, more comprehensively, and apply that data to ESG objectives.”

– Ravi Chidambaram

Our team at Rimm Sustainability would like to thank everyone who attended the event. We hope to see you at our next one!

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.