ESG factors are beginning to play a vital role in corporate decisions and strategies. This is where AI and Data Analytics can make this information even more accessible and actionable. Find out how below!

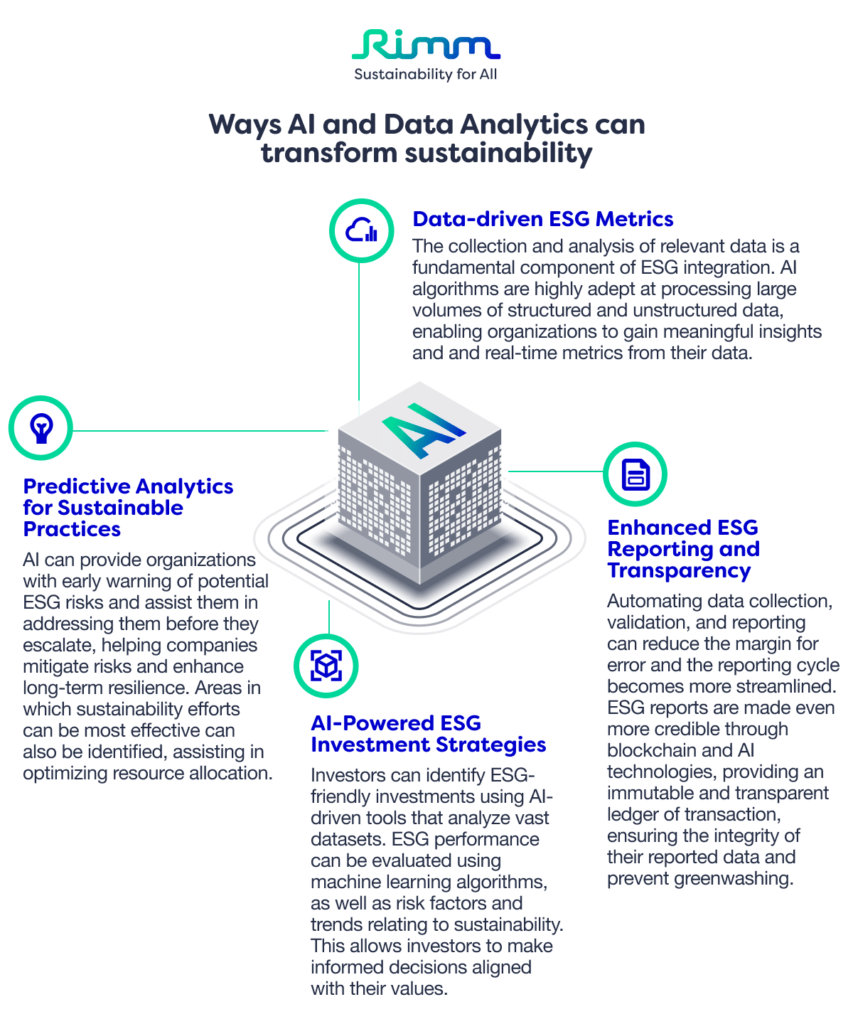

1. Data-Driven ESG Metrics

The collection and analysis of relevant data is a fundamental component of ESG integration. A large and complex dataset, such as that required by ESG initiatives, is often beyond the capacity of traditional methods. In contrast, AI algorithms are highly adept at processing large volumes of structured and unstructured data, enabling organizations to gain meaningful insights and metrics from their data.

Companies can gain a comprehensive understanding of their environmental impact, social initiatives, and governance structures by using machine learning models to identify correlations and trends. As a result of this data-driven approach, ESG strategies remain flexible and responsive to changing challenges while improving accuracy and enabling real-time monitoring and reporting.

2. Predictive Analytics for Sustainable Practices

A predictive analytics approach to AI can provide organizations with early warning of potential ESG risks and assist them in addressing them before they escalate. An algorithm that analyzes historical data can, for example, detect patterns that may indicate future environmental or social challenges. By proactively implementing sustainable practices, companies mitigate risks and enhance long-term resilience.

In addition, predictive analytics can identify areas in which sustainability efforts can be most effective and assist in optimizing resource allocation. This is why ESG initiatives should be aligned with overarching business objectives, leading to a win-win situation for the company’s sustainability as well as its financial performance.

3. Enhanced ESG Reporting and Transparency

It is crucial to foster trust among stakeholders and investors by providing transparent and accurate reporting. By automating data collection, validation, and reporting, the margin for error is reduced and the reporting cycle becomes more streamlined.

With blockchain technology, which is often integrated with AI, ESG reports are made even more credible because they provide an immutable and transparent ledger of transactions. By doing this, companies can ensure the integrity of their reported data and prevent greenwashing.

4. AI-Powered ESG Investment Strategies

ESG factors have become increasingly important to investors in their decision-making processes, and are seen as a potential source of long-term value creation and risk mitigation. Investors can identify ESG-friendly investments using AI-driven tools that analyze vast datasets. ESG performance can be evaluated using machine learning algorithms, as well as risk factors and trends relating to sustainability. Investing in responsible companies allows investors to make informed decisions aligned with their values.

How can Rimm help with your AI needs for sustainability?

As a pioneer in AI development, Rimm Sustainability has integrated AI into ‘myCSO’, an ESG platform designed to provide customers with a better ESG experience and simplify a complex reporting process to satisfy legislative requirements. Our AI-driven solutions empower organizations to not only meet current ESG standards, but also proactively shape a more sustainable future. The metrics and predictive analytics we provide, along with enhanced reporting and tailored investment strategies, are driven by data.

Rimm’s enhanced AI tools, such as Transition Risk, Risk Approximation and Risk Rating, provide enterprises with a 95% accurate picture of their risk exposure and profile. In this way, the executives can make critical decisions to continue driving the company’s growth. The synergy between AI and data will become a driving force for promoting environmental management, social responsibility, and ethical governance as we continue to harness technology.

Browse our solutions catalog or book a free demo today!

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.