The future of investing is being shaped by ESG benchmarks and indices, join us as we explore what they are, why they matter, and how they’re evolving.

What are ESG Benchmarks and Indices?

Companies or investment portfolios can be evaluated based on ESG benchmarks and indices. Using them, investors can make more informed decisions based on sustainability and ethical considerations by comparing the ESG practices of different entities.

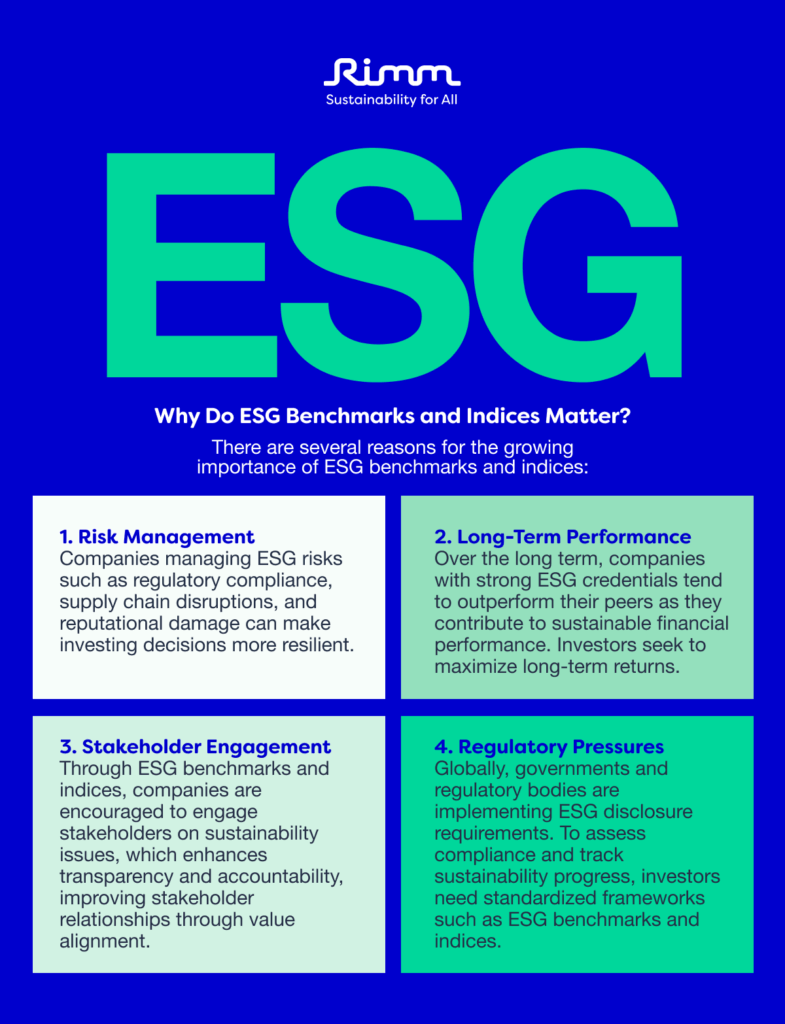

1. ESG Benchmarks:

An ESG benchmark typically measures the ESG performance of a subset of companies within a particular industry or region. For investors, these benchmarks serve as indicators of how well companies in a given sector address environmental, social, and governance issues. Dow Jones Sustainability Index (DJSI), MSCI ESG Ratings, and FTSE4Good Index Series are some examples of ESG benchmarks.

2. ESG Indices:

The ESG indices, on the other hand, are investment indices that contain companies that meet certain ESG criteria. Stocks or bonds of companies with strong ESG profiles are tracked by these indices. Investing portfolios can be constructed using ESG indices, or existing portfolios can be compared to them as benchmarks. Some well-known ESG indices include the MSCI ESG Leaders Index, S&P 500 ESG Index, and STOXX Global ESG Leaders Index.

The Future of ESG Investing and role Rimm’s solutions

As awareness of ESG issues grows, benchmarks and indices based on ESG issues will be in demand. As investors seek opportunities to align their financial objectives with their values, ESG considerations are becoming increasingly integrated into mainstream investment practices. As a result of technological advancements, such as big data analytics and artificial intelligence, ESG assessments and risk modeling are becoming more sophisticated. Consequently, ESG benchmarks and indices are becoming more accurate and granular, empowering investors.

The AI-powered Rimm Sustainability solution – Bespoke myCSO – is an all-in-one solution for companies of all sizes to manage their ESG requirements. With myCSO, you can build fully customized solutions from Rimm building blocks such as a Carbon calculator, a double materiality calculator, or a risk management solution. Our benchmarking database includes over 20,000 companies, and our question library contains more than 4000 questions that enable us to conduct detailed ESG analysis. For investors and portfolio managers, myCSO can be customized in such a way that it displays all the ESG metrics of portfolio companies on a single dashboard screen, helping investors make strategic decisions based on those metrics and performance. By providing standardized metrics and benchmarks for evaluating ESG performance, myCSO is changing the investment landscape across industries.

Invest wisely, invest sustainably, and invest for a better future!

Interested to learn more about our solutions? Book a session to talk with our team today.