In today’s dynamic and socially conscious world, ESG is a fundamental benchmark for evaluating a company’s sustainability and ethics. An ESG score plays a crucial role in assessing a company’s performance. Read on to learn more about how ESG can be properly and accurately measured in order to reflect a company’s true sustainability performance.

Unpacking ESG: A Brief Overview

A company’s ESG criteria measure its impact on sustainability, social responsibility, and corporate governance. Among the environmental factors that determine a company’s ecological footprint are energy use, carbon emissions, and resource management. In terms of social considerations, we focus on employee relations, diversity, human rights, and community involvement. A company’s leadership, transparency, ethics, and compliance practices are assessed by governance factors.

What is so significant about an ESG Scoring Methodology?

The ESG scoring methodology serves as the framework through which companies are assessed and compared based on their ESG performance. It involves a systematic approach to gathering, analyzing, and quantifying relevant ESG data. This enables the creation of scores or ratings that indicate a company’s performance in each ESG category. Stakeholders and investors can use these scores to gauge how sustainable a company is.

What makes up an ESG Scoring Methodology?

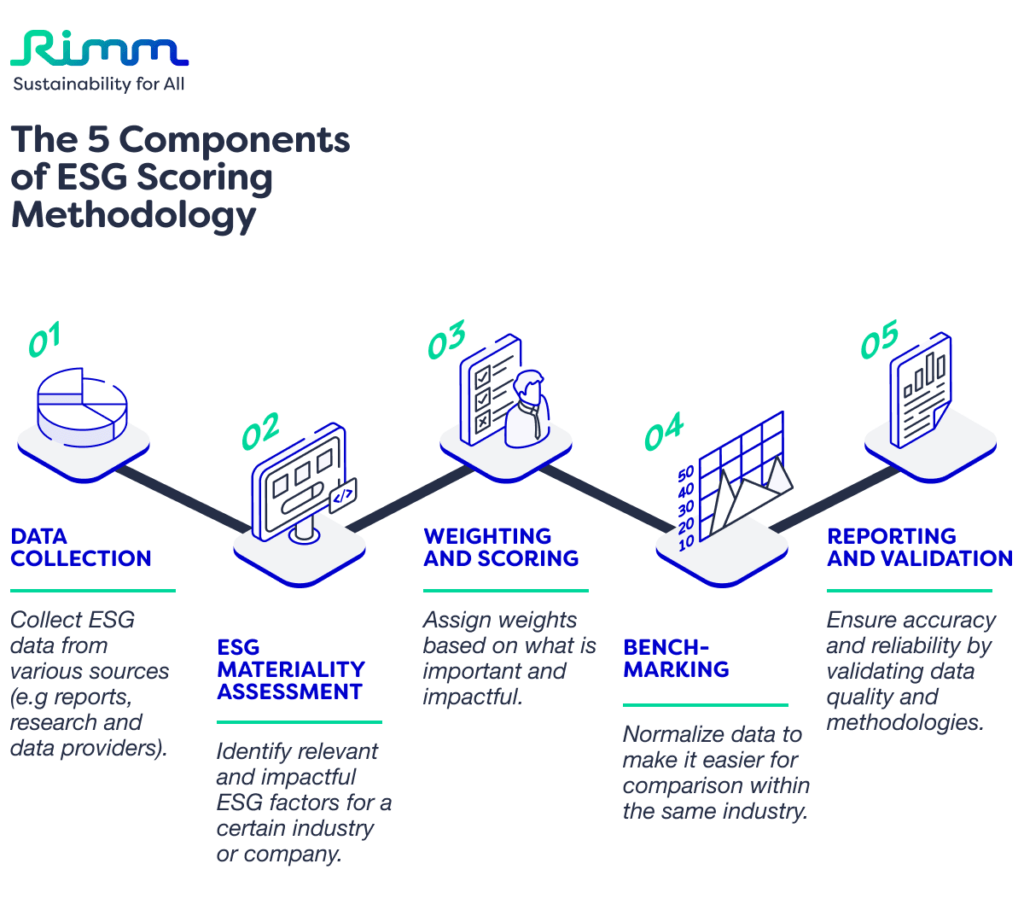

- Data Collection: ESG data is gathered from various sources, including company reports, regulatory filings, independent research, and ESG data providers. The data can be quantitative (e.g., carbon emissions, diversity ratios) or qualitative (e.g., corporate policies, ethical practices).

- ESG materiality assessment: Identifying the most relevant and impactful ESG factors for a certain industry or company. To make sure the scoring reflects the most important issues for a company, this step is crucial.

- Weighting and scoring: Assigning weights based on what’s important and impactful. Companies are then rated or scored based on each factor, often on a numerical scale.

- Benchmarking: Normalizing the data makes it easier to compare companies in the same industry. Benchmarking allows stakeholders to assess a company’s ESG performance relative to its peers.

- Reporting and validation: Ensure accuracy and reliability by rigorously validating data quality and scoring methodologies. Whether through reports, indices, or ratings agencies, the results help stakeholders make decisions.

Challenges and Evolving Trends

In addition to data reliability, standardization, and the subjective nature of certain ESG factors, ESG scoring methodologies face several challenges. In spite of this, the field continues to develop, with a focus on data quality, transparency, and industry-specific frameworks. ESG data providers are responding to these challenges by introducing new technologies and techniques, such as machine learning, to improve their ESG scoring. Additionally, data providers are working to increase transparency and comparability between different ESG scoring systems. By continuing to innovate, ESG data providers are ensuring that the field continues to evolve and provide reliable and useful data.

The ESG scoring methodology is a great tool for investors and stakeholders looking to align their investments with ethical and sustainable principles. An ESG score that’s standardized, transparent, and comprehensive will be crucial to foster public trust and enable informed decision-making. A commitment to enhancing ESG practices is beneficial for companies’ resilience and reputation. Additionally, it makes the global economy more sustainable and responsible.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.