Learn more about some of the most important developments in recent years accompanying the UK ESG regulatory landscape and how you can be better prepared.

As organizations across the globe ramp up their focus and strategies on ESG and sustainability, the need for consistent and transparent reporting has increased. The United Kingdom (UK) is already leading the way by establishing a range of ESG regulatory requirements for public companies. These reflect the need to facilitate disclosure and promote the management of climate-related financial risk and opportunities across the British economy, particularly for financial institutions and asset managers. Furthermore, with the British leadership announcing its intention for the UK to be the world’s “first net zero-aligned financial centre”, a common feature underpinning these developments is how ESG regulations and requirements are designed to strengthen disclosure and facilitate management of climate risk.

Recent and upcoming developments

The shift towards mandatory corporate responsibility for ESG issues in the UK is gaining traction. For instance, companies and limited liability partnerships (LLPs) “with the greatest economic and environmental impact” are now subject to new laws and regulations which include the Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022, as well as the Limited Liability Partnerships (LLPs) (Climate-related Financial Disclosure) Regulations 2022, which took effect on 6th April 2022. These new regulations stipulate a legal requirement for affected companies to assess climate risks and disclose climate-related financial information of their companies and to climate-related disclosures in their annual strategic report. Furthermore, the regulations require certain LLPs to provide a similar sustainability information statement on climate-related disclosures in their annual strategic report or their energy and carbon report.

The UK’s Financial Conduct Authority (FCA) is also the first securities regulator to mandate the Task Force on Climate-related Financial Disclosure – TCFD-aligned disclosure requirements for asset managers and asset owners. In December 2021, asset managers and certain asset owners, including life insurers and pension providers are required to make climate-related disclosures aligned with TCFD recommendations by 30th June 2024 – with a reporting period commencing on 1st January 2023.

In addition to asset managers and asset owners, the FCA has made the annual TCFD reporting mandatory for over 1,300 of the country’s largest UK-registered companies and financial institutions with effect from 6th April 2022. This will affect most of the UK’s largest publicly-traded companies, banks and insurers, as well as private companies with over 500 employees and £500 million in turnover.

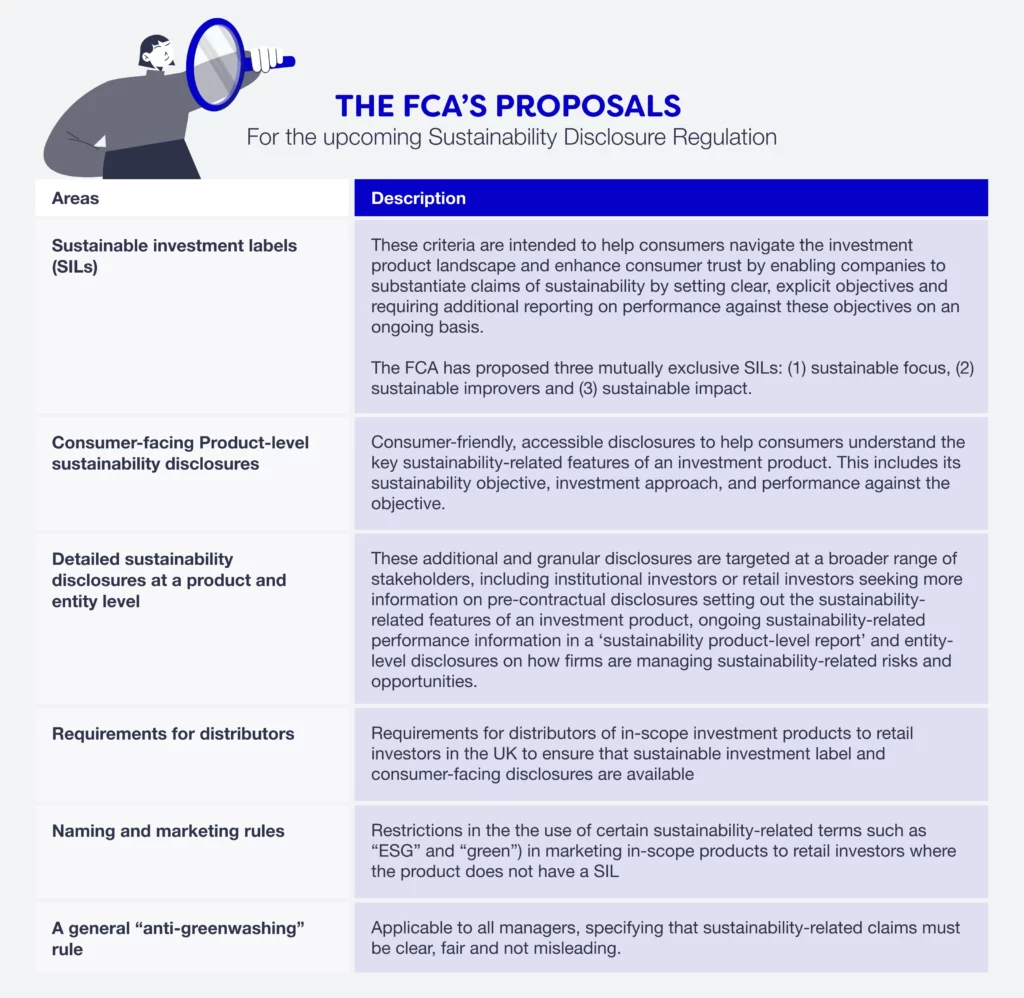

Furthermore, the UK’s Sustainable Disclosure Requirements (SDR), which is currently underway, will be a key development in the UK’s trajectory of strengthening disclosure requirements and combating greenwashing. The SDR will encompass a set of measures and modifications, including sustainable investment labels, disclosure requirements and restrictions on the use of sustainability-related terms in product naming and marketing with the objective of clamping down on greenwashing.

The emergence of these developments indicate the UK’s heightened focus and commitment to increase transparency and accelerate the management of climate-related risks and opportunities across UK corporations. These are also designed to enhance competition and risk management while protecting consumers from unsuitable products and greenwashing, as well as bolster investment and the mobilization of capital towards sustainable projects and activities.

What do these ESG developments mean for businesses?

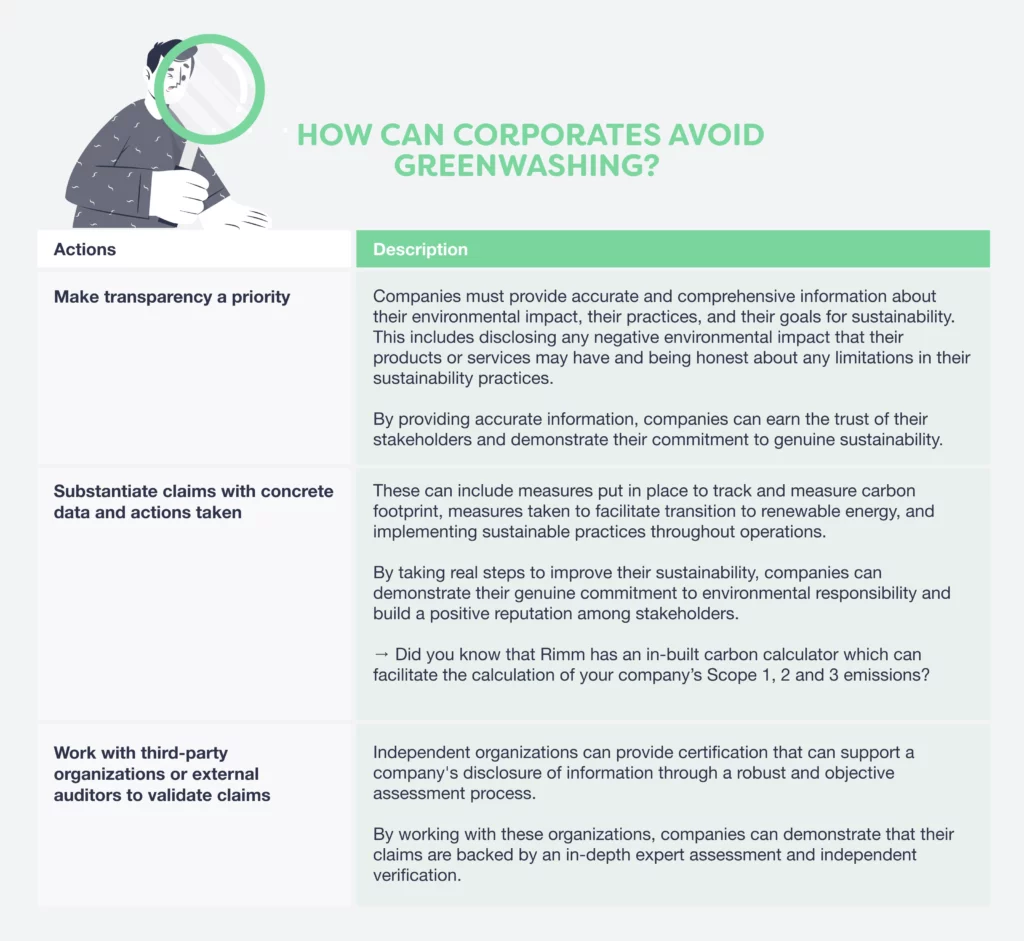

Developments in the regulatory regimes in the UK highlight the burgeoning pressure on companies to manage ESG related risks effectively across their corporate groups and supply chains. With increased levels of scrutiny on corporates who are increasingly questioned on their sustainability claims and levels of action by consumers, investors and shareholders, a failure to mitigate these risks and ramp up accountability could result in legal liabilities and even the possibility of being subject to litigation for companies.

While most of the recent regulatory developments affect major companies, asset managers and financial institutions, the emergence of these mandatory requirements and disclosure rules have implications for thousands of businesses connected with affected UK companies through their extensive supply chain networks and portfolios. This makes it increasingly critical for companies of all sizes and industries to be prepared for changes in the regulatory landscape especially since in light of rigorous disclosure requirements and growing stakeholder and investor pressure which indicates how ESG reporting and companies is becoming a key business priority.

It is critical for companies to embark on actionable steps to navigate the complexities in the ESG reporting landscape and ensure compliance.

3 Actionable Steps for Companies to Navigate ESG Compliance

Adopt quality control systems across ESG: Implementing quality controls and governance mechanisms are critical to ensure that companies adhere to their human rights and environmental due diligence and/or disclosure obligations, as well as any ESG related standards or targets.

Ramp up engagement with supply chain partners on disclosure: ESG-related reporting obligations should extend to relationships with a companies’ supply chain partners and there should be strategies in place to communicate on a companies’ reporting obligations and the management of supply chain risks.

In-depth understanding on rules and requirements: Firms, whether directly or indirectly affected, should familiarize themselves with the details of the rules and guidance in the industries and jurisdictions they are based in, and consider how they would be impacted to ensure that they are able to meet the requirements.

Simplify Your Sustainability Performance & Tracking With myCSO

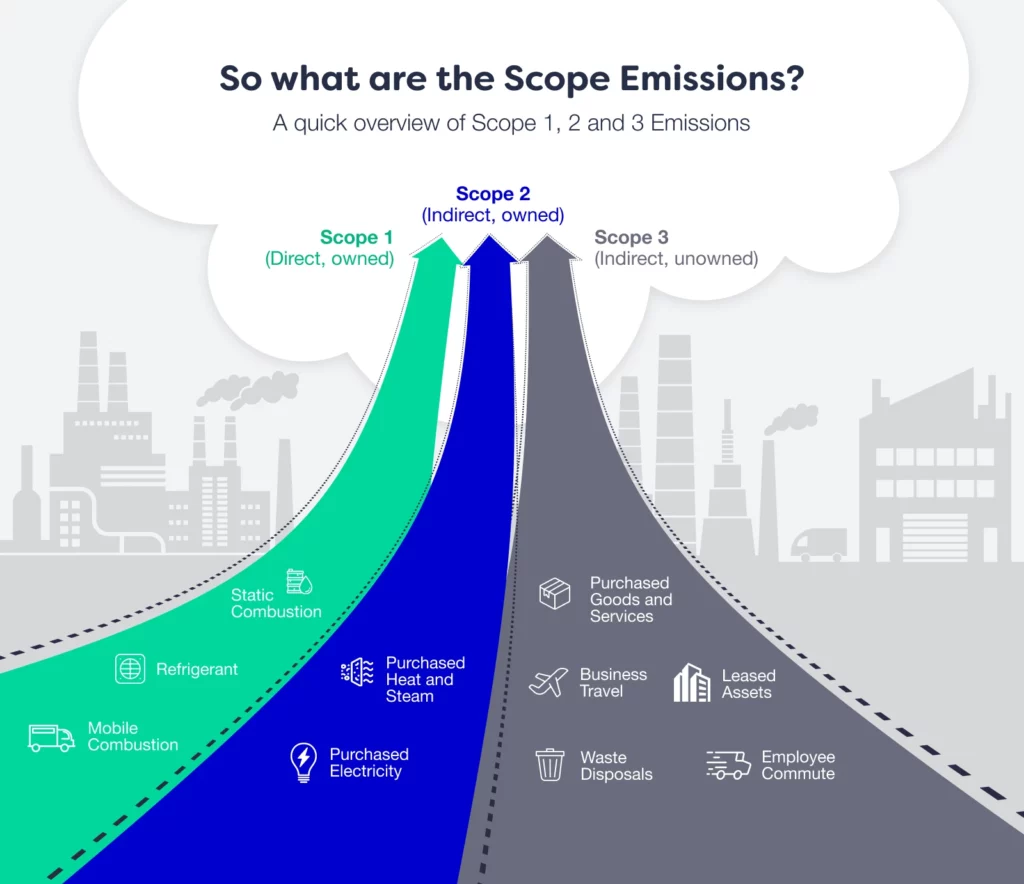

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.