Climate change and environmental degradation require more transparency in corporate sustainability reporting. Leading this conversation, we have The Task Force on Nature-related Financial Disclosures which incorporates nature-related risks and opportunities, much like its predecessor, the TCFD. Read on to find out more about this new and upcoming approach!

Understanding TNFD

In June 2021, TCFD created the Task Force on Nature-related Financial Disclosures. Nature plays a critical role in economic stability, as recognized by the TNFD initiative, which has the support of numerous organizations and financial institutions. Organizations are encouraged to report on their nature-related risks and opportunities in a standardized and consistent manner as part of the task force in an effort to bridge the gap between environmental and financial issues.

Why does TNFD Matter?

- Ecosystem Dependency: Ecosystems provide a variety of resources to businesses, including clean water, pollination, and timber. In addition to quantifying and communicating these dependencies, TNFD disclosures raise awareness about environmental conservation.

- Risk Assessment: TNFD provides a structured framework for assessing nature-related risks. As a result of supply chain disruptions, regulatory changes, or reputational damage, companies can identify vulnerabilities.

- Market Resilience: Investors increasingly factor environmental and social governance (ESG) criteria into their decision-making processes. Information provided by TNFD disclosures is vital to assessing a company’s environmental resilience.

- Regulatory Landscape: Companies must adapt to evolving compliance requirements as governments worldwide intensify environmental regulations. This emerging regulatory environment can be aligned with TNFD disclosures.

Key Components of TNFD Disclosures

TNFD disclosures can be divided into four main components:

- Governance: Companies need to disclose their commitment to integrating nature-related considerations into their decision-making processes. This includes outlining the responsibilities and structures in place for addressing nature-related risks and opportunities.

- Strategy: This section covers the company’s strategies and targets related to nature. It details how the company identifies, assesses, and manages nature-related risks and opportunities.

- Risk Management: Businesses must disclose their processes for identifying and mitigating nature-related risks, including their methods for assessing and responding to potential biodiversity loss or ecosystem degradation.

- Metrics and Targets: TNFD encourages the disclosure of quantitative metrics and targets that reflect the company’s impact on nature, such as carbon emissions, water usage, and land use. These metrics help investors and stakeholders gauge the company’s environmental performance.

Benefits and Challenges

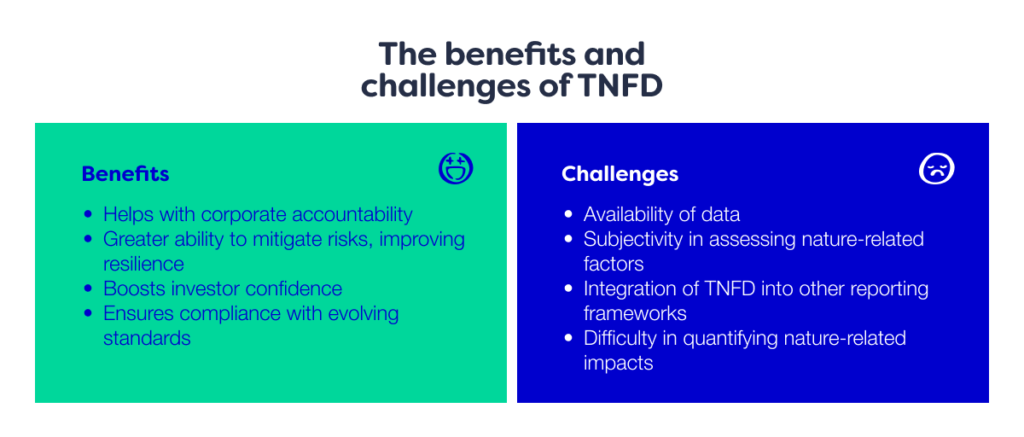

TNFD offers a number of benefits as well as challenges. Through TNFD, corporate accountability can be encouraged by assessing and disclosing nature-related dependencies and impacts. By doing so, businesses are able to mitigate risks, become more resilient, and innovate in sustainability practices. As long as it is incorporated into regulations, it improves investor confidence and ensures compliance with evolving environmental standards.

However, there are challenges relating to the availability of data and subjectivity in assessing nature-related factors as well as the decision of scope and limitations in resources. It can be challenging to integrate TNFD into other reporting frameworks and quantify nature-related impacts. Overall, TNFD has the potential to drive positive change in corporate sustainability practices, but its effectiveness depends on addressing these challenges and encouraging wide adoption among organizations, which will result in more responsible and environmentally conscious business practices as a result.

Conclusion

In recognition of nature-related financial risks, the TNFD disclosures represent a significant step forward. We must take into account nature-related considerations in all financial reporting as climate change and environmental issues increasingly affect our world. This isn’t just a compliance matter; it’s a strategic imperative. Nature can enhance the resilience of organizations to environmental challenges and also contribute to a more sustainable future for everyone when they adopt TNFD guidelines and incorporate them into their business models.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.