Learn more about the importance of Scopes 1, 2 and 3 emissions in sustainability reporting and how your organization can measure and report your carbon footprint.

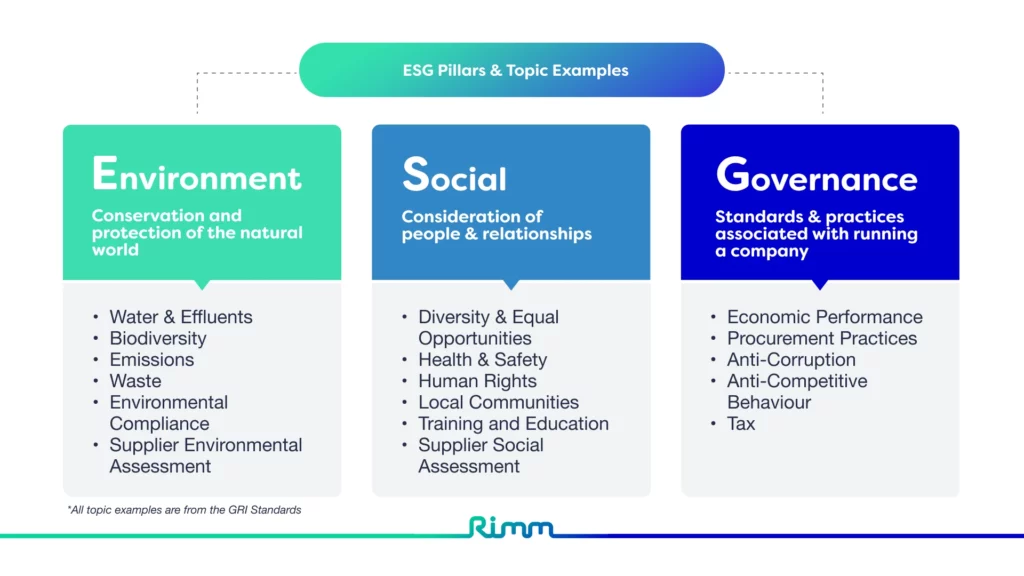

In the world of sustainability reporting and ESG analysis today, carbon emissions are particularly significant. They can be quite complex to calculate, but contribute greatly towards your organization’s sustainability agenda. If you have already decided to be a more sustainable business and have taken the first steps towards that goal, consider tracking and reducing your carbon footprint. This starts with tracking your Scope 1, 2 and 3 emissions.

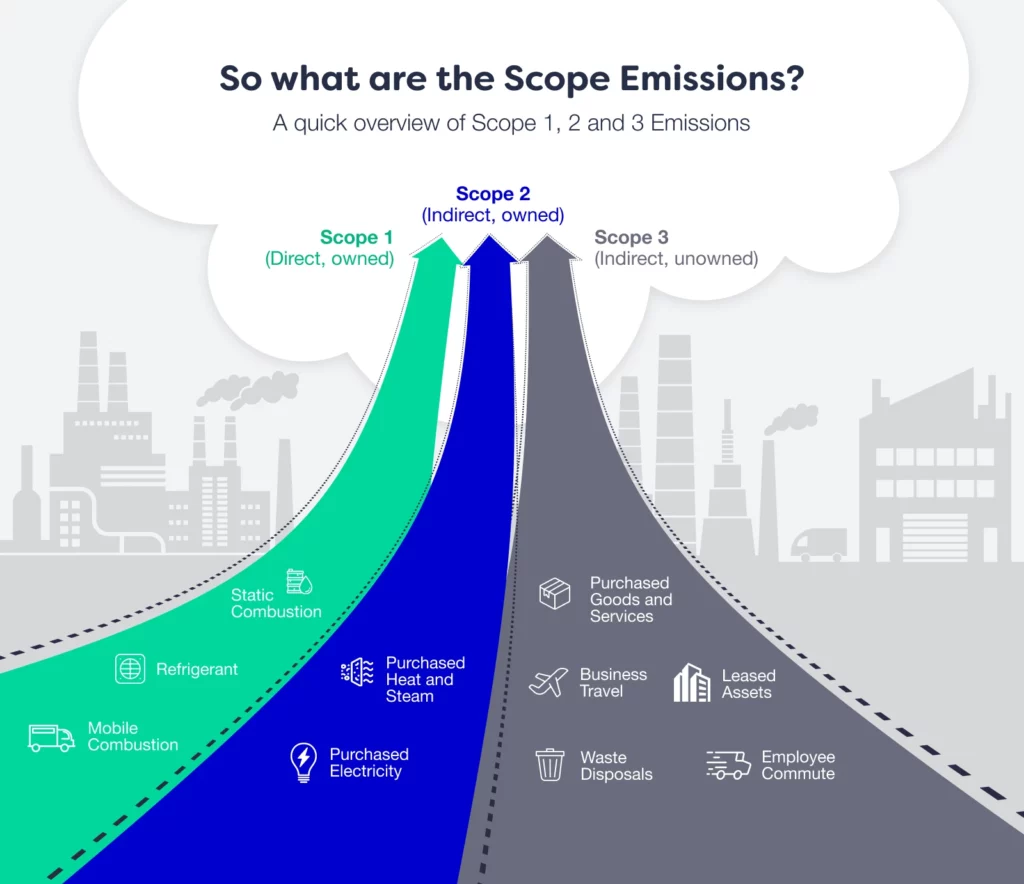

The Greenhouse Gas Protocol (GHG) is the world’s leading organization that sets the standards for carbon emissions reporting. It introduced the concept of “scopes” to help classify direct and indirect emissions, improve transparency and simplify emissions reporting for different types of businesses and organizations. These “scopes” are carefully defined to prevent the double-counting of emissions from one company’s emissions sources when calculating its carbon footprint.

Scope 1

Defined by the GHG Protocol as “direct GHG emissions occur from sources that are owned or controlled by the company,” scope 1 emissions can be divided into key categories:

- Static Combustion: Static or stationary combustion refers to combustion of fuels in stationary equipment at facilities, such as boilers, furnaces, burners, turbines, heaters, incinerators, engines, flares, etc. Examples of fuels include coal, crude oil, diesel, liquefied petroleum gases (LPGs), natural gas and propane gas.

- Refrigerant: A refrigerant is a compound typically found in either a fluid or gaseous state used in the refrigeration cycle of air conditioning systems and heat pumps. In most cases, refrigerants undergo a repeated phase transition from a liquid to a gas and back again.

- Mobile Combustion: These are all vehicles owned or leased by your organization that burn fuels producing greenhouse gasses. It encompasses the combustion of fuels in transportation devices such as automobiles, trucks, buses, trains, airplanes, boats, ships, barges, vessels, etc.

Scope 2

Scope 2 emissions are defined as the “GHG emissions from the generation of purchased electricity consumed by the company.” These are all indirect, owned GHG emissions released in the atmosphere, from the consumption of purchased electricity, steam, heat and cooling and they physically occur at the facility where electricity is generated. Some key categories include:

- Purchased heat and steam: These account for heat and steam purchased by the utility from an independent generation facility.

- Purchased electricity: This refers to the extraction, production, and transportation of fuels consumed in the generation of electricity, steam, heating and cooling consumed by the reporting company.

Scope 3

Scope 3 includes all indirect, unowned emissions that occur in the value chain of a reporting company and are not included in Scopes 1 and 2. Examples include purchased goods and services, business travel, employee commute, waste disposals, leased assets, franchises, etc.

Although scope 3 emissions may not fully be in your company’s control, they likely represent the biggest portion of your emissions inventory. This is the broadest emissions category, where the majority of an organization’s emissions come from and are also the most challenging to track.

But they can also offer big opportunities for carbon footprint reduction. Some of these benefits include:

- Cost reduction and energy efficiency improvements in your supply chain

- Clarity on which suppliers are leaders in sustainability performance and on how to develop initiatives to help improve the others

- Product energy efficiency improvements

A good way to go about measuring Scope 3 emissions is to use the GHG Protocol’s Scope 3 Standard that details the requirements and practical guidance for Scope 3 reporting. This guide will help assess your organization’s Scope 3 emissions inventories comprehensively and allow you to start devising emissions reduction plans.

All in all, reporting carbon emissions is not an easy task. It’s a time consuming and meticulous process that demands close expertise. However, as regulations become increasingly stringent and stakeholders increasingly push for a net-zero economy, the benefits of calculating and cutting emissions across all Scopes are beneficial, for your business as well as the environment.

Rimm’s Carbon Calculator, which is a feature in myCSO Essential, is making this process easier. By estimating carbon emissions for organizations using advanced machine learning algorithms, it’s one step in the emissions reduction journey for your organization.

Learn more about myCSO and get access to the carbon calculator today!

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.