Sustainability reports are usually viewed as the final step of the sustainability journey, in the contrary, it is only the beginning. How can companies move beyond reporting and start actioning on their ESG metrics? Read more below.

Sustainable living is no longer a buzzword; it is a necessity in today’s world. Concerns over climate change, resource depletion, and social equity are putting pressure on businesses around the globe to act on sustainability. This journey begins with sustainability reporting. For organizations, it is an essential tool for communicating their ESG performance. It is important to understand that sustainability reporting should not be considered the end goal, but rather the beginning of a journey toward a greener, more responsible future.

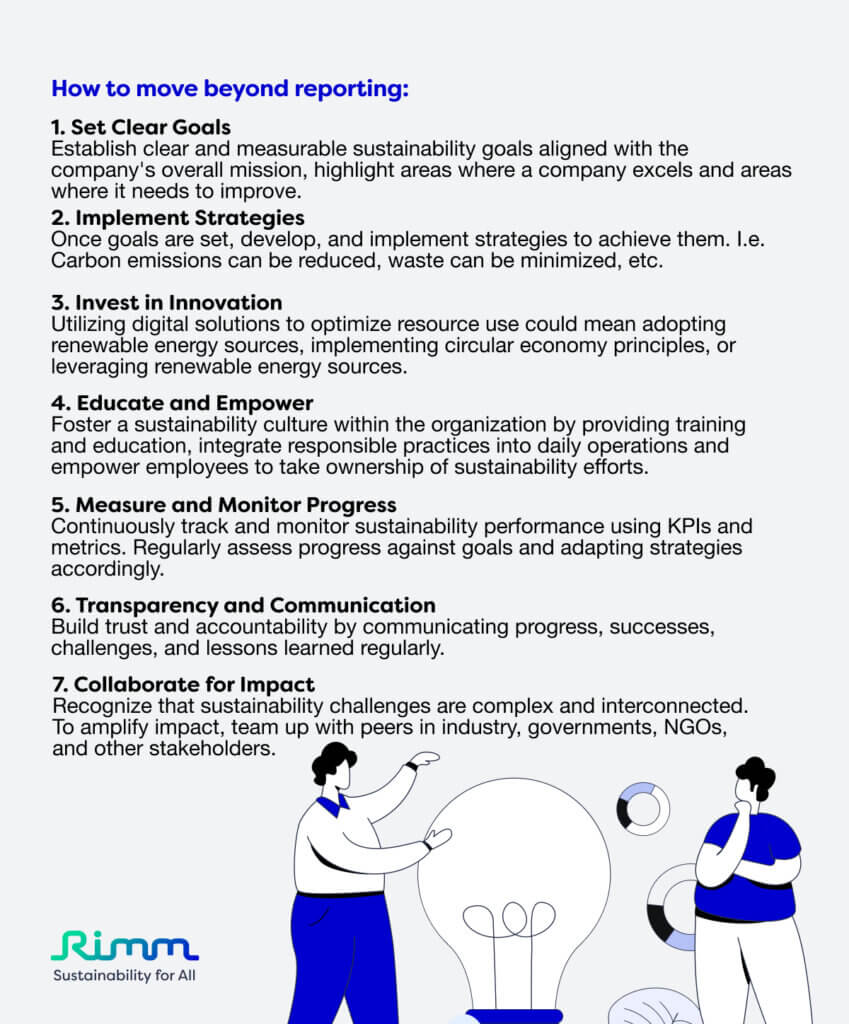

Following sustainability reporting, what does a company need to do? Here are some actionable steps.

How can Rimm guide you to achieve your green goals?

Through Rimm’s AI powered flagship product – myCSO, clients have access to many features to guide them through their sustainability journey such as:

- Dynamic Materiality Map

- Introduction To Sustainability

- Carbon Calculator

- Sustainability Performance Dashboard

- Sustainability Report Generator

- Guided Assessment, Sustainability Standards and Frameworks

- SDG Impact Dashboard

- Various Add-On Modules

Through such features, Rimm’s clients can easily track and measure their performance and make strategic business decisions based on accurate data. When it comes to building a more sustainable future, what comes after sustainability reporting is most important. By setting clear goals, implementing strategies, engaging stakeholders, and striving for continuous improvement, companies can create a greener, more equitable, and prosperous world for future generations.

Interested to learn more about our solutions? Book a session to talk with our team today.