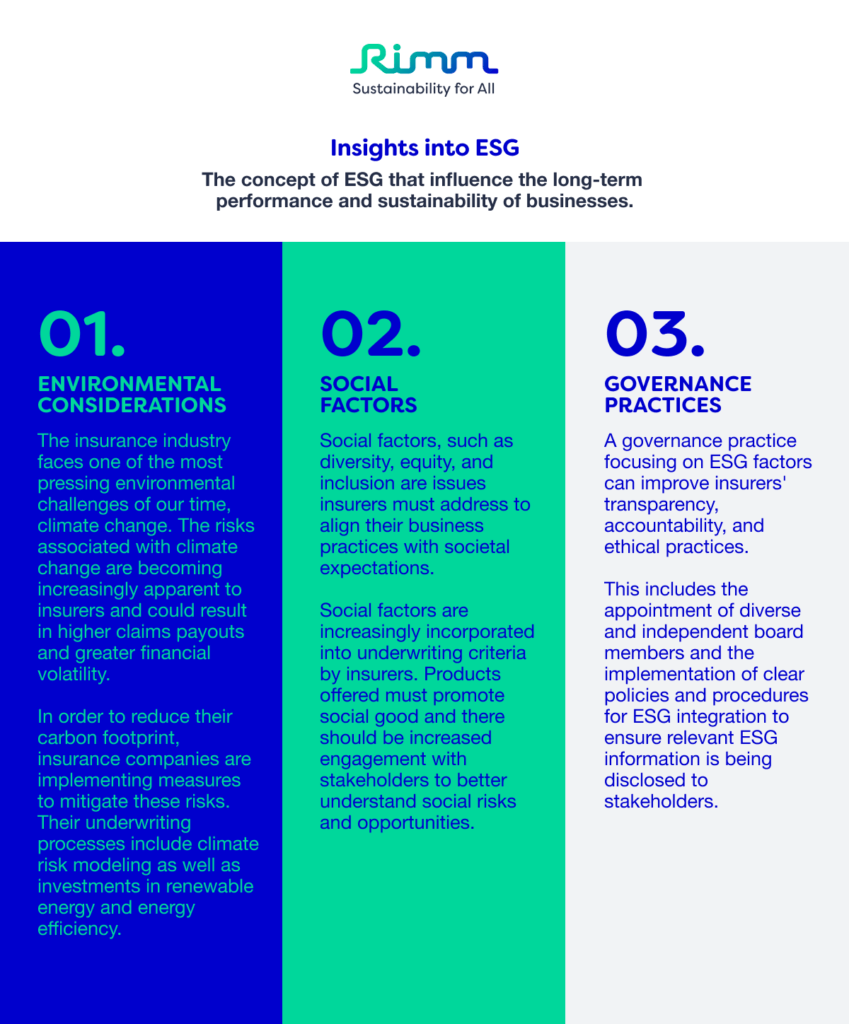

Increasing mental health concerns intersect with endeavors like ESG work, permeating every aspect of life. In order for sustainable, ethical, and socially responsible initiatives to succeed, mental well-being must be addressed. In these systems, how well are individuals doing? In the midst of Mental Health Awareness Week, it’s a good time to explore the relationship between ESG principles and mental health.

ESG’s Overlooked “S”

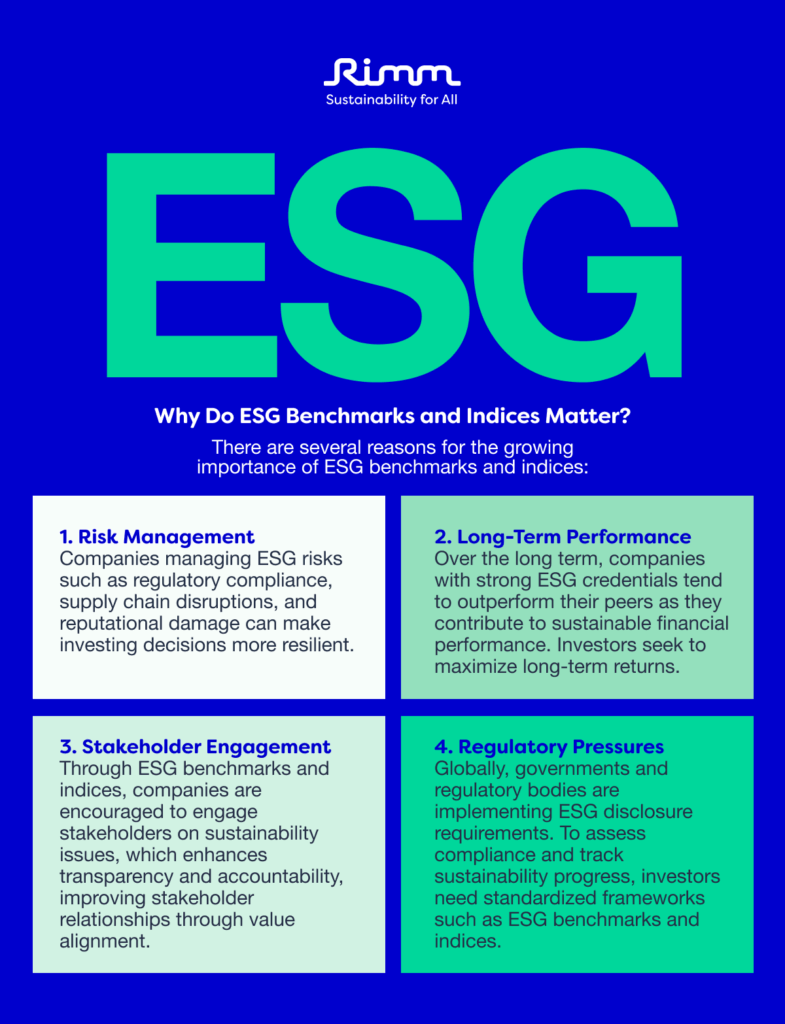

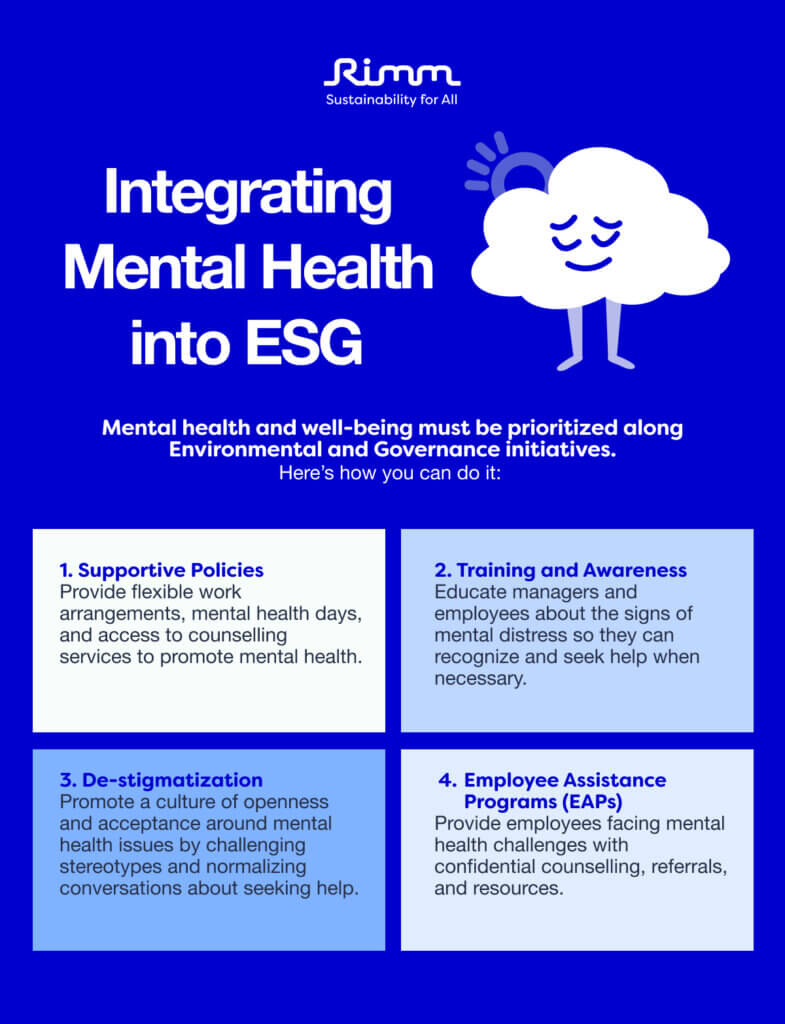

Environmental and governance aspects of ESG receive much attention, while the social dimension-especially mental health-is often overlooked. Despite its importance to social sustainability, mental health is often ignored or neglected.

The Mental Health Crisis

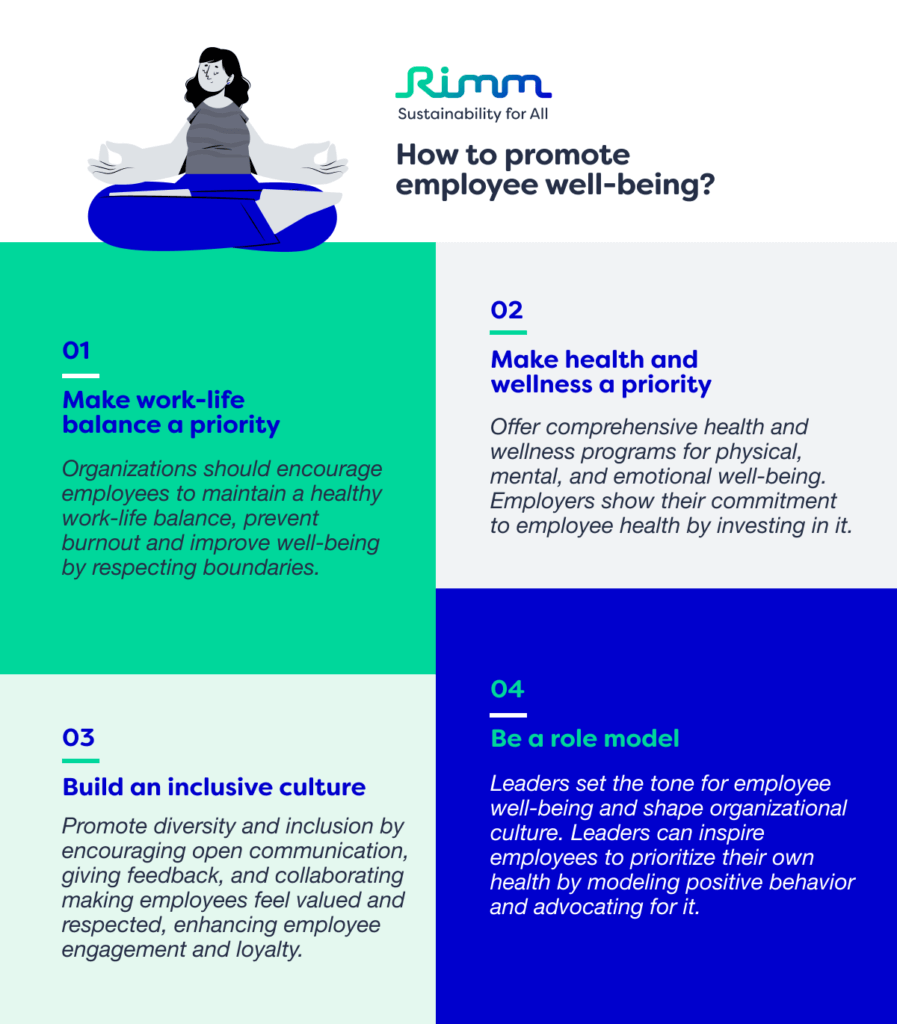

A sobering picture is painted by mental health statistics. In the world, one in four people will experience mental or neurological disorders in their lifetime. Worldwide, stress, anxiety, and depression have been exacerbated by the COVID-19 pandemic. The mental health crisis has also had a significant impact on the corporate world. High levels of stress, burnout, and decreased productivity have become prevalent among employees, highlighting the urgent need for companies to prioritize mental health support and create a supportive work environment.

The Corporate Connection

Organizational performance is directly impacted by the mental health of employees. Untreated mental health issues can lead to decreased productivity, absenteeism, and presenteeism, as well as higher healthcare costs. Furthermore, they undermine employee engagement, creativity, and innovation by contributing to a toxic work culture. For example, a study by the National Institute of Health found that workers with depression were 39% more likely to report job dissatisfaction and 45% more likely to report job insecurity.

The Investor Perspective

When evaluating companies, investors increasingly consider their social impact. Businesses that prioritize employee well-being and have robust mental health initiatives in place are viewed favorably since they demonstrate long-term sustainability and resilience. As confirmed in a study by Harvard Business Review, companies that prioritize sustainability also tend to be more attractive to investors since they tend to have lower operating costs and a higher return on investment. Companies that prioritize social impact are also likely to attract top talent, leading to a healthier, more productive workforce.

Let’s remember that Mental Health Awareness Week encompasses more than environmental concerns. It encompasses the wellbeing of individuals within communities and organizations. It is possible for companies to foster healthier, more resilient workplaces and contribute to a more sustainable future by incorporating mental health considerations into their ESG frameworks.