An important component to shaping a company’s ESG strategy is understanding how external stakeholders perceive their commitments to sustainability, ethics, and governance. In today’s fast-moving digital landscape, a single news story can quickly shape investor confidence, stakeholder trust, and brand reputation. Yet, keeping up with the ever-evolving ESG narrative can be a challenge. With thousands of news articles, reports, and discussions available online, organizations struggle to track and analyze what truly matters. The risk? Missing critical shifts in perception that can influence business resilience and long-term growth.

This is where our new solution, Tru View, comes in. By harnessing data-driven sentiment analysis, Tru View cuts through the noise, delivering clear, data-based insights into how your company is perceived in the ESG space. With Tru View, businesses can proactively manage their reputation, anticipate risks, and make informed decisions with confidence. Because in today’s world, understanding the story being told about your business isn’t just an advantage; it’s a necessity.

Why We Built Tru View

The increasing volume of ESG-related media coverage has made it difficult for businesses to stay on top of stakeholder sentiment. Organizations manually analyzing news can face many challenges:

- Time-Consuming & Resource-Intensive – An analyst would have to sift through vast quantities of news articles and reports, which is slow and labor-intensive

- Inconsistent Categorization – Different sources may report on ESG issues in varying formats and tones, making it difficult to get an overall view of how a particular issue is being perceived

- Difficulty in Benchmarking & Trend Identification – Without automated tracking, identifying trends over time (e.g., whether sentiment is improving or worsening) or benchmarking against competitors can be difficult

To address these pain points we’ve created Tru View, a media sentiment analysis tool that delivers actionable insights in seconds, allowing businesses to monitor and react to ESG-related media trends with confidence.

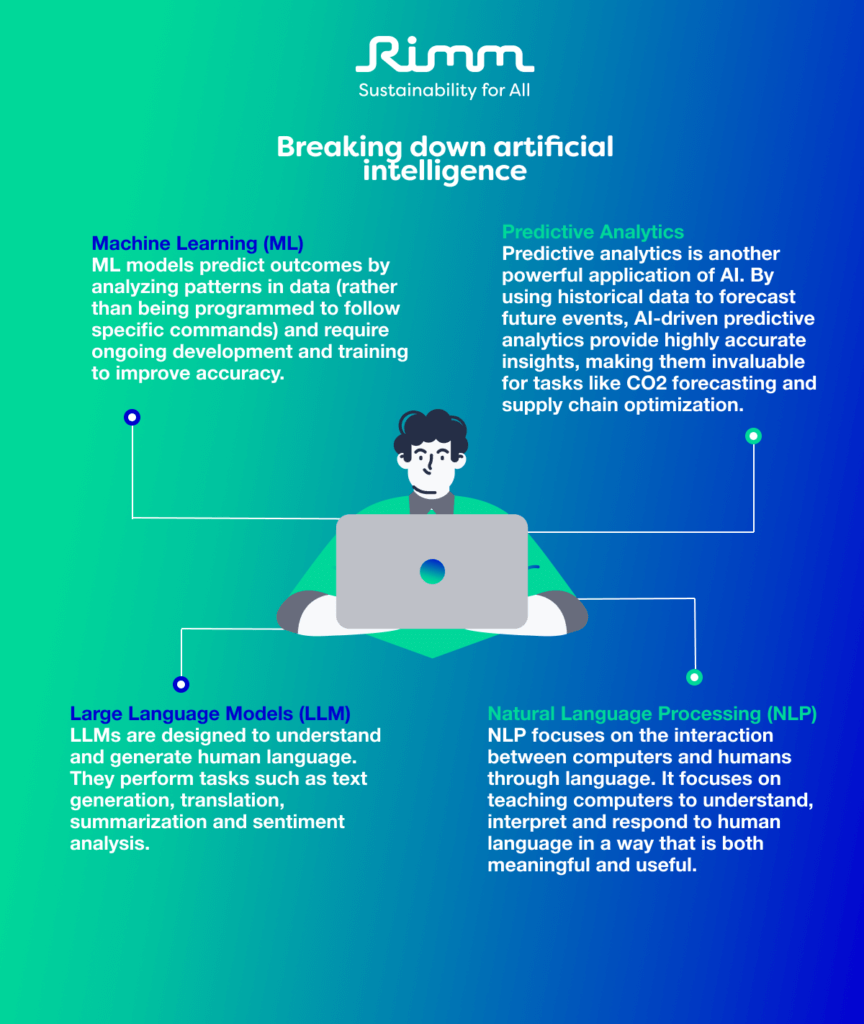

According to Roata Stefan-Cristian, our Data Scientist at Rimm, “Tru View is not just about analyzing sentiment; it’s about equipping businesses with the intelligence needed to navigate ESG narratives strategically. Powered by AI and seamlessly integrated with Rimm’s sustainability expertise, this tool enables organizations to pinpoint emerging risks, track industry sentiment trends, and proactively manage their ESG reputation with greater precision and insight. By leveraging advanced machine learning algorithms and comprehensive data analysis, Tru View helps companies stay ahead of evolving ESG conversations, identify potential challenges before they escalate, and make informed decisions that align with both regulatory expectations and stakeholder values.”

Key Capabilities of Tru View:

- Identify Topics Most Frequently Covered: Understand which ESG topics are covered most frequently in the news about your chosen entity

- ESG Sentiment Analytics & Trends: Track sentiment changes over time at the company, industry, or country level

- Aggregated News Insights: Access ESG-related stories from thousands of global sources in seconds

- Topic-Based Sentiment Comparison: Identify and compare sentiment shifts across relevant ESG themes

- Quote Aggregation: See what key voices in the media are saying about an entity

- Interactive News Chatbot: Ask questions and dig deeper into ESG coverage using Tru View’s intuitive AI-powered Q&A feature

- Multi-Language Coverage: Tru View can access news coverage in 13 different languages, providing a comprehensive global perspective

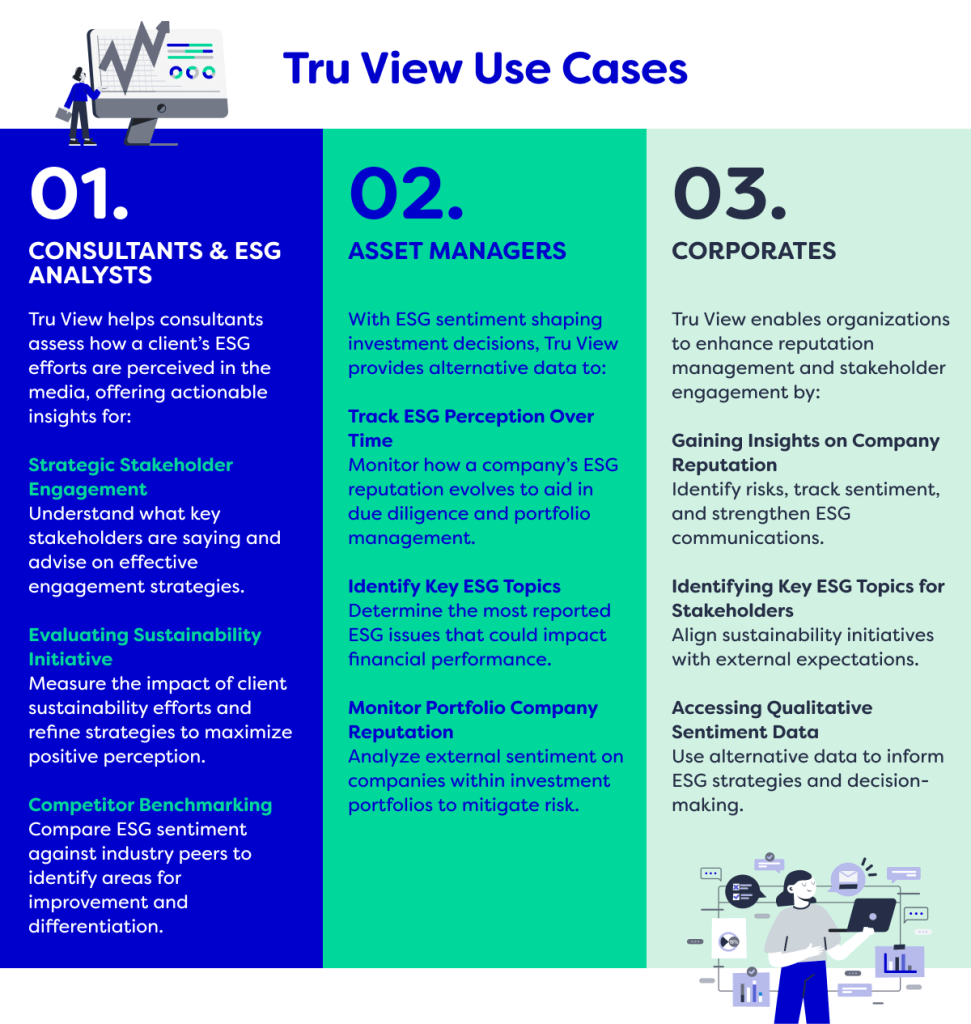

How Tru View Gives Your Business a Competitive Edge

Tru View is designed to empower businesses with deeper ESG insights, enabling them to stay ahead in an evolving sustainability landscape. Here’s how our tool provides a strategic advantage:

1. Strengthening ESG Reputation Management

Organizations can monitor sentiment trends, address reputational risks, and align their ESG strategies with market expectations. Tru View enables proactive reputation management by providing valuable insights into evolving ESG discussions.

2. Data-Driven Decision-Making

Tru View empowers businesses with accurate, clear data to refine sustainability efforts and improve ESG communications. By comparing sentiment trends across industries, companies can fine-tune messaging, align reporting strategies, and strengthen stakeholder engagement.

3. Speed and Efficiency

This automated tool rapidly processes vast amounts of ESG news data quickly, significantly reducing manual effort and allowing businesses to focus on strategic decision-making.

4. Competitive Benchmarking & Industry Comparison

By evaluating ESG sentiment against industry peers, businesses can identify leadership opportunities and refine sustainability positioning. Tru View highlights emerging trends and risks, ensuring organizations stay ahead of evolving ESG expectations.

5. Enhancing Investor Confidence

Investors can use ESG sentiment to gauge risk exposure and future sustainability performance. Tru View enables companies to track investor sentiment to demonstrate transparency.

Take ESG Insights to the Next Level with Tru View

ESG sentiment is shaping markets faster than ever, making data-driven insights a necessity, not a luxury. Tru View provides organizations with the tools to monitor evolving ESG narratives, manage reputational risks, and make data-informed decisions with confidence.

Are you ready to turn ESG sentiment into a strategic advantage? 👉🏾 Speak to our team of experts to learn more about Tru View here